|

Farmers and ranchers working with USDA’s Farm Service Agency can

now sign and share documents online in just a few clicks. By

using Box or OneSpan, producers can digitally complete business

transactions without leaving their homes or agricultural

operations. Both services are free, secure, and available for

multiple FSA programs. If you are interested in utilizing these

new tools, please contact your local Service Center. Farmers and ranchers working with USDA’s Farm Service Agency can

now sign and share documents online in just a few clicks. By

using Box or OneSpan, producers can digitally complete business

transactions without leaving their homes or agricultural

operations. Both services are free, secure, and available for

multiple FSA programs. If you are interested in utilizing these

new tools, please contact your local Service Center.

Before the calendar turns to planting season, please take some

time to update your farm records. FSA is cleaning up our

producer record database and needs your help. Please telephone

or email your local Farm Service Agency and report any of the

following:

• change of address, zip code, phone number, email address

• an incorrect name or business name on file

• changes in your farm operation, like the addition of a farm

by a lease or purchase

• changes to your operation in which you reorganize to form

a Trust, LLC or other legal entity

Updating these changes now will be beneficial for program

integrity moving forward.

If you are considering additional on-farm storage for this

year’s crop, please consider FSA’s Farm Storage Facility Loan

Program (FSFL). The FSFL program provides low-interest financing

to help you build or upgrade storage facilities and to purchase

portable (new or used) structures, equipment and storage and

handling trucks.

I’m hoping everyone has a safe spring planting season, and

please remember to report your acres to your local FSA office

after you are finished planting!

Stay safe and healthy!

Dan Puccetti

Acting State Executive Director

FSA Offers Joint Financing Option on Direct

Farm Ownership Loans

The USDA Farm Service Agency’s (FSA) can help farmers and

ranchers become owner-operators of family farms, improve and

expand current operations, increase agricultural productivity,

and assist with land tenure to save farmland for future

generations.

There are three types of Direct Farm Ownership Loans: regular,

down payment and joint financing. FSA also offers an option for

smaller financial needs up to $50,000.

Joint financing allows FSA to provide more farmers and ranchers

with access to capital. FSA lends up to 50 percent of the total

amount financed. A commercial lender, a State program or the

seller of the property being purchased, provides the balance of

loan funds, with or without an FSA guarantee. The maximum loan

amount for a joint financing loan is $600,000, and the repayment

period for the loan is up to 40 years.

The operation must be an eligible farm enterprise. Farm

Ownership loan funds cannot be used to finance nonfarm

enterprises and all applicants must be able to meet general

eligibility requirements. Loan applicants are also required to

have participated in the business operations of a farm or ranch

for at least three years out of the 10 years prior to the date

the application is submitted. The applicant must show

documentation that their participation in the business operation

of the farm or ranch was not solely as a laborer.

For more information about farm loans, contact your local County

USDA Service Center for information.

USDA Extends General Signup for Conservation

Reserve Program

The USDA is extending the Conservation Reserve Program (CRP)

General Signup period, which had previously been announced as

ending on February 12, 2021. USDA will continue to accept offers

as it takes this opportunity for the incoming Administration to

evaluate ways to increase enrollment. Under the previous

Administration, incentives and rental payment rates were reduced

resulting in an enrollment shortfall of over 4 million acres.

The program, administered by USDA’s Farm Service Agency (FSA),

provides annual rental payments for 10 to 15 years for land

devoted to conservation purposes, as well as other types of

payments. Before the General CRP Signup period ends, producers

will have the opportunity to adjust or resubmit their offers to

take advantage of planned improvements to the program.

This signup for CRP gives producers an opportunity to enroll

land for the first time or re-enroll land under existing

contracts that will be expiring September 30, 2021. All

interested producers, including those on Indian reservations and

with trust lands, are encouraged to contact their local USDA

Service Center for more information.

