|

Since shares and ownership of a farm can change year-to-year,

producers on the farm must enroll by signing a contract each

program year. Since shares and ownership of a farm can change year-to-year,

producers on the farm must enroll by signing a contract each

program year.

If a farm is not enrolled during the 2017 enrollment period, the

producers on that farm will not be eligible for financial

assistance from the ARC or PLC programs for the 2017 crop should

crop prices or farm revenues fall below the historical price or

revenue benchmarks established by the program. Producers who

made their elections in 2015 must still enroll during the 2017

enrollment period.

The ARC and PLC programs were authorized by the 2014 Farm Bill

and offer a safety net to agricultural producers when there is a

substantial drop in prices or revenues for covered commodities.

Covered commodities include barley, canola, large and small

chickpeas, corn, crambe, flaxseed, grain sorghum, lentils,

mustard seed, oats, peanuts, dry peas, rapeseed, long grain

rice, medium grain rice (which includes short grain and sweet

rice), safflower seed, sesame, soybeans, sunflower seed and

wheat. Upland cotton is no longer a covered commodity. For more

details regarding these programs, go to www.fsa.usda.gov/arc-plc.

For more information, producers are encouraged to visit their

local FSA office. To find a local FSA office, visit

http://offices.usda.gov.

Beginning Farmer Loans

FSA assists beginning farmers to finance agricultural

enterprises. Under these designated farm loan programs, FSA can

provide financing to eligible applicants through either direct

or guaranteed loans. FSA defines a beginning farmer as a person

who:

- Has operated a farm for not more than 10 years

- Will materially and substantially participate in the

operation of the farm

- Agrees to participate in a loan assessment, borrower

training and financial management program sponsored by FSA

- Does not own a farm in excess of 30 percent of the

county’s average size farm. Additional program information,

loan applications, and other materials are available at your

local USDA Service Center. You may also visit

www.fsa.usda.gov.

USDA Issues Safety-Net Payments to Farmers in Response to

2015 Market Downturn

The U.S. Department of Agriculture (USDA) announced that

beginning today, many of the 1.7 million farms that enrolled in

either the Agriculture Risk Coverage (ARC) or Price Loss

Coverage (PLC) programs will receive safety-net payments due to

market downturns during the 2015 crop year.

This fall, USDA will be making more than $7 billion in payments

under the ARC-County and PLC programs to assist participating

producers, which will account for over 10 percent of USDA’s

projected 2016 net farm income. These payments will help provide

reassurance to America’s farm families, who are standing strong

against low commodity prices compounded by unfavorable growing

conditions in many parts of the country.

Unlike the old direct payment program, which issued payments

during both weak and strong market conditions, the 2014 Farm

Bill authorized the ARC-PLC safety net to trigger and provide

financial assistance only when decreases in revenues or crop

prices, respectively, occur. The ARC and PLC programs primarily

allow producers to continue to produce for the market by making

payments on a percentage of historical base production, limiting

the impact on production decisions.

Nationwide, producers enrolled 96 percent of soybean base acres,

91 percent of corn base acres and 66 percent of wheat base acres

in the ARC-County coverage option. Producers enrolled 99 percent

of long grain rice and peanut base acres and 94 percent of

medium grain rice base acres in the PLC option. Overall, 76

percent of participating farm base acres are enrolled in

ARC-County, 23 percent in PLC and one percent in ARC-Individual.

For other program information including frequently asked

questions, visit www.fsa.usda.gov/arc-plc.

Payments are made to producers who enrolled base acres of

barley, corn, grain sorghum, lentils, oats, peanuts, dry peas,

soybeans, wheat and canola. In the upcoming months, payments

will be announced after marketing year average prices are

published by USDA’s National Agricultural Statistics Service for

the remaining covered commodities. These include long and medium

grain rice (except for temperate Japonica rice), which will be

announced in November, remaining oilseeds and chickpeas, which

will be announced in December, and temperate Japonica rice,

which will be announced in early February 2017. Upland cotton is

no longer a covered commodity.

The Budget Control Act of 2011, passed by Congress, requires

USDA to reduce 2015 ARC and PLC payments by 6.8 percent. For

more information, producers are encouraged to visit their local

Farm Service Agency (FSA) office. To find a local FSA office,

visit http://offices.usda.gov.

