|

The Illinois FSA State Committee was selected and announced on

March 18, 2022. The Illinois FSA State Committee was selected and announced on

March 18, 2022.

The State Committee members are:

• Steve Turner - Chairman - Chandlerville

• Erika Rae Allen - Member - Chicago

• Johari Cole-Kweli - Pembroke

• Ben Curtin - Member - Taylorville

• Brenda Hill - Member - Brookport

I look forward to working with each of them to better serve the

producers in Illinois.

On April 4, 2022 – USDA FSA announced that Grassland CRP sign up

opened.

The Spot Market Hog Pandemic Program (SMHPP) which is part of

USDA’s Pandemic Assistance for Producers initiative and

addresses gaps in previous assistance for hog producers.

FSA is accepting applications December 15, 2021 through April

29, 2022.

May 13, 2022 - Grassland CRP sign up ends May 30, 2022

Memorial Day Holiday - FSA Offices Closed

May 31, 2022 – Last Date to Request 2021Crop Corn, Soybean and

Grain Sorghum Marketing Assistance Loan (MAL)

FSA Ongoing Farm Storage Facility Loans (FSFL) If you are in

interested in increasing on the farm grain storage capacities

and needing to add a new grain bin, grain truck, cold storage

facility, cold storage or refrigerated truck etc., FSA has an

ongoing FSFL loan program with attractive low interest rates.

WHO IS ELIGIBLE?

An eligible borrower is any person who is a landowner, landlord,

leaseholder, tenant or sharecropper. Eligible borrowers must be

able to show repayment ability and meet other requirements to

qualify for a loan.

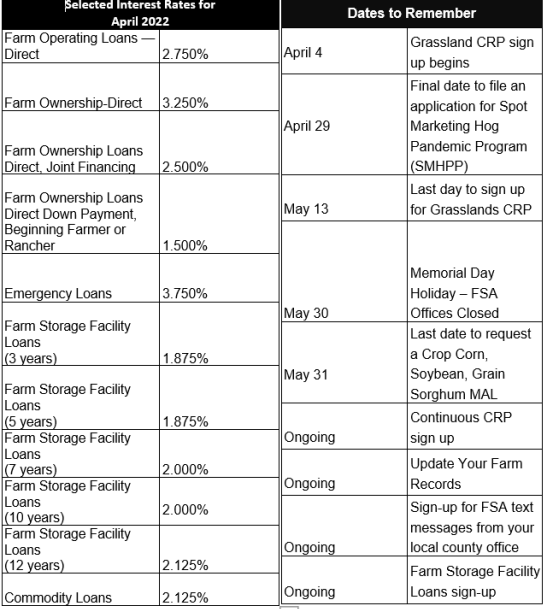

The April loan rates for FSFL loans are:

3 yrs. = 1.875%

5 yrs. = 1.875%

7 yrs. = 2.00%

10 yrs. = 2.00%

12 yrs. = 2.125%

(Loan rates are subject to change monthly)

Producers do not need to demonstrate the lack of commercial

credit availability to apply.

Please contact your local county FSA office for more information

regarding FSFL loans. As you complete your spring crop planting,

please remember to take that extra step in your every day

routine and continue to stay safe on and around the farm.

Sincerely,

Scott Halpin

State Executive Director

USDA to Provide Payments to Livestock

Producers Impacted by Drought or Wildfire

The U.S Department of Agriculture (USDA)

announced that ranchers who have approved applications through

the 2021 Livestock Forage Disaster Program (LFP) for forage

losses due to severe drought or wildfire in 2021 will soon begin

receiving emergency relief payments for increases in

supplemental feed costs in 2021 through the Farm Service

Agency’s (FSA) new Emergency Livestock Relief Program (ELRP).

Background

On September 30, 2021, President Biden signed into law the

Extending Government Funding and Delivering Emergency Assistance

Act (P.L. 117-43). This Act includes $10 billion in assistance

to agricultural producers impacted by wildfires, droughts,

hurricanes, winter storms and other eligible disasters

experienced during calendar years 2020 and 2021. Additionally,

the Act specifically targets $750 million to provide assistance

to livestock producers for losses incurred due to drought or

wildfires in calendar year 2021. ELRP is part of FSA’s

implementation of the Act.