Noninsured Crop Coverage Helps Producers

Manage Risks

The Farm Service Agency’s (FSA) Noninsured Crop Disaster

Assistance Program (NAP) helps you manage risk through coverage

for both crop losses and crop planting that was prevented due to

natural disasters. The eligible or “noninsured” crops include

agricultural commodities not covered by federal crop insurance.

You must be enrolled in the program and have purchased coverage

for the eligible crop in the crop year in which the loss

incurred to receive program benefits following a qualifying

natural disaster.

NAP Buy-Up Coverage Option

NAP offers higher levels of coverage, from 50 to 65 percent of

expected production in 5 percent increments, at 100 percent of

the average market price. Buy-up levels of NAP coverage are

available if the producer can show at least one year of

previously successfully growing the crop for which coverage is

being requested.

Producers of organics and crops marketed directly to consumers

also may exercise the “buy-up” option to obtain NAP coverage of

100 percent of the average market price at the coverage levels

of between 50 and 65 percent of expected production.

NAP basic coverage is available at 55 percent of the average

market price for crop losses that exceed 50 percent of expected

production.

Buy-up coverage is not available for crops intended for grazing.

NAP Service Fees

For all coverage levels, the NAP service fee is the lesser of

$325 per crop or $825 per producer per county, not to exceed a

total of $1,950 for a producer with farming interests in

multiple counties.

NAP Enhancements for Qualified Military Veterans

Qualified veteran farmers or ranchers are eligible for a service

fee waiver and premium reduction, if the NAP applicant meets

certain eligibility criteria.

Beginning, limited resource and targeted underserved farmers or

ranchers remain eligible for a waiver of NAP service fees and

premium reduction when they file form CCC-860, “Socially

Disadvantaged, Limited Resource and Beginning Farmer or Rancher

Certification.”

For NAP application, eligibility and related program

information, contact your local County USDA Service Center or

visit http://offices.usda.gov.

Successful Conservation Cropping Seminars

for 2021

This year’s virtual Conservation Cropping Seminars were a

roaring success. Although the in-person events couldn’t be held,

virtual meetings were developed and based on survey feedback,

attendance was very good. This was the 8th year for holding the

event and estimates are that 724 people attended all three

seminars. Keynote speakers included Dr. Nic Jelinski from

University of Minnesota, Ray Archuleta, and Dr. Joel Gruver from

Western Illinois University.

Most registrants were from the US and Illinois, but a surprising

number of participants joined in from other states and there

were several visitors from other countries—something which

doesn’t happen often at regular seminars.

Primary topics include cover crops, soil health, nutrient

management, conservation tillage, and benefits of using

conservation systems. Personal testimonials and stories from

Illinois farmers are always part of the seminars so farmers can

hear from professionals, researchers, and real-life farmers. 41%

of survey respondents indicated they planned to use more soil

health related practices and management activities on their

operations in the future.

What conservation partners are involved in the Conservation

Cropping Seminars? Just a few: Illinois Department of

Agriculture, USDA’s Natural Resources Conservation Service,

American Farmland Trust, the Illinois Stewardship Alliance,

Illinois Environmental Protection Agency, University of Illinois

Extension, and local Soil and Water Conservation Districts.

If you were unable to participate in the LIVE events, you can

still benefit from hearing the speakers and presentations on

your next rainy day. Just visit https://www.youtube.com/playlist?list=PLIq7XlTOe3ali-tWzx08L1C_dMW3eMeAM..

Plans will be underway soon for the 2022 seminars!

USDA Extends Flexibilities Amid Continuing

COVID-19 Pandemic

USDA’s Risk Management Agency is extending crop insurance

flexibilities for you amid the COVID-19 pandemic. Specifically,

relief provided for electronic notifications and signatures is

extended through July 15, 2021; organic certification, replant

self-certification and assignment of indemnity are extended

through June 30, 2021.

