|

The microloan program, which celebrates its third anniversary

this week, has been hugely successful, providing more than

16,800 low-interest loans, totaling over $373 million to

producers across the country. Microloans have helped farmers and

ranchers with operating costs, such as feed, fertilizer, tools,

fencing, equipment, and living expenses since 2013. Seventy

percent of loans have gone to new farmers. The microloan program, which celebrates its third anniversary

this week, has been hugely successful, providing more than

16,800 low-interest loans, totaling over $373 million to

producers across the country. Microloans have helped farmers and

ranchers with operating costs, such as feed, fertilizer, tools,

fencing, equipment, and living expenses since 2013. Seventy

percent of loans have gone to new farmers.

Now, microloans will be available to also help with farm land

and building purchases, and soil and water conservation

improvements. FSA designed the expanded program to simplify the

application process, expand eligibility requirements and

expedite smaller real estate loans to help farmers strengthen

their operations. Microloans provide up to $50,000 to qualified

producers, and can be issued to the applicant directly from the

USDA Farm Service Agency (FSA).

This microloan announcement is another USDA resource for

America’s farmers and ranchers to utilize, especially as new and

beginning farmers and ranchers look for the assistance they need

to get started. To learn more about the FSA microloan program

visit www.fsa.usda.gov/microloans, or contact your local FSA

office. To find your nearest office location, please visit

http://offices.usda.gov.

USDA to Provide Agricultural Credit Training, Expand

Opportunities for Farmer Veterans and Beginning Farmers

USDA announced a partnership with the Farmer Veteran Coalition (FVC)

to conduct agricultural credit training sessions in the Midwest

for military veterans and beginning farmers and ranchers. States

under consideration to host the workshops include Iowa,

Illinois, Indiana, Michigan, Minnesota, Missouri, and Nebraska.

These workshops will provide individuals interested in farming

as a career, including military veterans, with methods to

improve business planning and financial skills, and improve

understanding of the risk management tools that can help small

farm operations.

Other partners include Niman Ranch a community network of more

than 700 independent family farmers and ranchers, and the Farm

Credit Council and the Farm Credit System, which provides loans,

leases and financial services to farmers, ranchers and rural

businesses across the United States. The workshops will also

include assistance with credit applications and introductions to

local or regional food markets.

To learn more about veterans in agriculture, visit

www.usda.gov/veterans.

Visit

www.fsa.usda.gov/farmloans or your local Farm Service

Agency (FSA) office to learn more about FSA's farm loan

programs. To find your local FSA office, visit http://offices.usda.gov.

More information also is available from the Farmer Veteran

Coalition at www.farmvetco.org.

Farm Service Agency (FSA) and Risk Management Agency (RMA) to

Prevent Fraud, Waste, and Abuse

FSA supports the RMA in the prevention of fraud, waste and abuse

of the Federal Crop Insurance Program. FSA has been, and will

continue to, assist RMA and insurance providers by monitoring

crop conditions throughout the growing season. FSA will continue

to refer all suspected cases of fraud, waste and abuse directly

to RMA. Producers can report suspected cases to the county

office staff, the RMA office, or the Office of the Inspector

General.

Uauthorized Disposition of Grain

If loan grain has been disposed of through feeding, selling or

any other form of disposal without prior written authorization

from the county office staff, it is considered unauthorized

disposition. The financial penalties for unauthorized

dispositions are severe and a producer’s name will be placed on

a loan violation list for a two-year period. Always call before

you haul any grain under loan.

Dairy Indemnity Payment Program (DIPP)

The 2014 Farm Bill authorized the extension of the Dairy

Indemnity Payment Program (DIPP) through September 30, 2018.

DIPP provides payments to dairy producers and manufacturers of

dairy products when they are directed to remove their raw milk

or products from the market because of contamination.

USDA Financial Assistance Available to Help Organic Farmers

Create Conservation Buffers

USDA is assisting organic farmers with the cost of establishing

up to 20,000 acres of new conservation buffers and other

practices on and near farms that produce organic crops.

The financial assistance is available from the USDA Conservation

Reserve Program (CRP), a federally funded voluntary program that

contracts with agricultural producers so that environmentally

sensitive land is not farmed or ranched, but instead used for

conservation benefits. CRP participants establish long-term,

resource-conserving plant species, such as approved grasses or

trees (known as “covers”) to control soil erosion, improve water

quality and develop wildlife habitat. In return, FSA provides

participants with rental payments and cost-share assistance.

Contract duration is between 10 and 15 years.

For conservation buffers, funds are available for establishing

shrubs and trees, or supporting pollinating species, and can be

planted in blocks or strips. Interested organic producers can

offer eligible land for enrollment in this initiative at any

time.

Other USDA FSA programs that assist organic farmers include:

- The Noninsured Crop Disaster Assistance Program that

provides financial assistance for 55 to 100 percent of the

average market price for organic crop losses between 50 to

65 percent of expected production due to a natural disaster.

- Marketing assistance loans that provide interim

financing to help producers meet cash flow needs without

having to sell crops during harvest when market prices are

low, and deficiency payments to producers who forgo the loan

in return for a payment on the eligible commodity.

- A variety of loans for operating expenses, ownership or

guarantees with outside lenders, including streamlined

microloans that have a lower amount of paperwork.

- Farm Storage Facility Loans that provide low-interest

financing to build or upgrade storage facilities for organic

commodities, including cold storage, grain bins, bulk tanks

and drying and handling equipment.

- Services such as mapping farm and field boundaries and

reporting organic acreage that can be provided to a farm’s

organic certifier or crop insurance agent.

Visit

www.fsa.usda.gov/organic to learn more about how FSA

can help organic farmers. For an interactive tour of CRP success

stories, visit

www.fsa.usda.gov/CRPis30 or follow #CRPis30 on

Twitter. To learn more about FSA programs visit a local FSA

office or www.fsa.usda.gov.

To find your local FSA office, visit

http://offices.usda.gov.

MAL’s Available for Crop Years 2015-2018

The 2014 farm bill authorizes 2014-2018 crop year Marketing

Assistance Loans (MAL’s).

MALs provide financing and marketing assistance for wheat, feed

grains, soybeans, and other oilseeds, pulse crops, wool and

honey. MALs provide producers interim financing after harvest to

help them meet cash flow needs without having to sell their

commodities when market prices are typically at harvest-time

lows.

FSA is now accepting requests for 2015 crop MALs for all

eligible commodities after harvest.

The 2014 Farm Bill also establishes payment limitations per

individual or entity not to exceed $125,000 annually on certain

commodities for the following program benefits: ARC PLC,

marketing loan gains (MLGs) and LDPs. These payment limitations

do not apply to MAL loan disbursements.

For more information and additional eligibility requirements,

please visit a nearby USDA Service Center or FSA’s website

www.fsa.usda.gov.

Maintaining the Quality of Loaned Grain

Bins are ideally designed to hold a level volume of grain. When

bins are overfilled and grain is heaped up, airflow is hindered

and the chance of spoilage increases.

Producers who take out marketing assistance loans and use the

farm-stored grain as collateral should remember that they are

responsible for maintaining the quality of the grain through the

term of the loan.

Livestock Indemnity Program (LIP)

The Livestock Indemnity Program (LIP) provides assistance to

eligible producers for livestock death losses in excess of

normal mortality due to an extreme or abnormal adverse weather

event and/or attacks by animals reintroduced into the wild by

the federal government or protected by federal law. LIP

compensates livestock owners and contract growers for livestock

death losses in excess of normal mortality due to adverse

weather, including losses due to hurricanes, floods, blizzards,

wildfires, extreme heat or extreme cold.

[to top of second column] |

For 2015, eligible losses must occur on or after Jan. 1, 2015,

and before December 31, 2015. A notice of loss must be filed

with FSA within 30 days of when the loss of livestock is

apparent. Participants must provide the following supporting

documentation to their local FSA office no later than 30

calendar days after the end of the calendar year for which

benefits are requested:

- Proof of death documentation

- Copy of growers contracts

- Proof of normal mortality documentation

Emergency Assistance for Livestock, Honeybees and Farm-Raised

Fish Program (ELAP)

ELAP provides emergency assistance to eligible producers of

livestock, honeybees and farm-raised fish that have losses due

to disease, adverse weather, or other conditions, such as

blizzards and wildfires.

Producers who suffer eligible livestock, honeybee, or

farm-raised fish losses from October 1, 2015 to September 30,

2016 must file:

A notice of loss the earlier of 30 calendar days of when the

loss is apparent or by November 1, 2016

An application for payment by November 1, 2016

The Farm Bill caps ELAP disaster funding at $20 million per

federal fiscal year.

To view ELAP Farm-Raised Fish, ELAP for Livestock or ELAP for

Honeybee fact sheets visit the FSA fact sheet web page at

www.fsa.usda.gov/factsheets.

CRP Payment Limitation

Payments and benefits received under the Conservation Reserve

Program (CRP) are subject to the following:

- payment limitation by direct attribution

- foreign person rule

- average adjusted gross income (AGI) limitation The 2014

Farm Bill continued the $50,000 maximum CRP payment amount

that can be received annually, directly or indirectly, by

each person or legal entity. This payment limitation

includes all annual rental payments and incentive payments

(Sign-up Incentive Payments and Practice Incentive

Payments). Annual rental payments are attributed (earned) in

the fiscal year in which program performance occurs. Sign-up

Incentive Payments (SIP) are attributed (earned) based on

the fiscal year in which the contract is approved, not the

fiscal year the contract is effective. Practice Incentive

Payments (PIP) are attributed (earned) based on the fiscal

year in which the cost-share documentation is completed and

the producer or technical service provider certifies

performance of practice completion to the county office.

Such limitation on payments is controlled by direct

attribution.

Program payments made directly or indirectly to a person are

combined with the pro rata interest held in any legal entity

that received

- payment, unless the payments to the legal entity

have been reduced by the pro rata share of the person.

- Program payments made directly to a legal entity are

attributed to those persons that have a direct and

indirect interest in the legal entity, unless the

payments to the legal entity have been reduced by the

pro rata share of the person.

- Payment attribution to a legal entity is tracked

through four levels of ownership. If any part of the

ownership interest at the fourth level is owned by

another legal entity, a reduction in payment will be

applied to the payment entity in the amount that

represents the indirect interest of the fourth level

entity in the payment entity. Essentially, all payments

will be “attributed” to a person’s Social Security

Number. Given the current CRP annual rental rates in

many areas, it is important producers are aware of how

CRP offered acreages impact their $50,000 annual payment

limitation. Producers should contact their local FSA

office for additional information. NOTE: The information

in the above article only applies to contracts subject

to 4-PL and 5-PL regulations. It does not apply to

contacts subject to 1-PL regulations.

Enrollment Period for 2016 USDA Safety Net Coverage Ends Aug.

1

USDA’s Farm Service Agency (FSA) has announced that producers

who chose coverage from the safety net programs established by

the 2014 Farm Bill, known as the Agriculture Risk Coverage (ARC)

or the Price Loss Coverage (PLC) programs, can visit FSA county

offices through Aug. 1, 2016, to sign contracts to enroll in

coverage for 2016.

Although the choice between ARC and PLC is completed and remains

in effect through 2018, producers must still enroll their farm

by signing a contract each year to receive coverage.

Producers are encouraged to contact their local FSA office to

schedule an appointment to enroll. If a farm is not enrolled

during the 2016 enrollment period, producers on that farm will

not be eligible for financial assistance from the ARC or PLC

programs should crop prices or farm revenues fall below the

historical price or revenue benchmarks established by the

program.

The two programs were authorized by the 2014 Farm Bill and offer

a safety net to agricultural producers when there is a

substantial drop in prices or revenues for covered commodities.

Covered commodities include barley, canola, large and small

chickpeas, corn, crambe, flaxseed, grain sorghum, lentils,

mustard seed, oats, peanuts, dry peas, rapeseed, long grain

rice, medium grain rice (which includes short grain and sweet

rice), safflower seed, sesame, soybeans, sunflower seed and

wheat. Upland cotton is no longer a covered commodity. For more

details regarding these programs, go to

www.fsa.usda.gov/arc-plc.

For more information, producers are encouraged to visit their

local FSA office. To find a local FSA office, visit

http://offices.usda.gov.

Microloans for Land and Equipment

Watch FSA Administrator Val Dolcini describe how microloans can

help you!

http://fsa.blogs.govdelivery.com/2016/

03/04/microloan-message-from-administrator/

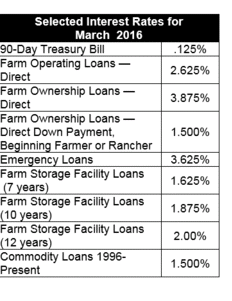

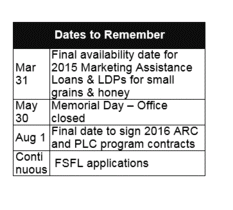

March Interest Rates & Dates to Remember

Illinois Farm Service Agency

3500

Wabash Ave.

Springfield, IL 62711

www.fsa.usda.gov/il

State

Committee:

Jill Appell - Chairperson

Brenda Hill - Member

Jerry Jimenez - Member

Joyce Matthews - Member

Gordon Stine - Member

State

Executive Director:

Scherrie V. Giamanco

Executive Officer:

Rick Graden

Administrative Officer:

Dan Puccetti

Division Chiefs:

Doug Bailey

Jeff Koch

Stan Wilson

|