Column: Six Social Security fixes that should be on

Biden’s agenda next year

Send a link to a friend

Send a link to a friend

[December 18, 2020] By

Mark Miller [December 18, 2020] By

Mark Miller

CHICAGO (Reuters) - President-elect Joe

Biden will be plenty busy battling the pandemic when he takes office

next month, and Social Security will likely not be on top of his agenda.

But nudging higher reforms for Social Security, our most important

retirement program, would be a very smart move.

The role of this safety net has never been more important as the country

attempts to dig out from the COVID-19 disaster. Here are six Social

Security moves the new president and Congress should make.

ADDRESS SOLVENCY

Social Security’s long-term solvency already was eroding before the

pandemic, and that has accelerated a bit due to the economic downturn

and accompanying slump in revenue from the Federal Insurance

Contributions Act (FICA) - better known as the payroll tax. Social

Security’s actuary now projects that the combined retirement and

disability trust funds will be “exhausted” in 2034 - a term referencing

the point when reserve funds will be gone. That is one year earlier than

the last projection by Social Security’s trustees, before the pandemic

began.

At the point of exhaustion, Social Security would have sufficient income

from current tax payments to meet roughly 80% of promised benefits. And

the exhaustion date could come sooner, depending on the length and depth

of the recession.

As a candidate, Biden issued a detailed plan for Social Security that

addresses the solvency problem by adding a new tier of FICA

contributions for high earners. Currently, workers and employers split a

12.4% FICA tax, levied on income up to $137,700 (In 2021, the cap will

be adjusted for inflation to $142,800). Biden would add a new tax at the

same rate on incomes over $400,000.

Biden stayed away from any broad-based FICA tax hike, which would allow

lawmakers to avoid political flak for raising taxes on people with

less-than-stratospheric incomes - but his plan extends solvency only

until 2040. It would be good to go further, but that would probably need

a new source of revenue - for example, a tax on Wall Street or fossil

fuels. That seems sensible but unlikely to me.

IMPROVE BENEFIT ADEQUACY

The economic devastation wrought by COVID-19 makes expansion of Social

Security benefits more critical than ever. Biden has proposed a series

of moderate expansions that should be passed into law. They include

crediting caregivers in their benefits for time spent out of the

workforce - a change that would especially benefit women, who already

face a substantial retirement gender gap https://nyti.ms/3mk50h5. He

also would expand benefits for widows and seniors who had collected

payments for 20 years.

Biden also favors shifting to a more generous yardstick for determining

Social Security’s annual cost-of-living adjustment.

REOPEN FIELD OFFICES - SAFELY

The Social Security Administration’s vast network of field offices has

been closed since March due to the pandemic, with most staff operating

virtually. As the pandemic recedes, it will be critical to reopen the

offices safely from a health perspective, with a priority on offices

that serve lower-income workers who are less likely to interact with the

agency online.

Reopening could present opportunities for modernization of the offices.

“You could really transform the offices to make them green from an

environmental perspective and safe,” said Nancy Altman, president of

Social Security Works, an advocacy group that recently published a set

of transition recommendations https://bit.ly/2LtNqdJ for the new

administration.

[to top of second column] |

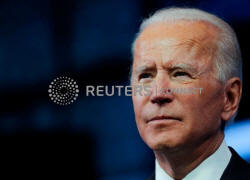

U.S. President-elect Joe Biden pauses as he delivers a televised

address to the nation, after the U.S. Electoral College formally

confirmed his victory over President Donald Trump in the 2020 U.S.

presidential election, from Biden's transition headquarters at the

Queen Theater in Wilmington, Delaware, U.S., December 14, 2020.

REUTERS/Mike Segar/File Photo

REVERSE TIGHTENING OF DISABILITY RULES

The new administration should move quickly to reverse -wherever possible - steps

the Trump administration has taken through rulemaking to make it tougher to file

for, and receive, Social Security disability benefits. That is especially

wrongheaded as evidence grows that many COVID-19 victims will suffer long-term

effects from the disease https://reut.rs/2KadgmR that will leave them unable to

work and in need of Social Security income.

FIX THE COVID 'NOTCH'

Pandemic-driven job loss has created a technical glitch that threatens

unwarranted benefit cuts for workers who turn 60 this year.

Benefits are based on each worker’s earnings history, indexed to reflect growth

in the aggregate of all national wages. But aggregate wages will fall

substantially this year due to job loss in the pandemic - an unusual situation

that the Social Security system is not built to accommodate. The indexing is

done in the year you turn 60, which is why this age group would suffer a

singular hit. Social Security’s actuaries estimated earlier this year that

someone expecting an initial benefit of $2,000 per month next year would receive

roughly $119 less as a result of the “notch.”

The most sensible fix also is simple. Congress should put a floor underneath the

system’s indexing of earnings - similar to the hold-harmless provision for

cost-of-living adjustments - to ensure that the aggregate wage calculation

cannot decrease benefits.

FIX THE FICA MESS

President Donald Trump signed a presidential memorandum https://reut.rs/2KtBGay

in August ordering the deferral of FICA taxes through year-end as an economic

stimulus measure. This was an ineffective idea from the start, since it provided

tax relief to employed people, not those who have lost jobs and need disaster

relief. And most employers wanted nothing to do with it, since it created a

liability that would have to be repaid later through a temporary doubling of tax

liabilities for workers and employers.

Lacking federal guidance, very few private-sector employers implemented the plan

- but it was enforced by the federal government. That means federal workers will

see a sudden bump in their taxes starting in January.

Biden could reduce the impact with an executive order that spreads out the

repayments over a longer period of time.

A much broader set of retirement policy reform also awaits action. But Social

Security was designed to meet moments like this one. The opportunity to put the

program to good use should not be wasted.

(The opinions expressed here are those of the author, a columnist for Reuters.)

(Writing by Mark Miller; Editing by Matthew Lewis)

[© 2020 Thomson Reuters. All rights

reserved.] Copyright 2020 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |