|

|

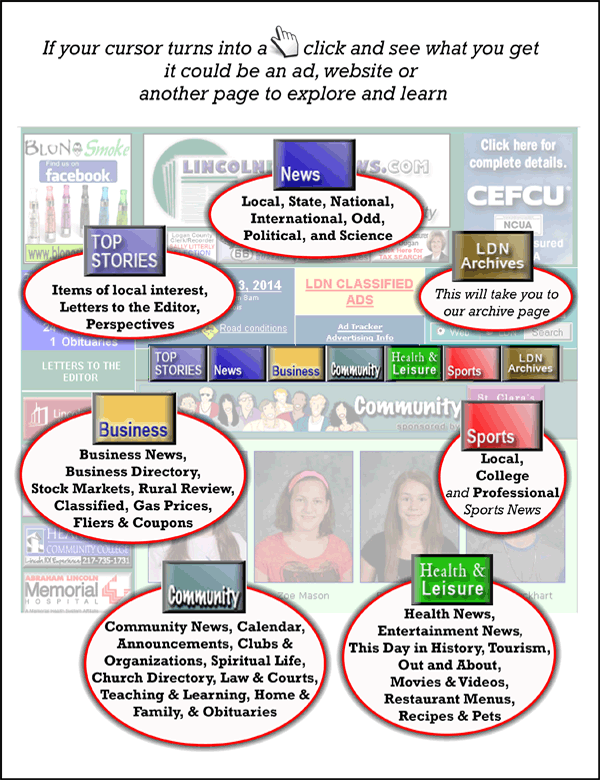

Something new in your business? Click here to submit your business press release Chamber Corner | Main Street News | Job Hunt | Classifieds | Calendar | Illinois Lottery |

|

|

Swiss watchdog investigates Espirito Santo private bank [September 03, 2014] ZURICH (Reuters) - Switzerland's financial regulator said on Wednesday it is investigating Banque Privee Espirito Santo SA (BPES), a Swiss private bank which is part of the Espirito Santo family's troubled business empire. |

|

The Lausanne-based bank is owned by Espirito

Santo Financial Group (ESFG), which has been under creditor

protection since late July after it buckled under massive debts

linked to its founding family. [© 2014 Thomson Reuters. All rights reserved.] Copyright 2014 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

|

|

|

|

|

|

|

|