For impacted producers, USDA will leverage LFP data to deliver

immediate relief for increases in supplemental feed costs in

2021. LFP is an important tool that provides up to 60% of the

estimated replacement feed cost when an eligible drought

adversely impacts grazing lands or 50% of the monthly feed cost

for the number of days the producer is prohibited from grazing

the managed rangeland because of a qualifying wildfire.

FSA received more than 100,000 applications totaling nearly $670

million in payments to livestock producers under LFP for the

2021 program year.

Congress recognized requests for assistance beyond this existing

program and provided specific funding for disaster-impacted

livestock producers in 2021.

ELRP Eligibility – Phase One

To be eligible for an ELRP payment under phase one of program

delivery, livestock producers must have suffered grazing losses

in a county rated by the U.S. Drought Monitor as having a D2

(severe drought) for eight consecutive weeks or a D3 (extreme

drought) or higher level of drought intensity during the 2021

calendar year and have applied and been approved for 2021 LFP.

Additionally, producers whose permitted grazing on federally

managed lands was disallowed due to wildfire are also eligible

for ELRP payments if they applied and were approved for 2021 LFP.

As part of FSA’s efforts to streamline and simplify the delivery

of ELRP phase one benefits, producers are not required to submit

an application for payment; however, they must have the

following forms on file with FSA within a subsequently announced

deadline as determined by the Deputy Administrator for Farm

Programs:

CCC-853, Livestock Forage Disaster Program Application

Form AD-2047, Customer Data Worksheet.

Form CCC-902, Farm Operating Plan for an individual or legal

entity.

Form CCC-901, Member Information for Legal Entities (if

applicable).

Form FSA-510, Request for an Exception to the $125,000 Payment

Limitation for Certain Programs (if applicable).

Form CCC-860, Socially Disadvantaged, Limited Resource,

Beginning and Veteran Farmer or Rancher Certification, if

applicable, for the 2021 program year.

A highly erodible land conservation (sometimes referred to as

HELC) and wetland conservation certification (Form AD-1026

Highly Erodible Land Conservation (HELC) and Wetland

Conservation (WC) Certification) for the ELRP producer and

applicable affiliates.

ELRP Payment Calculation – Phase One

To further expedite payments to eligible livestock producers,

determine eligibility, and calculate an ELRP phase one payment,

FSA will utilize livestock inventories and drought-affected

forage acreage or restricted animal units and grazing days due

to wildfire already reported by the producer when they submitted

a 2021 CCC-853, Livestock Forage Disaster Program Application

form.

Phase one ELRP payments will be equal to the eligible livestock

producer’s gross 2021 LFP calculated payment multiplied by a

payment percentage, to reach a reasonable approximation of

increased supplemental feed costs for eligible livestock

producers in 2021.

The ELRP payment percentage will be 90% for historically

underserved producers, including beginning, limited resource,

and veteran farmers and ranchers, and 75% for all other

producers. These payments will be subject to a payment

limitation.

To qualify for the higher payment percentage, eligible producers

must have a CCC-860, Socially Disadvantaged, Limited Resource,

Beginning and Veteran Farmer or Rancher Certification, form on

file with FSA for the 2021 program year.

Payments to eligible producers through phase one of ELRP are

estimated to total more than $577 million.

ELRP - Phase Two

Today’s announcement is only Phase One of relief for livestock

producers. FSA continues to evaluate and identify impacts of

2021 drought and wildfire on livestock producers to ensure

equitable and inclusive distribution of much-needed emergency

relief program benefits.

Emergency Relief Program (ERP) Assistance for Crop Producers

FSA is developing a two-phased process to provide assistance to

diversified, row crop and specialty crop operations that were

impacted by an eligible natural disaster event in calendar years

2020 or 2021.

This program will provide assistance to crop producers and will

follow a two-phased process similar to that of the livestock

assistance with implementation of the first phase in the coming

weeks. Phase one of the crop assistance program delivery will

leverage existing Federal Crop Insurance or Noninsured Crop

Disaster Assistance Program data as the basis for calculating

initial payments.

Making the initial payments using existing safety net and risk

management data will both speed implementation and further

encourage participation in these permanent programs, including

the Pasture, Rangeland, Forage Rainfall Index Crop Insurance

Program, as Congress intended.

The second phase of the crop program will be intended to fill

additional assistance gaps and cover eligible producers who did

not participate in existing risk management programs.

Through proactive communication and outreach, USDA will keep

producers and stakeholders informed as ERP implementation

details are made available.

Additional Livestock Drought Assistance

Due to the persistent drought conditions in the Great Plains and

West, FSA will be offering additional relief through the

Emergency Assistance for Livestock, Honeybees and Farm-raised

Fish Program (ELAP) to help ranchers cover above normal costs of

hauling livestock to forage. This policy enhancement

complements previously announced ELAP compensation for hauling

feed to livestock. Soon after FSA announced the assistance for

hauling feed to livestock, stakeholders were quick to point out

that producers also were hauling the livestock to the feed

source as well and encouraged this additional flexibility.

It is important to note that, unlike ELRP emergency relief

benefits which are only applicable for eligible losses incurred

in the 2021 calendar year, this ELAP livestock and feed hauling

compensation will not only be retroactive for 2021 but will also

be available for losses in 2022 and subsequent years.

To calculate ELAP program benefits, an online tool is currently

available to help producers document and estimate payments to

cover feed transportation cost increases caused by drought and

will soon be updated to assist producers with calculations

associated with drought related costs incurred for hauling

livestock to forage.

More Information

Additional USDA disaster assistance information can be found on

farmers.gov, including USDA resources specifically for producer

impacted by drought and wildfire and the Disaster Assistance

Discovery Tool, Disaster-at-a-Glance fact sheet, and Farm Loan

Discovery Tool. For FSA and Natural Resources Conservation

Service programs, producers should contact their local USDA

Service Center. For assistance with a crop insurance claim,

producers and landowners should contact their crop insurance

agent.

USDA Updates Eligibility for Spot Market Hog

Pandemic Program

The U.S. Department of Agriculture (USDA) has

clarified the definition of a spot market sale and hog

eligibility under the Spot Market Hog Pandemic Program (SMHPP),

which assists producers who sold hogs through a spot market sale

from April 16, 2020, through Sept. 1, 2020. Hog producers will

also now be required to submit documentation to support

information provided on their SMHPP application. USDA’s Farm

Service Agency (FSA) will accept applications through April 29,

2022, which is an extension of the April 15, 2022, deadline

previously set for the program.

USDA is offering the SMHPP in response to a reduction in packer

production due to the COVID-19 pandemic, which resulted in fewer

negotiated hogs being procured and subsequent lower market

prices. The program is part of USDA’s broader Pandemic

Assistance for Producers initiative and addresses gaps in

previous assistance for hog producers.

SMHPP Program Updates

When the pandemic disrupted normal marketing channels, including

access to packers, producers sold their hogs through cash sales

to local processors or butchers, direct sales to individuals and

third-party intermediaries, including sale barns or brokers. The

use of third-party intermediaries was the only available

marketing alternative for many producers and are now included in

SMHPP. The only direct to packer sales that are eligible for

SMHPP are those through a negotiated sale. Hogs sold through a

contract that includes a premium above the spot-market price or

other formula such as the wholesale cut-out price remain

ineligible. Hogs must be suitable and intended for slaughter to

be eligible. Immature swine (pigs) are ineligible.

FSA will now require documentation to support the accuracy of

information provided on the FSA-940 Spot Market Hog Pandemic

Program application, including the number of hogs reported on

the application that were sold through a spot market sale and

how the price was determined for the sale.

SMHPP payments will be calculated by multiplying the number of

head of eligible hogs, not to exceed 10,000 head, by the payment

rate of $54 per head. To ensure SMHPP funding availability is

disbursed equitably to all eligible producers, FSA will now

issue payments after the application period ends. If calculated

payments exceed the amount of available funding, payments will

be factored.

Applying for Assistance

Eligible hog producers can apply for SMHPP by April 29, 2022, by

completing the FSA-940, Spot Market Hog Pandemic Program

application, along with required supporting documentation.

Producers can visit farmers.gov/smhpp for examples of supporting

documentation, information on applicant eligibility and more

information on how to apply.

Applications can be submitted to the FSA office at any USDA

Service Center nationwide by mail, fax, hand delivery or via

electronic means. To find their local FSA office, producers

should visit farmers.gov/service-locator. Hog producers can also

call 877-508-8364 to speak directly with a USDA employee ready

to offer assistance.

Borrower Training for Farm Loan Customers

Borrower training is available for all Farm

Service Agency (FSA) customers. This training is required for

all direct loan applicants, unless the applicant has a waiver

issued by the agency.

Borrower training includes instruction in production and

financial management. The purpose is to help the applicants

develop and improve skills that are necessary to successfully

operate a farm and build equity in the operation. It aims to

help the producer become financially successful. Borrower

training is provided, for a fee, by agency approved vendors.

Contact your local FSA Farm Loan Manager for a list of approved

vendors.

USDA Updates Crop Insurance to Respond to

Producer Needs, Support Conservation and Climate Mitigation

Efforts

The U.S. Department of Agriculture (USDA) is making updates to

crop insurance to respond to the needs of agricultural

producers, including organic producers, as well as to support

conservation of natural resources on agricultural land.

Specifically, USDA’s Risk Management Agency (RMA) is making

permanent a new provision that allows producers to hay, graze or

chop cover crops and still receive a full prevented planting

payment. To accommodate the different farming practices across

the country, RMA is also increasing flexibility related to the

prevented planting “1 in 4” requirement, as well as aligning

crop insurance definitions with USDA’s National Organic

Program.

Haying, Grazing, and Chopping of Cover Crops

In July, RMA announced producers can hay, graze, or chop cover

crops for silage, haylage, or baleage at any time and still

receive 100% of the prevented planting payment. Previously,

cover crops could only be hayed, grazed or chopped after

November 1. Otherwise, the prevented planting payment was

reduced by 65% if producers took those actions on the cover

crop.

RMA added this flexibility starting with the 2021 crop year as

part of a broader effort to encourage producers to use

cover crops, an important conservation and good farming

practice. Cover crops are especially important on fields

prevented from being planted because they cover ground that

would otherwise be left bare, which helps reduce soil

erosion, boost soil health and increase soil carbon

sequestration.

This change builds on the advanced research and identified

benefits cover crops have supporting healthy soils and cropland

sustainability efforts. Studies also show that cover crops

provide increased corn and soybean yields. While results vary by

region and soil type, cover crops are proven to reduce erosion,

improve water quality and increase the health and productivity

of the soil while building resilience to climate change.

Additionally, RMA provided a premium benefit to producers who

planted cover crops through the Pandemic Cover Crop Program to

help producers maintain cover crop systems amid the financially

challenging pandemic.

“1 in 4” Requirement Flexibilities

For the 2020 crop year, RMA implemented a policy stating that

for land to be eligible for prevented planting coverage, the

acreage must meet the “1 in 4” requirement, which means the land

must be planted, insured and harvested in at least one of the

four most recent crop years. Now, RMA is adding flexibilities to

recognize different farming practices and crops grown, as well

as the availability of risk management options.

New flexibilities allowed in order to meet the “1 in 4”

requirement include:

The annual regrowth for an insured perennial crop, such as

alfalfa, red clover, or mint, to be considered planted.

Allow a crop covered by the Noninsured Crop Disaster Assistance

Program (NAP) to meet the insurability requirement.

If crop insurance or NAP coverage was not available, allow the

producer to prove the acreage was planted and harvested using

good farming practices in at least two consecutive years out of

the four previous years to meet the insurability requirement.

Aligning Organic Terms

RMA is revising four organic definitions to be consistent with

USDA’s National Organic Program. Consistency across USDA

programs is important to eliminate the potential for confusion

between the various programs that USDA is committed to providing

to the producers.

This change builds on other RMA efforts to expand and improve

current options for organic producers. In Sept. 2021, RMA

announced several updates to Whole-Farm Revenue Protection (WFRP),

including increasing farm operation growth limits for organic

producers to the higher of $500,000 or 35% over the five-year

average allowable income, and to allowing a producer to report

acreage as certified organic, or as acreage in transition to

organic, when the producer has requested an organic

certification by the acreage reporting date. In addition, RMA

announced it will be offering the new Micro Farm policy through

WFRP that specifically targets coverage for small, diversified

farmers, including organic growers.

Other Changes

RMA made other changes to Common Crop Insurance Policy Basic

Provisions, Area Risk Protection Insurance Regulations, Coarse

Grains Crop Insurance Provisions, and other insurance

provisions, which published today:

RMA is providing an option for producers to delay measurement of

farm-stored production for 180-days through the Special

Provisions, similar to flexibilities already available to grain

crop producers.

RMA added earlage and snaplage as an acceptable method of

harvest for coarse grains. During the 2020 Derecho, many

producers salvaged their damaged corn crop by harvesting as earlage

or snaplage instead of grain or silage.

[to top of second column] |

Crop insurance is sold and delivered solely through private crop

insurance agents. A list of crop insurance agents is available

at all USDA Service Centers and online at the RMA Agent Locator.

Learn more about crop insurance and the modern farm safety net

at rma.usda.gov.

Farm Storage Facility Loans

FSA’s Farm Storage Facility Loan (FSFL) program

provides low-interest financing to producers to build or upgrade

storage facilities and to purchase portable (new or used)

structures, equipment and storage and handling trucks.

The low-interest funds can be used to build or upgrade permanent

facilities to store commodities. Eligible commodities include corn,

grain sorghum, rice, soybeans, oats, peanuts, wheat, barley, minor

oilseeds harvested as whole grain, pulse crops (lentils, chickpeas,

and dry peas), hay, honey, renewable biomass, fruits, nuts and

vegetables for cold storage facilities, floriculture, hops, maple

sap, rye, milk, cheese, butter, yogurt, meat and poultry

(unprocessed), eggs, and aquaculture (excluding systems that

maintain live animals through uptake and discharge of water).

Qualified facilities include grain bins, hay barns and cold storage

facilities for eligible commodities.

Loans up to $50,000 can be secured by a promissory

note/security agreement and loans between $50,000 and $100,000 may

require additional security. Loans exceeding $100,000 require

additional security.

Producers do not need to demonstrate the lack of commercial credit

availability to apply. The loans are designed to assist a diverse

range of farming operations, including small and mid-sized

businesses, new farmers, operations supplying local food and farmers

markets, non-traditional farm products, and underserved producers.

To learn more about the FSA Farm Storage Facility Loan, visit

www.fsa.usda.gov/pricesupport or contact your local FSA county

office. To find your local FSA county office, visit

http://offices.usda.gov.

Keeping Livestock Inventory Records

Livestock inventory records are necessary in the

event of a natural disaster, so remember to keep them updated.

When disasters strike, the USDA Farm Service Agency (FSA) can help

you if you’ve suffered excessive livestock death losses and grazing

or feed losses due to eligible natural disasters.

To participate in livestock disaster assistance programs, you’ll be

required to provide verifiable documentation of death losses

resulting from an eligible adverse weather event and must submit a

notice of loss to your local FSA office within 30 calendar days of

when the loss of livestock is apparent. For grazing or feed losses,

you must submit a notice of loss to your local FSA office within 30

calendar days of when the loss is apparent and should maintain

documentation and receipts.

You should record all pertinent information regarding livestock

inventory records including:

Documentation of the number, kind, type, and weight range of

livestock

Beginning inventory supported by birth recordings or purchase

receipts.

Producers are encouraged to file acreage reports which include

pasture and hayland acres to ensure eligibility for current and

future programs. For more information on documentation requirements,

contact your local County USDA Service Center or visit fsa.usda.gov.

Reminders for FSA Direct and Guaranteed

Borrowers with Real Estate Security

Farm loan borrowers who have pledged real estate as

security for their Farm Service Agency (FSA) direct or guaranteed

loans are responsible for maintaining loan collateral. Borrowers

must obtain prior consent or approval from FSA or the guaranteed

lender for any transaction that affects real estate security. These

transactions include, but are not limited to:

Leases of any kind

Easements of any kind

Subordinations

Partial releases

Sales

Failure to meet or follow the requirements in the loan agreement,

promissory note, and other security instruments could lead to

nonmonetary default which could jeopardize your current and future

loans.

It is critical that borrowers keep an open line of communication

with their FSA loan staff or guaranteed lender when it comes to

changes in their operation. For more information on borrower

responsibilities, read Your FSA Farm Loan Compass.

Reporting Organic Crops

If you want to use the Noninsured Crop Disaster

Assistance Program (NAP) organic price and you select the "organic"

option on your NAP application, you must report your crops as

organic.

When certifying organic acres, the buffer zone acreage must be

included in the organic acreage.

