Insurers face large claims after second Boeing 737 MAX

crash

Send a link to a friend

Send a link to a friend

[March 12, 2019]

By Noor Zainab Hussain, Carolyn Cohn and Suzanne Barlyn [March 12, 2019]

By Noor Zainab Hussain, Carolyn Cohn and Suzanne Barlyn

(Reuters) - Boeing Co's insurers face big

claims from families of the victims of the Ethiopian Airlines crash,

coming less than six months after the crash of the same type of Boeing

aircraft in Indonesia, insurance and aviation sources said.

An Ethiopian Airlines passenger jet bound for Nairobi crashed minutes

after take-off on Sunday, killing all 157 people on board, raising

questions about the safety of the Boeing 737 MAX 8, a new model that

also crashed in Indonesia in October.

While the initial insurance payments will be made by Ethiopian Airlines'

insurers, they may look to recoup their money from Boeing's insurers if

they can prove that the aircraft was faulty, the sources said.

Initial payments to the passengers' families are bound by the Warsaw and

Montreal conventions, but those payouts could be much higher if families

pursue legal claims, particularly through U.S. courts, said Clive

Garner, head of law firm Irwin Mitchell's travel litigation group in

London.

"If there were to be anything defective in terms of the plane or any of

its components, then it would be possible to bring a claim against the

manufacturer as well as the airline," he added.

Insurers typically form a consortium to share the risks of large claims,

with the lead insurer taking a larger proportion of the risk. The

insured value of the plane itself was likely around $50 million,

according to industry sources.

Willis Towers Watson was the insurance broker for Ethiopian Airlines,

while Chubb was the lead insurer, a Willis spokeswoman said on Monday. A

Chubb spokesman declined to comment.

Britain's Global Aerospace was the lead insurer for Boeing and also for

Lion Air, which operated the plane that crashed in October, said Global

Aerospace Chief Executive Nick Brown.

Marsh was Boeing's insurance broker, two sources told Reuters. None of

the sources gave financial details of the policies.

[to top of second column] |

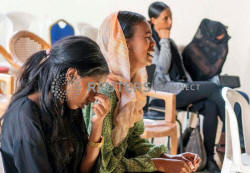

Members of the Ethiopian Airline Pilots' Association mourn as they

attend a memorial service for the Ethiopian Airlines Flight ET 302

plane that crashed, in Addis Ababa, Ethiopia, March 11, 2019.

REUTERS/Maheder Haileselassie

Boeing shares fell 5.6 percent on Monday.

U.S. LAWSUITS POSSIBLE

Boeing self-insures an initial layer of coverage before the Global Aerospace

coverage kicks in, said Justin Green, a New York-based aviation lawyer who has

represented families in cases against Boeing. Boeing declined comment on its

insurance cover.

It is not uncommon for the planemaker, which is headquartered in Chicago, to

face lawsuits in the United States, where legal compensation payments for the

crash victims could run around $2 million to $3 million per person, depending on

the law applied, compared to about $200,000 in Ethiopia, said Green.

U.S. courts often throw out such lawsuits, given the difficulty of finding

witnesses overseas, but the fact that eight U.S. citizens were killed in the

Ethiopian Airlines crash increases the likelihood that litigation on behalf of

all victims' families could be heard by a U.S. court, Green said.

Initial compensation costs for all 157 passengers who died on the flight could

be around $25 million, according to Reuters calculations based on the terms of

the Montreal convention.

The Montreal convention provides for a maximum of 113,100 special drawing

rights, currently worth $1.39, for death or injury of each passenger, although

not all countries are joined up to the convention.

(Reporting by Noor Zainab Hussain in Bengaluru and Carolyn Cohn in London and

Suzanne Barlyn in New York; Editing by Rachel Armstrong and Bill Rigby)

[© 2019 Thomson Reuters. All rights

reserved.] Copyright 2019 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |