|

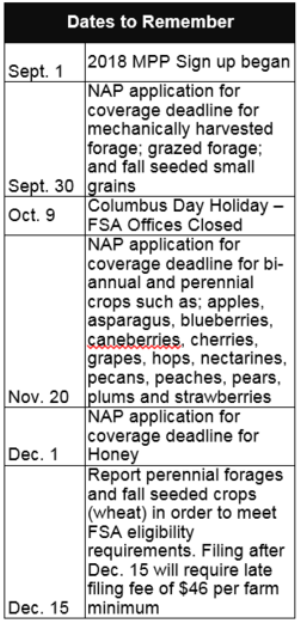

2018 NAP Application Closing Dates: 2018 NAP Application Closing Dates:

August 31, 2017 - canola

September 1, 2017 - value loss crops, such as, aquaculture,

Christmas trees, ornamental nursery, and turfgrass sod

September 30, 2017 - mechanically harvested forage, grazed

forage, and fall seeded small grains.

November 20, 2017 - bi-annual and perennial crops, such as

apples, asparagus, blueberries, caneberries, cherries, grapes,

hops, nectarines, pecans, peaches, pears, plums, and

strawberries.

December 1, 2017 - honey

March 15, 2018 - spring and summer planted NAP crops

May 1, 2017 – 2018 nursery crops

Eligible producers can apply for 2018 NAP coverage at their

local FSA Office using form CCC-471, Application for Coverage.

The service fee for basic NAP coverage is the lesser of $250 per

crop or $750 per producer per administrative county, not to

exceed a total of $1,875 for a producer with farming interest in

multiple counties. Producers interested in buy-up coverage must

pay a premium, in addition to the service fee. The maximum

premium will be $6,563.

Producer meeting the definition of a socially disadvantaged

farmer or rancher, beginning farmer or rancher or limited

resource farmer or rancher will have service fees waived.

Producers meeting this definition that choose to purchase buy-up

coverage will also have service fees waived and the premium will

be capped at $3,282.

CRP Participants Must Maintain Approved Cover on Acreages

Enrolled in CRP and Farm Programs

Conservation Reserve Program (CRP) participants are responsible

for ensuring adequate, approved vegetative and practice cover is

maintained to control erosion throughout the life of the

contract after the practice has been established. Participants

must also control undesirable vegetation, weeds (including

noxious weeds), insects and rodents that may pose a threat to

existing cover or adversely impact other landowners in the area.

All CRP maintenance activities, such as mowing, burning, disking

and spraying, must be conducted outside the primary nesting or

brood rearing season for wildlife, which for Illinois is April

15th through August 1st. However, spot treatment of the acreage

may be allowed during the primary nesting or brood rearing

season if, left untreated, the weeds, insects or undesirable

species would adversely impact the approved cover. In this

instance, spot treatment is limited to the affected areas in the

field and requires County Committee approval prior to beginning

the spot treatment. The County Committee will consult with NRCS

to determine if such activities are needed to maintain the

approved cover.

Annual mowing of CRP for generic weed control, or for cosmetic

purposes, is prohibited at all times.

Breaking New Ground

Agricultural producers are reminded to consult with FSA and NRCS

before breaking out new ground for production purposes as doing

so without prior authorization may put a producer’s federal farm

program benefits in jeopardy. This is especially true for land

that must meet Highly Erodible Land (HEL) and Wetland

Conservation (WC) provisions.

Producers with HEL determined soils are required to apply

tillage, crop residue and rotational requirements as specified

in their conservation plan.

Producers should notify FSA as a first point of contact prior to

conducting land clearing or drainage type projects to ensure the

proposed actions meet compliance criteria such as clearing any

trees to create new cropland, then these areas will need to be

reviewed to ensure such work will not risk your eligibility for

benefits.

Landowners and operators complete the form AD-1026 - Highly

Erodible Land Conservation (HELC) and Wetland Conservation (WC)

Certification to identify the proposed action and allow FSA to

determine whether a referral to Natural Resources Conservation

Service (NRCS) for further review is necessary.

USDA Announces Additional Financial Incentives for

Conservation Reserve Program Participants to Improve Forest

Health and Enhance Wildlife Habitat

In an effort to improve wildlife habitat and the health of

private forest lands, the U.S. Department of Agriculture (USDA)

Farm Service Agency (FSA) announced additional incentives

available for Conservation Reserve Program (CRP) participants to

actively manage forest lands enrolled in the program.

Under the provisions of the 2014 Farm Bill, $10 million is

available nationwide to eligible CRP participants. Those

selected will be encouraged to thin, prescribe burn or otherwise

manage their forests in order to allow sunlight to reach the

forest floor. This will encourage the development of grasses,

forbs and legumes, benefitting numerous species including

pollinators and grassland-dependent birds such as the northern

bobwhite.

Eligibility is limited to landowners and agricultural producers

already enrolled in CRP with conservation covers primarily

containing trees. Incentive payments, not to exceed 150 percent

of the cost to implement a particular customary forestry

activity as described, have been established. CRP participants

meeting eligibility requirements and interested in making offers

to participate should visit their local FSA county office.

For more information about FSA conservation programs, visit the

FSA office at the local USDA service center or go to

www.fsa.usda.gov/

conservation.

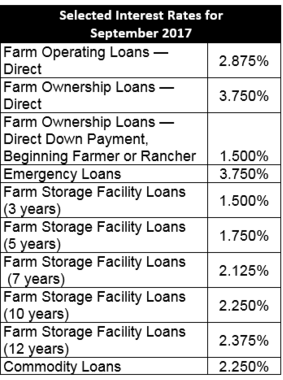

Communication is Key in Lending

Farm Service Agency (FSA) is committed to providing our farm

loan borrowers the tools necessary to be a success. A part of

ensuring this success is providing guidance and counsel from the

loan application process through the borrower’s graduation to

commercial lending institutions. While it is FSA’s commitment to

advise borrowers as they identify goals and evaluate progress,

it is crucial for borrowers to communicate with their farm loan

staff when changes occur. It is the borrower’s responsibility to

alert FSA to any of the following:

Any proposed or significant changes in the farming operation;

Any significant changes to family income or expenses;

The development of problem situations;

Any losses or proposed significant changes in security In

addition, if a farm loan borrower cannot make payments to

suppliers, other creditors, or FSA on time, contact your farm

loan staff immediately to discuss loan servicing options. For

more information on FSA farm loan programs, visit

www.fsa.usda.gov.

Filing CCC-941 Adjusted Gross Income (AGI) Certifications

Many producers have experienced delays in receiving Agriculture

Risk Coverage (ARC) and Price Loss Coverage (PLC) payments, Loan

Deficiency Payments (LDPs) and Market Gains on Marketing

Assistance Loans (MALs) because they have not filed form

CCC-941, Adjusted Gross Income Certification. LDPs will not be

paid until all eligible producers, including landowners who

share in the crop, have filed a valid CCC-941.

Producers without a valid CCC-941 certifying their compliance

with the average adjusted gross income provisions will not

receive payments that have been processed. All farm

operator/tenants/owners who have not filed a CCC-941 and have

pending payments should IMMEDIATELY file the form with their

recording county FSA office. Farm operators and tenants are

encouraged to ensure that their landowners have filed the form.

FSA has been issuing 2016 LDPs and Market Gains.

FSA can accept the CCC-941 for 2015, 2016 and 2017. Unlike the

past, producers must have the CCC-941 certifying their AGI

compliance before any payments can be issued.

Update Your Records

FSA is cleaning up our producer record database. If you have any

unreported changes of address or zip code or an incorrect name

or business name on file they need to be reported to our office.

Changes in your farm operation, like the addition of a farm by

lease or purchase, need to be reported to our office as well.

Producers participating in FSA and NRCS programs are required to

timely report changes in their farming operation to the County

Committee in writing and update their CCC-902 Farm Operating

Plan.

If you have any updates or corrections, please call your local

FSA office to update your records.

2015, 2016 and 2017 Average Adjusted Gross Income Compliance

Reviews

The AGI verification and compliance reviews for 2015, 2016 and

2017 are conducted on producers whom the IRS indicated may have

exceeded the adjusted gross income limitations described in [7

CFR 1400.500]. Based on this review, producers will receive

determinations of eligibility or ineligibility.

[to top of second column] |

If the producer is determined to have exceeded the average AGI

limitation of $900,000, receivables will be established for

payments earned directly or indirectly by the producer subject

to the $900,000 limitation. The Illinois State FSA Office

continues to notify producers selected for review. If you have

any questions about the review process or determinations, please

contact the Illinois State FSA Office at 217-241-6600. Producers

who receive initial debt notification letters may only appeal

the amount of the debt to their local FSA office.

Loan Servicing

There are options for Farm Service Agency loan customers during

financial stress. If you are a borrower who is unable to make

payments on a loan, contact your local FSA Farm Loan Manager to

learn about the options available to you.

Maintaining the Quality of Farm-Stored Loan Grain

Bins are ideally designed to hold a level volume of grain. When

bins are overfilled and grain is heaped up, airflow is hindered

and the chance of spoilage increases.

Producers who take out marketing assistance loans and use the

farm-stored grain as collateral should remember that they are

responsible for maintaining the quality of the grain through the

term of the loan.

Dairy Producers Can Enroll for 2018 Coverage

The U.S. Department of Agriculture (USDA) Farm Service Agency

(FSA) today announced that starting Sept. 1, 2017, dairy

producers can enroll for 2018 coverage in the Margin Protection

Program (MPP-Dairy). Secretary Sonny Perdue has utilized

additional flexibility this year by providing dairy producers

the option of opting out of the program for 2018.

To opt out, a producer should not sign up during the annual

registration period. By opting out, a producer would not receive

any MPP-Dairy benefits if payments are triggered for 2018. Full

details will be included in a subsequent Federal Register

Notice. The decision would be for 2018 only and is not

retroactive.

