|

Under these designated farm loan programs, FSA can provide

financing to eligible applicants through either direct or

guaranteed loans. FSA defines a beginning farmer as a person

who:

Has operated a farm for not more than 10 years

-

Will materially and substantially

participate in the operation of the farm

-

Agrees to participate in a loan assessment,

borrower training and financial management program sponsored

by FSA

-

Does not own a farm in excess of 30 percent

of the county’s average size farm. Additional program

information, loan applications, and other materials are

available at your local USDA Service Center. You may also

visit www.fsa.usda.gov.

Change in Farming Operation

If you have bought or sold land, or if you have picked up or

dropped rented land from your operation, make sure you report

the changes to the office as soon as possible. You need to

provide a copy of your deed or recorded land contract for

purchased property.

Failure to maintain accurate records with FSA on all land you

have an interest in can lead to possible program ineligibility

and penalties. Making the record changes now will save you time

in the future. Update signature authorization when changes in

the operation occur. Producers are reminded to contact the

office if there is a change in operations on a farm so that

records can be kept current and accurate.

Loans for Targeted Underserved Producers

FSA has a number of loan programs available to assist applicants

to begin or continue in agriculture production. Loans are

available for operating type loans and/or to purchase or improve

farms or ranches.

While all qualified producers are eligible to apply for these

loan programs, FSA has provided priority funding for members of

targeted underserved applicants.

A targeted underserved applicant is one of a group whose members

have been subjected to racial, ethnic or gender prejudice

because of his or her identity as members of the group without

regard to his or her individual qualities.

For purposes of this program, targeted underserved groups are

women, African Americans, American Indians, Alaskan Natives,

Hispanics, Asian Americans and Pacific Islanders.

FSA loans are only available to applicants who meet all the

eligibility requirements and are unable to obtain the needed

credit elsewhere. You may also visit

www.fsa.usda.gov.

FSA County Committee Nomination Period is Now Open

The nomination period for all FSA county committees begins on

June 15, 2017. Nomination forms must be postmarked or received

in the County FSA Office by close of business on Aug. 1, 2017.

County Committees are unique to FSA and allow producers to have

a voice on federal farm program implementation at the local

level.

To be eligible to serve on the FSA county committee, a person

must participate or cooperate in an agency administered program,

be eligible to vote in a county committee election and reside in

the Local Administrative Area (LAA) where they are nominated.

All producers, including women, minority and beginning farmers

and ranchers are encouraged to participate in the nomination and

election process.

Producers may nominate themselves or others as candidates.

Organizations representing minority and women farmers and

ranchers may also nominate candidates. To become a nominee,

eligible individuals must sign form FSA-669A. The form and more

information about county committee elections is available online

at: www.fsa.usda.gov/elections.

Elected county committee members serve a three-year term and are

responsible for making decisions on FSA disaster, conservation,

commodity and price support programs, as well as other important

federal farm program issues. County committees consist of three

members.

FSA will mail election ballots to eligible voters beginning

November 6, 2017. Ballots are due back in the County Office by

mail or in person no later than December 4, 2017. All newly

elected county committee members and alternates will take office

January 1, 2018.

For more information about county committees, please contact

your local County FSA office or visit

www.fsa.usda.gov/elections.

Payment Limitation

Program payments are limited by direct attribution to

individuals or entities. A legal entity is defined as an entity

created under Federal or State law that owns land or an

agricultural commodity, product or livestock. Through direct

attribution, payment limitation is based on the total payments

received by the individual, both directly and indirectly.

Qualifying spouses are eligible to be considered separate

persons for payment limitation purposes, rather than being

automatically combined under one limitation.