RMA is also allowing Approved Insurance Providers (AIPs) further

flexibilities for production reporting, submitting written

agreement requests and obtaining producer signatures for written

agreement offers. Producer signatures for written agreement

offers, issued by RMA on or before June 30, 2021, with an

expiration date on or before July 30, 2021, will allow producer

signatures to be accepted after the expiration date with proper

self-certification or documentation. However, all documentation

and signatures for these offers must be completed no later than

August 2, 2021. AIPs also have 30 business days to submit

written agreement requests and applicable documentation for

requests with submission deadlines prior to July 1, 2021.

For more information about these and other flexibilities, please

refer to Manager’s Bulletin MGR 20-030, RMA’s Frequently Asked

Questions, contact your crop insurance agent or visit

farmers.gov/coronavirus.

USDA Fruit, Vegetable and Wild Rice Planting

Rules Unchanged in 2018 Farm Bill

Fruit, vegetable and wild rice producers will continue to follow

the same rules for certain Farm Service Agency (FSA) programs.

If you intend to participate in the Agriculture Risk Coverage

(ARC) or Price Loss Coverage (PLC) programs, you are subject to

an acre-for-acre payment reduction when fruits and nuts,

vegetables or wild rice are planted on payment acres of a farm.

Payment reductions do not apply to mung beans, dry peas, lentils

or chickpeas. Planting fruits, vegetables or wild rice on acres

not considered payment acres will not result in a payment

reduction. Farms that are eligible to participate in ARC/PLC but

are not enrolled for a particular year may plant unlimited

fruits, vegetables and wild rice for that year but will not

receive ARC/PLC payments. Eligibility for succeeding years is

not affected.

Planting and harvesting fruits, vegetables and wild rice on

ARC/PLC acreage is subject to the acre-for-acre payment

reduction when those crops are planted on more than 15 percent

of the base acres of an ARC enrolled farm using the county

coverage or PLC, or more than 35 percent of the base acres of an

ARC enrolled farm using the individual coverage.

Fruits, vegetables and wild rice that are planted in a

double-cropping practice will not cause a payment reduction if

the farm is in a double-cropping region as designated by the

USDA’s Commodity Credit Corporation.

Fruit, vegetable and wild rice producers will continue to follow

the same rules for certain Farm Service Agency (FSA) programs.

If you intend to participate in the Agriculture Risk Coverage

(ARC) or Price Loss Coverage (PLC) programs, you are subject to

an acre-for-acre payment reduction when fruits and nuts,

vegetables or wild rice are planted on payment acres of a farm.

Payment reductions do not apply to mung beans, dry peas, lentils

or chickpeas. Planting fruits, vegetables or wild rice on acres

not considered payment acres will not result in a payment

reduction. Farms that are eligible to participate in ARC/PLC but

are not enrolled for a particular year may plant unlimited

fruits, vegetables and wild rice for that year but will not

receive ARC/PLC payments. Eligibility for succeeding years is

not affected.

Planting and harvesting fruits, vegetables and wild rice on

ARC/PLC acreage is subject to the acre-for-acre payment

reduction when those crops are planted on more than 15 percent

of the base acres of an ARC enrolled farm using the county

coverage or PLC, or more than 35 percent of the base acres of an

ARC enrolled farm using the individual coverage.

Fruits, vegetables and wild rice that are planted in a

double-cropping practice will not cause a payment reduction if

the farm is in a double-cropping region as designated by the

USDA’s Commodity Credit Corporation.

Fruit, vegetable and wild rice producers will continue to follow

the same rules for certain Farm Service Agency (FSA) programs.

If you intend to participate in the Agriculture Risk Coverage

(ARC) or Price Loss Coverage (PLC) programs, you are subject to

an acre-for-acre payment reduction when fruits and nuts,

vegetables or wild rice are planted on payment acres of a farm.

Payment reductions do not apply to mung beans, dry peas, lentils

or chickpeas. Planting fruits, vegetables or wild rice on acres

not considered payment acres will not result in a payment

reduction.

[to top of second column] |

Farms that are eligible to participate in ARC/PLC but are not

enrolled for a particular year may plant unlimited fruits,

vegetables and wild rice for that year but will not receive ARC/PLC

payments. Eligibility for succeeding years is not affected.

Planting and harvesting fruits, vegetables and wild

rice on ARC/PLC acreage is subject to the acre-for-acre payment

reduction when those crops are planted on more than 15 percent of

the base acres of an ARC enrolled farm using the county coverage or

PLC, or more than 35 percent of the base acres of an ARC enrolled

farm using the individual coverage.

Fruits, vegetables and wild rice that are planted in a

double-cropping practice will not cause a payment reduction if the

farm is in a double-cropping region as designated by the USDA’s

Commodity Credit Corporation.

Environmental Review Required Before Project

Implementation

The National Environmental Policy Act (NEPA) requires Federal

agencies to consider all potential environmental impacts for

federally-funded projects before the project is approved.

For all Farm Service Agency (FSA) programs, an environmental review

must be completed before actions are approved, such as site

preparation or ground disturbance. These programs include, but are

not limited to, the Emergency Conservation Program (ECP), Farm

Storage Facility Loan (FSFL) program and farm loans. If project

implementation begins before FSA has completed an environmental

review, the request will be denied. Although there are exceptions

regarding the Stafford Act and emergencies, it’s important to wait

until you receive written approval of your project proposal before

starting any actions.

Applications cannot be approved until FSA has copies of all permits

and plans. Contact your local FSA office early in your planning

process to determine what level of environmental review is required

for your program application so that it can be completed timely.

USDA Offers New Forest Management Incentive for

Conservation Reserve Program

The U.S. Department of Agriculture (USDA) is making available $12

million for use in making payments to forest landowners with land

enrolled in the Conservation Reserve Program (CRP) in exchange for

their implementing healthy forest management practices. Existing CRP

participants can now sign up for the Forest Management Incentive (FMI),

which provides financial incentives to landowners with land in CRP

to encourage proper tree thinning and other practices.

Right now, less than 10% of land currently enrolled in CRP is

dedicated to forestland. But, these nearly 2 million acres of CRP

forestland, if properly managed, can have enormous benefits for

natural resources by reducing soil erosion, protecting water

quality, increasing water quantity, and diversifying local farm

operations and rural economies.

Only landowners and agricultural producers with active CRP contracts

involving forest cover can enroll. However, this does not include

active CRP contracts that expire within two years. Existing CRP

participants interested in tree thinning and prescribed burning must

comply with the standards and specifications established in their

CRP contract.

CRP participants will receive the incentive payment once tree

thinning and/or other authorized forest management practices are

completed.

The incentive payment is the lower of:

The actual cost of completing the practice; or

75% of the payment rate offered by USDA’s Natural Resources

Conservation Service (NRCS) if

the practice is offered through NRCS conservation programs.

CRP signup is currently open. FSA will announce deadline later this

year. Interested producers should contact their FSA county office.

Applying for Youth Loans

The Farm Service Agency (FSA) makes loans to youth to establish and

operate agricultural income-producing projects in connection with

4-H clubs, FFA and other agricultural groups. Projects must be

planned and operated with the help of the organization advisor,

produce sufficient income to repay the loan and provide the youth

with practical business and educational experience. The maximum loan

amount is $5,000.

Youth Loan Eligibility Requirements:

1. Be a citizen of the United States (which includes Puerto Rico,

the Virgin Islands, Guam, American Samoa, the Commonwealth of the

Northern Mariana Islands) or a legal resident alien

2. Be 10 years to 20 years of age

3. Comply with FSA’s general eligibility

requirements

4. Be unable to get a loan from other sources

5. Conduct a modest income-producing project in a

supervised program of work as outlined above

6. Demonstrate capability of planning, managing and

operating the project under guidance and assistance from a project

advisor

The project supervisor must recommend the youth

loan applicant, along with providing adequate

supervision.

For help preparing the application forms, contact your local County

USDA Service Center or visit

http://offices.usda.gov.

USDA Encourages Completion of Cash Rents and

Leases Survey

You may have received a Cash Rents and Leases survey from the U.S.

Department of Agriculture’s National Agricultural Statistics Service

(NASS). This survey provides the basis for estimates of the current

year’s cash rents paid for irrigated cropland, non-irrigated

cropland, and permanent pasture. Please complete your Cash Rents and

Leases survey by June 21, 2021. This survey can be completed and

returned by mail, over the phone, or at agcounts.usda.gov.

Information from this survey is used in the Farm Service Agency

(FSA) Conservation Reserve Program (CRP) as an alternative soil

rental rate prior to finalizing new rates each year. Survey

responses from as many localities as possible help calculate more

accurate rental rates. Completion of the survey ensures cash rental

rates accurately represent your locality. Survey results will also

give you a useful tool in negotiating your rental agreements, and

financial planning for your agricultural operation.

In accordance with federal law, survey responses are kept

confidential. Survey results will be available in aggregate form

only to ensure that no individual producer or operation can be

identified. NASS will publish the survey results on August 27, 2021

at quickstats.nass.usda.gov/.

If you have any questions about this survey, please call

888-424-7828, or visit:

https://www.nass.usda.gov/Surveys/

Guide_to_NASS_Surveys/Cash_Rents_

by_County/index.php

You may have received a Cash Rents and Leases survey from the U.S.

Department of Agriculture’s National Agricultural Statistics Service

(NASS). This survey provides the basis for estimates of the current

year’s cash rents paid for irrigated cropland, non-irrigated

cropland, and permanent pasture. Please complete your Cash Rents and

Leases survey by June 21, 2021. This survey can be completed and

returned by mail, over the phone, or at agcounts.usda.gov.

Information from this survey is used in the Farm Service Agency

(FSA) Conservation Reserve Program (CRP) as an alternative soil

rental rate prior to finalizing new rates each year. Survey

responses from as many localities as possible help calculate more

accurate rental rates. Completion of the survey ensures cash rental

rates accurately represent your locality. Survey results will also

give you a useful tool in negotiating your rental agreements, and

financial planning for your agricultural operation.

In accordance with federal law, survey responses are kept

confidential. Survey results will be available in aggregate form

only to ensure that no individual producer or operation can be

identified. NASS will publish the survey results on August 27, 2021

at quickstats.nass.usda.gov/.

If you have any questions about this survey, please call

888-424-7828, or visit:

https://www.nass.usda.gov/Surveys/Guide

_to_NASS_Surveys/Cash_Rents_by_

County/index.php

Farm Storage Facility Loans

FSA’s Farm Storage Facility Loan (FSFL) program provides

low-interest financing to producers to build or upgrade storage

facilities and to purchase portable (new or used) structures,

equipment and storage and handling trucks.

The low-interest funds can be used to build or upgrade permanent

facilities to store commodities. Eligible commodities include corn,

grain sorghum, rice, soybeans, oats, peanuts, wheat, barley, minor

oilseeds harvested as whole grain, pulse crops (lentils, chickpeas

and dry peas), hay, honey, renewable biomass, fruits, nuts and

vegetables for cold storage facilities, floriculture, hops, maple

sap, rye, milk, cheese, butter, yogurt, meat and poultry

(unprocessed), eggs, and aquaculture (excluding systems that

maintain live animals through uptake and discharge of water).

Qualified facilities include grain bins, hay barns and cold storage

facilities for eligible commodities.

Loans up to $50,000 can be secured by a promissory note/security

agreement and loans between $50,000 and $100,000 may require

additional security. Loans exceeding $100,000 require additional

security.

Producers do not need to demonstrate the lack of commercial credit

availability to apply. The loans are designed to assist a diverse

range of farming operations, including small and mid-sized

businesses, new farmers, operations supplying local food and farmers

markets, non-traditional farm products, and underserved producers.

To learn more about the FSA Farm Storage Facility Loan, visit

www.fsa.usda.gov/pricesupport or contact your local FSA county

office.

To find your local FSA county office, visit

http://offices.usda.gov.

Maintaining the Quality of Farm-Stored Loan

Grain

Bins are ideally designed to hold a level volume of grain. When bins

are overfilled and grain is heaped up, airflow is hindered and the

chance of spoilage increases.

Producers who take out marketing assistance loans and use the

farm-stored grain as collateral should remember that they are

responsible for maintaining the quality of the grain through the

term of the loan.

Unauthorized Disposition of Grain

If loan grain has been disposed of through feeding, selling or any

other form of disposal without prior written authorization from the

county office staff, it is considered unauthorized disposition. The

financial penalties for unauthorized dispositions are severe and a

producer’s name will be placed on a loan violation list for a

two-year period. Always call before you haul any grain under loan.

Watch Your Local Newspaper for NRCS Program

Announcements

Staff at the Illinois Natural Resources Conservation Service are

pulling together final announcements and information on applications

and sign-up opportunities for programs, namely the Conservation

Stewardship Program. Whether you are interested in applying for

programs for the first time or you are considering renewing your

contract, keep an eye out for details and deadlines. Spring is

almost here and there’s a lot to get done, but be sure you’re in

business with all the conservation programs, technical, and

financial assistance you’ll need in 2021 and beyond. You can always

check the Illinois NRCS Newsroom website so you are always

up-to-date on all the information you need! Visit

www.il.nrcs.usda.gov and bookmark the Newsroom today.

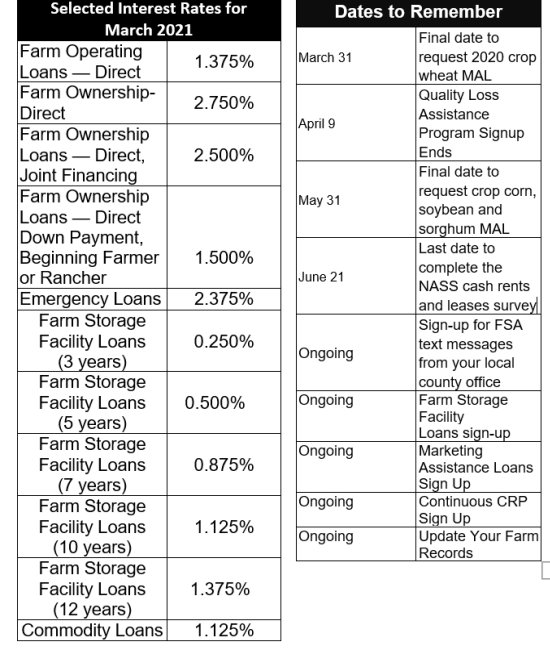

March Interest Rates and Important Dates

Illinois Farm Service Agency

3500 Wabash Ave.

Springfield, Illinois 62711

Phone: 217-241-6600 ext. 2

Fax: 855-800-1760

www.fsa.usda.gov/il

Acting State

Executive Director:

Dan Puccetti

State Committee:

James Reed-Chairperson

Melanie DeSutter-Member

Kirk Liefer-Member

George Obernagel III-Member

Troy Uphoff-Member

Administrative Officer:

Dan Puccetti

Division Chiefs:

Vicki Donaldson

John Gehrke

Wendy Mueller

Randy Tillman

To find contact information for your local office go to

www.fsa.usda.gov/il

Check out https://www.farmers.gov/ for information about ALL the

programs available through your local USDA Service Center FSA and

NRCS offices, including county office locations, agriculture

statistics, loan interest rates and much more!

Learn about Risk Management Agency's crop insurance programs at

https://cropinsurance101.org/ |