FSA Urges Farmers and Ranchers to Vote in County Committee

Elections

USDA encourages farmers and ranchers to make their voices heard

by voting in the upcoming Farm Service Agency (FSA) County

Committee elections. Beginning Monday, Nov. 7, 2016, USDA will

begin mailing ballots to eligible farmers and ranchers across

the country. Producers must return ballots to their local FSA

offices by Dec. 5, 2016, to ensure that their vote is counted.

Nearly 7,700 FSA County Committee members serve FSA offices

nationwide. Each committee has three to 11 elected members who

serve three-year terms of office. One-third of county committee

seats are up for election each year. County committee members

apply their knowledge and judgment to help FSA make important

decisions on its commodity support programs, conservation

programs, indemnity and disaster programs, and emergency

programs and eligibility.

Producers must participate or cooperate in an FSA program to be

eligible to vote in the county committee election. Farmers and

ranchers who supervise and conduct the farming operations of an

entire farm, but are not of legal voting age, also may be

eligible to vote.

Farmers and ranchers will begin receiving their ballots the week

of Nov. 7. Ballots include the names of candidates running for

the local committee election. FSA has modified the ballot,

making it easily identifiable and less likely to be overlooked.

Voters in local administrative area holding an election who do

not receive ballots in the coming week can pick one up at their

local FSA office. Ballots returned by mail must be postmarked no

later than Dec. 5, 2016. Newly elected committee members will

take office Jan. 1, 2017.

For more information, visit the FSA website at www.fsa.usda.gov/elections

or contact your local County FSA office.

USDA Expands Working-Lands Conservation Opportunities through

CRP

USDA will offer a new Conservation Reserve Program (CRP)

Grasslands practice specifically tailored for small-scale

livestock grazing operations. Small livestock operations with

100 or fewer head of grazing dairy cows (or the equivalent) can

submit applications to enroll up to 200 acres of grasslands per

farm. USDA’s goal is to enroll up to 200,000 acres.

The current CRP Grassland ranking period will end on Nov. 10,

2016. To date, the USDA’s Farm Service Agency (FSA) has received

nearly 5,000 offers covering over 1 million acres for this CRP

working-lands conservation program. These offers are

predominantly larger acreage ranchland in Western states.

The new practice for small-scale livestock grazers aims, in

part, to encourage greater diversity geographically and in types

of livestock operation. This opportunity will close on Dec. 16,

2016. Offers selected this fiscal year will be enrolled into CRP

Grasslands beginning Oct. 1, 2017.

Participants in CRP Grasslands establish or maintain long-term,

resource-conserving grasses and other plant species to control

soil erosion, improve water quality and develop wildlife habitat

on marginally productive agricultural lands. CRP Grasslands

participants can use the land for livestock production (e.g.

grazing or producing hay), while following their conservation

and grazing plans in order to maintain the cover. A goal of CRP

Grasslands is to minimize conversion of grasslands either to row

crops or to non-agricultural uses. Participants can receive

annual payments of up to 75 percent of the grazing value of the

land and up to 50 percent to fund cover or practices like

cross-fencing to support rotational grazing or improving pasture

cover to benefit pollinators or other wildlife.

USDA will select offers for enrollment based on six ranking

factors: (1) current and future use, (2) new farmer/rancher or

underserved producer involvement, (3) maximum grassland

preservation, (4) vegetative cover, (5) environmental factors

and (6) pollinator habitat. Offers for the second ranking period

also will be considered from producers who submitted offers for

the first ranking period but were not accepted, as well as from

new offers submitted through Dec. 16, 2016.

Small livestock operations or other farming and ranching

operations interested in participating in CRP Grasslands should

contact their local FSA office. To find your local FSA office,

visit http://offices.usda.gov. To learn more about FSA’s

conservation programs, visit

www.fsa.usda.gov/conservation.

Update Your Records

FSA is cleaning up our producer record database. If you have any

unreported changes of address or zip code or an incorrect name

or business name on file they need to be reported to our office.

Changes in your farm operation, like the addition of a farm by

lease or purchase, need to be reported to our office as well.

Producers participating in FSA and NRCS programs are required to

timely report changes in their farming operation to the County

Committee in writing and update their CCC-902 Farm Operating

Plan.

If you have any updates or corrections, please call your local

FSA office to update your records.

Margin Protection Program for Dairy Enrollment Deadline is

Dec. 16

The deadline for dairy producers to enroll in the Margin

Protection Program (MPP) for Dairy is Dec. 16, 2016. This

voluntary dairy safety net program, established by the 2014 Farm

Bill, provides financial assistance to participating dairy

producers when the margin – the difference between the price of

milk and feed costs – falls below the coverage level selected by

the producer. A USDA web tool, available at www.fsa.usda.gov/mpptool,

allows dairy producers to calculate levels of coverage available

from MPP based on price projections.

USDA Climate Hubs

are working with farmers, livestock producers, pasture and

forest landowners to effectively partner in ways to help

mitigate and adapt to a changing climate. Next in our series

on the 10 Building Blocks for Climate Smart Agriculture and

Forestry is Nitrogen Stewardship.

Within the United

States, agriculture is a significant source of nitrous oxide

(N2O) emissions—a greenhouse gas (GHG) that has a global

warming potential 250 times more than carbon dioxide (CO2).

In 2013, cropland agriculture released approximately 136

MMTCO2e (Million Metric Tons of Carbon Dioxide-Equivalent)

in direct N2O emissions. More than half of these N2O

emissions are from synthetic fertilizers and organic

amendments. Improved nitrogen management practices can

reduce emissions from these sources.

The primary

practice used in the Nitrogen Stewardship Building Block to

reduce GHG emissions involves the 4Rs: right source, right

rate, right time, and right place. The 4Rs come from the

NRCS Conservation Practice Standard (CPS) Nutrient

Management (590). To read more about Nitrogen Stewardship

click the following link or copy and paste the link into

your web browser: http://www.usda.gov/oce/climate_

change/building_blocks/2_NitrogenStewardship.pdf

For more

information about the USDA Climate Hubs click here:

http://www.climatehubs.

oce.usda.gov/.

USDA Packages Disaster Protection with Loans to Benefit

Specialty Crop and Diversified Producers

Producers who apply for FSA farm loans will be offered the

opportunity to enroll in new disaster loss protections

created by the 2014 Farm Bill. The new coverage, available

from the Noninsured Crop Disaster Assistance Program (NAP),

is available to FSA loan applicants who grow non-insurable

crops, so this is especially important to fruit and

vegetable producers and other specialty crop growers.

New, underserved and limited income specialty growers who

apply for farm loans could qualify for basic loss coverage

at no cost, or higher coverage for a discounted premium.

The basic disaster coverage protects at 55 percent of the

market price for crop losses that exceed 50 percent of

production. Covered crops include “specialty” crops, for

instance, vegetables, fruits, mushrooms, floriculture,

ornamental nursery, aquaculture, turf grass, ginseng, honey,

syrup, hay, forage, grazing and energy crops. FSA allows

beginning, underserved or limited income producers to obtain

NAP coverage up to 90 days after the normal application

closing date when they also apply for FSA credit.

In addition to free basic coverage, beginning, underserved

or limited income producers are eligible for a 50 percent

discount on premiums for the higher levels of coverage that

protect up to 65 percent of expected production at 100

percent of the average market price. Producers also may work

with FSA to protect value-added production, such as organic

or direct market crops, at their fair market value in those

markets. Targeted underserved groups eligible for free or

discounted coverage are American Indians or Alaskan Natives,

Asians, Blacks or African Americans, Native Hawaiians or

other Pacific Islanders, Hispanics, and women.

FSA offers a variety of loan products, including farm

ownership loans, operating loans and microloans that have a

streamlined application process.

[to top of second column] |

Growers need not apply for an FSA loan, nor be a beginning,

limited resource, or underserved farmer, to be eligible for

Noninsured Crop Disaster Assistance Program assistance. To learn

more, visit

www.fsa.usda.gov/nap or

www.fsa.usda.gov/

farmloans, or contact your local FSA office at

https://offices.usda.gov.