Payments and benefits under certain FSA programs are subject to

some or all of the following:

-

payment limitation by direct attribution

-

payment limitation amounts for the applicable

programs

-

actively engaged in farming requirements

-

cash-rent tenant rule

-

foreign person rule

-

average AGI limitations

-

programs subject to AGI limitation

-

effective date of implementation of AGI

limitation

No program benefits subject to payment

eligibility and limitation will be provided until all required

forms for the specific situation are provided and necessary

payment eligibility and payment limitation determinations are

made. Payment eligibility and payment limitation determinations

may be initiated by the County Committee or requested by the

producer. There are statutory provisions that require entities,

earning program benefits that are subject to limitation, to

provide the names, addresses, and TINs of the entities’ members

to the County Committee. All applicable payment eligibility and

payment limitation forms submitted by producers are subject to

spot check through the end-of-year review process.

Producers selected for end-of-year review must provide the

County Committee with operating loan documents, income and

expense ledgers, canceled checks for all expenditures, lease and

purchase agreements, sales contracts, property tax statements,

equipment listings, lease agreements, purchase contracts,

documentation of who provided actual labor and management,

employee time sheets or books, crop sales documents, warehouse

ledgers, gin ledgers, corporate or entity papers, etc. A

determination of not actively engaged in farming results in the

producer being ineligible for any payment or benefit requiring a

determination of actively engaged in farming. Noncompliance with

AGI provisions, either by exceeding the applicable limitation or

failure to submit a certification and consent for disclosure

statement, will result in the determination of ineligibility for

all program benefits subject to AGI provisions.

Program benefits shall be reduced in an amount that is

commensurate with the direct and indirect interest held by an

ineligible person or legal entity in any legal entity, general

partnership, or joint operation that receives benefits subject

to the average AGI limitations. If any changes occur that could

affect an actively engaged in farming, cash-rent tenant, foreign

person, or average Adjusted Gross Income (AGI) determination,

producers must timely notify their County FSA Office by filing

revised farm operating plans and/or supporting documentation, as

applicable. Failure to timely notify the County FSA Office may

adversely affect payment eligibility.

The

USDA Farm Service Agency (FSA) recently made several policy

updates for acreage reporting for cover crops, revising intended

use, late-filed provisions, grazing allotments as well as

updated the definitions of “idle” and “fallow.”

Reporting Cover Crops:

FSA

made changes to the types of cover crops. Cover crop types can

be chosen from the following four categories:

-

Cereals and other grasses -

Any cover crop that is classified as a grass plant or cereal

grain, and would include, but not be limited to, the

following cover crops: cereal rye, wheat, barley, oats,

black oats, triticale, annual ryegrass, pearl millet,

foxtail millet (also called German, Italian or Hungarian

millet), sorghum sudan grass, sorghum and other millets and

grasses.

-

Legumes -

Any cover crop that is classified as a legume, including,

but not limited to, clovers, vetches, peas, sun hemp,

cowpeas, lentils and other legumes.

-

Brassicas and other broadleaves -

Any cover crop that is classified as a non-legume broadleaf,

including, but not limited to, Brassicas such as radishes,

turnips, canola, rapeseed, oilseed rape, and mustards, as

well as other broadleaf plants such as phacelia, flax,

sunflower, buckwheat, and safflower.

-

Mixtures -

Mixes of two or more cover crop species planted at the same

time, for example, oats and radishes. If the cover crop is

harvested for any use other than forage or grazing and is

not terminated according to policy guidelines, then that

crop will no longer be considered a cover crop and the

acreage report must be revised to reflect the actual crop.

Permitted Revision of Intended use After Acreage Reporting Date:

New

operators or owners who pick up a farm after the acreage

reporting deadline has passed and the crop has already been

reported on the farm, have 30 days to change the intended use.

Producer share interest changes alone will not allow for

revisions to intended use after the acreage reporting date. The

revision must be performed by either the acreage reporting date

or within 30 calendar days from the date when the new operator

or owner acquired the lease on land, control of the land or

ownership and new producer crop share interest in the previously

reported crop acreage. Under this policy, appropriate

documentation must be provided to the County Committee’s

satisfaction to determine that a legitimate operator or

ownership and producer crop share interest change occurred to

permit the revision.

Acreage Reports:

In

order to maintain program eligibility and benefits, producers

must timely file acreage reports. Failure to file an acreage

report by the crop acreage reporting deadline may result in

ineligibility for future program benefits. FSA will not accept

acreage reports provided more than a year after the acreage

reporting deadline.