The voluntary program, established by the 2014 Farm Bill,

provides financial assistance to participating dairy producers

when the margin – the difference between the price of milk and

feed costs – falls below the coverage level selected by the

producer.

MPP-Dairy gives participating dairy producers the flexibility to

select coverage levels best suited for their operation.

Enrollment ends on Dec. 15, 2017, for coverage in calendar year

2018. Participating farmers will remain in the program through

Dec. 31, 2018, and pay a minimum $100 administrative fee for

2018 coverage. Producers have the option of selecting a

different coverage level from the previous coverage year during

open enrollment.

Dairy operations enrolling in the program must meet conservation

compliance provisions and cannot participate in the Livestock

Gross Margin Dairy Insurance Program. Producers can mail the

appropriate form to the producer’s administrative county FSA

office, along with applicable fees, without necessitating a trip

to the local FSA office. If electing higher coverage for 2018,

dairy producers can either pay the premium in full at the time

of enrollment or pay 100 percent of the premium by Sept. 1,

2018. Premium fees may be paid directly to FSA or producers can

work with their milk handlers to remit premiums on their behalf.

USDA has a web tool to help producers determine the level of

coverage under the MPP-Dairy that will provide them with the

strongest safety net under a variety of conditions. The online

resource, available at www.fsa.usda.gov/mpptool, allows dairy

farmers to quickly and easily combine unique operation data and

other key variables to calculate their coverage needs based on

price projections. Producers can also review historical data or

estimate future coverage based on data projections. The secure

site can be accessed via computer, Smartphone, tablet or any

other platform, 24 hours a day, seven days a week.

For more information, visit FSA online at www.fsa.usda.gov/dairy

or stop by a local FSA office to learn more about the MPP-Dairy.

Unauthorized Disposition of Grain

If loan grain has been disposed of through feeding, selling or

any other form of disposal without prior written authorization

from the county office staff, it is considered unauthorized

disposition. The financial penalties for unauthorized

dispositions are severe and a producer’s name will be placed on

a loan violation list for a two-year period. Always call before

you haul any grain under loan.

Emergency Assistance for Livestock, Honeybee, and Farm-Raised

Fish Program (ELAP)

The Emergency Assistance for Livestock, Honeybees and

Farm-Raised Fish Program (ELAP) provides emergency assistance to

eligible livestock, honeybee, and farm-raised fish producers who

have losses due to disease, adverse weather or other conditions,

such as blizzards and wildfires, not covered by other

agricultural disaster assistance programs.

Eligible livestock losses include grazing losses not covered

under the Livestock Forage Disaster Program (LFP), loss of

purchased feed and/or mechanically harvested feed due to an

eligible adverse weather event, additional cost of transporting

water because of an eligible drought and additional cost

associated with gathering livestock to treat for cattle tick

fever.

Eligible honeybee losses include loss of purchased feed due to

an eligible adverse weather event, cost of additional feed

purchased above normal quantities due to an eligible adverse

weather condition, colony losses in excess of normal mortality

due to an eligible weather event or loss condition, including

CCD, and hive losses due to eligible adverse weather.

Eligible farm-raised fish losses include death losses in excess

of normal mortality and/or loss of purchased feed due to an

eligible adverse weather event.

Producers who suffer eligible livestock, honeybee, or

farm-raised fish losses from Oct. 1, 2016 to Sept. 30, 2017 must

file:

A notice of loss the earlier of 30 calendar days of when the

loss is apparent or by Nov. 1, 2017

An application for payment by Nov. 1, 2017

The Farm Bill caps ELAP disaster funding at $20 million per

federal fiscal year.

The following ELAP Fact Sheets (by topic) are available online:

ELAP for Farm-Raised Fish Fact Sheet

ELAP for Livestock Fact Sheet

ELAP for Honeybees Fact Sheet

To view these and other FSA program fact sheets, visit the FSA

fact sheet web page at

www.fsa.usda.gov/factsheets

Illinois Farm Service Agency

3500 Wabash Ave.

Springfield, IL 62711

Phone: 217-241-6600 ext. 2

Fax: 855-800-1760

www.fsa.usda.gov/il

Acting State Executive Director: Richard L. Graden

Acting State Committee:

Jill Appell-Chairperson

Brenda Hill-Member

Jerry Jimenez-Member

Joyce Matthews-Member

Gordon Stine-Member

Division Chiefs:

Doug Bailey

Jeff Koch

Randy Tillman

To find contact information for your local office go to

www.fsa.usda.gov/il

USDA is an equal opportunity

provider, employer and lender. To file a complaint of

discrimination, write: USDA, Office of the Assistant Secretary for

Civil Rights, Office of Adjudication, 1400 Independence Ave., SW,

Washington, DC 20250-9410 or call (866) 632-9992 (Toll-free Customer

Service), (800) 877-8339 (Local or Federal relay), (866) 377-8642

(Relay voice users). |