Unauthorized Disposition of Grain

If loan grain has been disposed of through feeding, selling or

any other form of disposal without prior written authorization

from the county office staff, it is considered unauthorized

disposition and a violation of the terms and conditions of the

Note and Security Agreement. The financial penalties for

unauthorized dispositions are severe and a producer’s name will

be placed on a loan violation list for a two-year period. Always

call before you haul any grain under loan. If you have questions

concerning the movement of grain under loan, please contact your

local county FSA office.

Maintaining the Quality of Loaned Grain

Bins are ideally designed to hold a level volume of grain. When

bins are overfilled and grain is heaped up, airflow is hindered

and the chance of spoilage increases.

Producers who take out marketing assistance loans and use the

farm-stored grain as collateral should remember that they are

responsible for maintaining the quality of the grain through the

term of the loan.

2017 Acreage Reporting Dates

Emergency Assistance for Livestock, Honeybees and Farm-Raised

Fish Program (ELAP)

In order to comply with FSA program eligibility requirements,

all producers are encouraged to visit their local FSA office to

file an accurate crop certification report by the applicable

deadline.

Acreage reporting dates vary by crop and by county so please

contact your local FSA office for a list of county-specific

deadlines.

The following exceptions apply to acreage reporting dates:

- If the crop has not been planted by the applicable acreage

reporting date, then the acreage must be reported no later than

15 calendar days after planting is completed.

- If a producer acquires additional acreage after the

applicable acreage reporting date, then the acreage must be

reported no later than 30 calendars days after purchase or

acquiring the lease. Appropriate documentation must be provided

to the county office.

- If a perennial forage crop is reported with the intended use

of “cover only,” “green manure,” “left standing,” or “seed,”

then the acreage must be reported by July 15th. Noninsured Crop

Disaster Assistance Program (NAP) policy holders should note

that the acreage reporting date for NAP covered crops is the

earlier of the applicable dates or 15 calendar days before

grazing or harvesting of the crop begins.

For questions regarding crop certification and crop loss

reports, please contact your local FSA office.

The following 2017 acreage reporting dates are applicable for

Illinois:

- January 2, 2017 honey

- January 15, 2017 apples, asparagus, blueberries,

caneberries, cherries, grapes,

nectarines, peaches, plums, strawberries

- June 15, 2017 cucumbers (planted 5/1 – 5/31)

- July 15, 2017 All other spring and summer planted crops

- August 15, 2017 cabbage (planted 6/1 – 7/20)

- September 15, 2017 cucumbers (planted 6/1 – 8/15)

ELAP provides emergency assistance to eligible producers of

livestock, honeybees and farm-raised fish that have losses due

to disease, adverse weather, or other conditions, such as

blizzards and wildfires.

Producers who suffer eligible livestock, honeybee, or

farm-raised fish losses from October 1, 2016 to September 30,

2017 must file:

- A notice of loss the earlier of 30 calendar days of

when the loss is apparent or by November 1, 2017

- An application for payment by November 1, 2017

The Farm Bill caps ELAP disaster funding at $20 million per

federal fiscal year.

To view ELAP Farm-Raised Fish, ELAP for Livestock or ELAP for

Honeybee fact sheets visit the FSA fact sheet web page at

www.fsa.usda.gov/

factsheets.

Livestock Indemnity Program (LIP)

The Livestock Indemnity Program (LIP) provides assistance to

eligible producers for livestock death losses in excess of

normal mortality due to an extreme or abnormal adverse weather

event and/or attacks by animals reintroduced into the wild by

the federal government or protected by federal law. LIP

compensates livestock owners and contract growers for livestock

death losses in excess of normal mortality due to adverse

weather, including losses due to hurricanes, floods, blizzards,

wildfires, extreme heat or extreme cold.

For 2016, eligible losses must occur on or after January 1,

2016, and before December 31, 2016. A notice of loss must be

filed with FSA within 30 days of when the loss of livestock is

apparent. Participants must provide the following supporting

documentation to their local FSA office no later than 30

calendar days after the end of the calendar year (January 30,

2017) for which benefits are requested:

- Proof of death documentation

- Copy of growers contracts

- Proof of normal mortality documentation

USDA Offers New Loans for Portable Farm Storage and Handling

Equipment

USDA’s Farm Service Agency (FSA) will provide a new financing

option to help farmers purchase portable storage and handling

equipment through the Farm Storage Facility Loan (FSFL) program.