Definitions of Terms

FSA

defines “idle” as cropland or a balance of cropland within a

Common Land Unit (CLU) (field/subfield) which is not planted or

considered not planted and does not meet the definition of

fallow or skip row. For example, a turn area that is not

planted would be reported as idle.

[to top of second column] |

Fallow is

considered unplanted cropland acres which are part of a crop/fallow

rotation where cultivated land that is normally planted is purposely

kept out of production during a regular growing season. Resting the

ground in this manner allows it to recover its fertility and

conserve moisture for crop production in the next growing season.

In order

to comply with FSA program eligibility requirements, all producers

are encouraged to visit their local FSA office to file an accurate

crop certification report by the applicable deadline.

Acreage

reporting dates vary by crop and by county so please contact your

local FSA office for a list of county-specific deadlines.

The

following exceptions apply to acreage reporting dates:

-

If the

crop has not been planted by the applicable acreage reporting

date, then the acreage must be reported no later than 15

calendar days after planting is completed.

-

If a

producer acquires additional acreage after the applicable

acreage reporting date, then the acreage must be reported no

later than 30 calendars days after purchase or acquiring the

lease. Appropriate documentation must be provided to the county

office.

-

If a

perennial forage crop is reported with the intended use of “left

standing,” or “seed,” then the acreage must be reported by July

15th. Noninsured Crop Disaster Assistance Program

(NAP) policy holders should note that the acreage reporting date

for NAP covered crops is the earlier of the applicable dates or

15 calendar days before grazing or harvesting of the crop

begins.

2017 Acreage Reporting Dates in Illinois are:

June 15, 2017

cucumbers (planted 5/1 – 5/31)

July 15, 2017

All other spring and summer planted crops (corn, soybeans,

pumpkins, sweet corn etc.)

August 15, 2017

cabbage (planted 6/1 – 7/20)

September 15, 2017

cucumbers (planted 6/1 – 8/15)

For questions regarding crop certification and crop loss reports,

please contact your local FSA office.

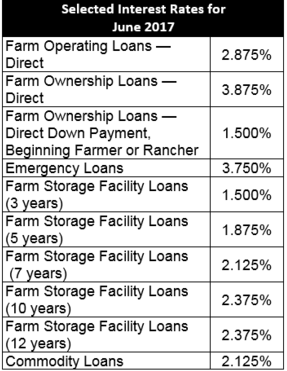

FSA’s Farm

Storage Facility Loan (FSFL) program provides low-interest financing

to producers to build or upgrade storage facilities and to purchase

portable (new or used) structures, equipment and storage and

handling trucks.

The

low-interest funds can be used to build or upgrade permanent

facilities to store commodities. Eligible commodities include corn,

grain sorghum, rice, soybeans, oats, peanuts, wheat, barley, minor

oilseeds harvested as whole grain, pulse crops (lentils, chickpeas

and dry peas), hay, honey, renewable biomass, fruits, nuts and

vegetables for cold storage facilities, floriculture, hops, maple

sap, rye, milk, cheese, butter, yogurt, meat and poultry

(unprocessed), eggs, and aquaculture (excluding systems that

maintain live animals through uptake and discharge of water).

Qualified facilities include grain bins, hay barns and cold storage

facilities for eligible commodities.

Loans up

to $50,000 can be secured by a promissory note/security agreement

and loans between $50,000 and $100,000 may require additional

security. Loans exceeding $100,000 require additional security.

Producers

do not need to demonstrate the lack of commercial credit

availability to apply. The loans are designed to assist a diverse

range of farming operations, including small and mid-sized

businesses, new farmers, operations supplying local food and farmers

markets, non-traditional farm products, and underserved producers.

To learn

more about the FSA Farm Storage Facility Loan, visit www.fsa.usda.gov/pricesupport or

contact your local FSA county office. To find your local FSA

county office, visithttp://offices.usda.gov.

Producers

who want to use the Noninsured Crop Disaster Assistance Program

(NAP) organic price and selected the "organic" option on their NAP

application must report their crops as organic.

When

certifying organic acres, the buffer zone acreage must be included

in the organic acreage.

Producers

must also provide a current organic plan, organic certificate or

documentation from a certifying agent indicating an organic plan is

in effect. Documentation must include:

-

name

of certified individuals

-

address

-

telephone number

-

effective date of certification

-

certificate number

-

list

of commodities certified

-

name

and address of certifying agent

-

a map

showing the specific location of each field of certified

organic, including the buffer zone acreage

Certification exemptions are available for producers whose annual

gross agricultural income from organic sales totals $5,000 or less.

Although exempt growers are not required to provide a written

certificate, they are still required to provide a map showing the

specific location of each field of certified organic, transitional

and buffer zone acreage.

For

questions about reporting organic crops, contact your local FSA

office. To find your local office, visit http://offices.usda.gov.

The

Agricultural Foreign Investment Disclosure Act (AFIDA) requires all

foreign owners of U.S. agricultural land to report their holdings to

the Secretary of Agriculture. Foreign persons who have purchased or

sold agricultural land in the county are required to report the

transaction to FSA within

90 days of

the closing. Failure to submit the AFIDA form could result in civil

penalties of up to 25 percent of the fair market value of the

property. County government offices, realtors, attorneys and others

involved in real estate transactions are reminded to notify foreign

investors of these reporting requirements.

Bins are

ideally designed to hold a level volume of grain. When bins are

overfilled and grain is heaped up, airflow is hindered and the

chance of spoilage increases.

Producers

who take out marketing assistance loans and use the farm-stored

grain as collateral should remember that they are responsible for

maintaining the quality of the grain through the term of the loan.

Program

participants convicted under federal or state law of any planting,

cultivating, growing, producing, harvesting or storing a controlled

substance are ineligible for program payments and benefits. If

convicted of one of these offensives, the program participant shall

be ineligible during that crop year and the four succeeding crop

years for price support loans, loan deficiency payments, market loan

gains, storage payments, farm facility loans, Non-insured Crop

Disaster Assistance Program payments or disaster payments.

Program

participants convicted of any federal or state offense consisting of

the distribution (trafficking) of a controlled substance, at the

discretion of the court, may be determined ineligible for any or all

program payments and benefits:

-

for up

to 5 years after the first conviction

-

for up

to 10 years after the second conviction

-

permanently for a third or subsequent conviction

Program

participants convicted of federal or state offense for the

possession of a controlled substance shall be ineligible, at the

discretion of the court, for any or all program benefits, as

follows:

-

up to

1 year upon the first conviction

-

up to

5 years after a second or subsequent conviction

If loan

grain has been disposed of through feeding, selling or any other

form of disposal without prior written authorization from the county

office staff, it is considered unauthorized disposition. The

financial penalties for unauthorized dispositions are severe and a

producer’s name will be placed on a loan violation list for a

two-year period. Always call before you haul any grain under loan.

June Interest Rates and

Important Dates to Remember

Illinois Farm Service Agency

3500 Wabash Ave.

Springfield, IL 62711

Phone:217-241-6600 ext. 2

Fax: 855-800-1760

www.fsa.usda.gov/il

Acting State Executive Director: Richard L. Graden

Acting State Committee:

Jill Appell-Chairperson

Brenda Hill-Member

Jerry Jimenez-Member

Joyce Matthews-Member

Gordon Stine-Member

Division Chiefs:

Doug Bailey

Jeff Koch

Randy Tillman

To find contact information for your local office go to

www.fsa.usda.gov/il

USDA is an equal opportunity

provider, employer and lender. To file a complaint of

discrimination, write: USDA, Office of the Assistant Secretary for

Civil Rights, Office of Adjudication, 1400 Independence Ave., SW,

Washington, DC 20250-9410 or call (866) 632-9992 (Toll-free Customer

Service), (800) 877-8339 (Local or Federal relay), (866) 377-8642

(Relay voice users). |