The loans, which now include a smaller microloan option with

lower down payments, are designed to help producers, including

new, small and mid-sized producers, grow their businesses and

markets. The FSFL program allows producers of eligible

commodities to obtain low-interest financing to build or upgrade

farm storage and handling facilities.

The program also offers a new “microloan” option, which allows

applicants seeking less than $50,000 to qualify for a reduced

down payment of five percent and no requirement to provide three

years of production history, with CCC providing a loan for the

remaining 95 percent of the net cost of the eligible FSFL

equipment. Farms and ranches of all sizes are eligible. The

microloan option is expected to be of particular benefit to

smaller farms and ranches, and specialty crop producers who may

not have access to commercial storage or on-farm storage after

harvest. These producers can invest in equipment like conveyers,

scales or refrigeration units and trucks that can store

commodities before delivering them to markets. FSFL microloans

can also be used to finance wash and pack equipment used

post-harvest, before a commodity is placed in cold storage.

Producers do not need to demonstrate the lack of commercial

credit availability to apply for FSFL’s.

Larger farming and ranching operations, that may not be able to

participate in the new “microloan” option, may apply for the

traditional, larger FSFL’s with the maximum principal amount for

each loan through FSFL of $500,000.00. Participants are required

to provide a down payment of 15 percent, with CCC providing a

loan for the remaining 85 percent of the net cost of the

eligible storage facility and permanent drying and handling

equipment. Additional security is required for poured-cement

open-bunker silos, renewable biomass facilities, cold storage

facilities, hay barns and for all loans exceeding $100,000.00.

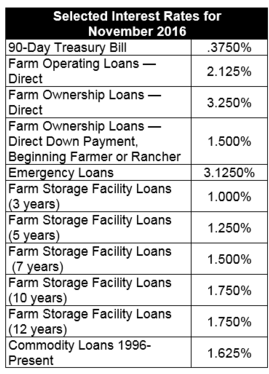

FSFL loan terms of 3, 5, 7, 10 or 12 years are available

depending on the amount of the loan. Interest rates for each

term rate may be different and are based on the rate which CCC

borrows from the Treasury Department.

Earlier this year, FSA significantly expanded the list of

commodities eligible for FSFL. Eligible commodities now include

aquaculture; floriculture; fruits (including nuts) and

vegetables; corn, grain sorghum, rice, oilseeds, oats, wheat,

triticale, spelt, buckwheat, lentils, chickpeas, dry peas,

sugar, barley, rye, hay, honey, hops, maple sap, unprocessed

meat and poultry, eggs, milk, cheese, butter, yogurt and

renewable biomass.

Applications for FSFL must be submitted to the FSA county office

that maintains the farm's records. The FSFL application must be

approved before: purchasing the FSFL equipment, beginning any

excavation or site preparation, accepting delivery of FSFL

equipment, beginning installation or construction.

To learn more about Farm Storage Facility Loans, visit

www.fsa.usda.gov/pricesupport or contact a local FSA county

office. To find your local FSA county office, visit http://offices.usda.gov.

November Interest Rates and Important Dates to Remember

Illinois Farm Service Agency

3500 Wabash Ave.

Springfield, IL 62711

Phone:217-241-6600 ext. 2

www.fsa.usda.gov/il

State Executive Director:

Scherrie V. Giamanco

State Committee:

Jill Appell - Chairperson

Brenda Hill - Member

Jerry Jimenez - Member

Joyce Matthews - Member

Gordon Stine - Member

Executive Officer:

Rick Graden

Administrative Officer:

Dan Puccetti

Division Chiefs:

Doug Bailey

Jeff Koch

Stan Wilson

To find contact information for your local office go to

www.fsa.usda.gov/il USDA

is an equal opportunity provider, employer and

lender. To file a complaint of discrimination,

write: USDA, Office of the Assistant Secretary for

Civil Rights, Office of Adjudication, 1400

Independence Ave., SW, Washington, DC 20250-9410 or

call (866) 632-9992 (Toll-free Customer Service),

(800) 877-8339 (Local or Federal relay), (866)

377-8642 (Relay voice users).

|