You must also provide a current organic plan, organic certificate or

documentation from a certifying agent indicating an organic plan is

in effect. Documentation must include:

name of certified individuals

address

telephone number

effective date of certification

certificate number

list of commodities certified

name and address of certifying agent

a map showing the specific location of each field of certified

organic, including the buffer zone acreage

Certification exemptions are available for

producers whose annual gross agricultural income from organic sales

totals $5,000 or less. Although exempt growers are not required to

provide a written certificate, they are still required to provide a

map showing the specific location of each field of certified

organic, transitional and buffer zone acreage.

Filing CCC-941 Adjusted Gross Income

Certifications

If you have experienced delays in receiving

Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC)

payments, Loan Deficiency Payments (LDPs) and Market Gains on

Marketing Assistance Loans (MALs), it may be because you have not

filed form CCC-941, Adjusted Gross Income Certification.

If you don’t have a valid CCC-941 on file for the applicable crop

year you will not receive payments. All farm operator/tenants/owners

who have not filed a CCC-941 and have pending payments should

IMMEDIATELY file the form with their recording county FSA office.

Farm operators and tenants are encouraged to ensure that their

landowners have filed the form.

FSA can accept the CCC-941 for 2018, 2019, 2020, 2021, and 2022.

Unlike the past, you must have the CCC-941 certifying your AGI

compliance before any payments can be issued.

More information on adjusted gross income is available at Payment

Eligibility (usda.gov).

A Message from the State Conservationist

The U.S. Department of Agriculture (USDA) unveiled

a new plan to help guide voluntary conservation work over the next

five years across 25 states, including over 7 million acres of new

conservation practices on productive, working lands, and will

contribute to the current Administration’s efforts to make our

nation a leader on climate change mitigation, adaptation and

resilience. Illinois is one of those states.

The plan will accelerate voluntary conservation efforts for the

Northern bobwhite quail and the grassland and savanna landscapes

that the species calls home. This plan, the Northern Bobwhite,

Grasslands and Savannas Framework for Conservation Action, outlines

how USDA’s Natural Resources Conservation Service (NRCS) will work

with agricultural producers and partners like Quail Forever to

increase adoption of targeted conservation practices that are good

for farmers, the bobwhite, and natural resources. This framework

leverages conservation efforts on working lands and supports the

Administration’s America the Beautiful initiative.

“When we manage for bobwhite habitat, we can also create healthier

forests and forage, which is good for livestock producers,

landowners, and natural resources,” said Ivan Dozier, NRCS State

Conservationist in Illinois. “This new framework builds on what we

know – that America’s agricultural producers using conservation

practices are helping declining species like the bobwhite while also

providing food and fiber and conserving our resources for future

generations. In the face of weather extremes, as well as habitat

loss and fragmentation, expanding efforts to conserve landscapes and

wildlife communities is more important than ever.”

“Quail Forever recognizes the need to help landowners build farming

systems that match profitability with ecological performance;

supporting the bottom line of farmers and ranchers while

contributing to a habitat mosaic that creates positive gains for

bobwhite quail and other species,” said Ron Leathers, Chief

Conservation Officer for Quail Forever. “To that end, we’re proud to

partner with the United States Department of Agriculture in this

endeavor and look forward to assisting producers with the

implementation of working lands programs that provide incredible

gains for wildlife, water quality, farm profitability, climate

resiliency, and soil health.”

The framework:

Reduces threats, like drought and wildfire, to grassland and savanna

landscapes that northern bobwhite and other species call home.

Establishes native warm-season grasses to reduce erosion, recharge

aquifers and supplement forage during summer slump periods.

Focuses on key conservation practices, including prescribed grazing,

brush management, prescribed burning, herbaceous weed treatment,

forage and biomass planting, contour buffer strips and forest stand

improvement.

Leverages support from partners like Quail Forever to help producers

with planning and implementing practices.

Monitors and measures the response of northern bobwhite and other

wildlife species through the Northern Bobwhite Technical Committee (NBTC)

and Quail Forever.

Develops landscape-wide models to track wildlife and economic

outcomes by researchers at the University of Georgia and Mississippi

State University.

Develops outcomes assessments that include quantifying tons of

carbon stored because of conservation efforts to mitigate harmful

greenhouse gases.

How Landowners Can Get Involved

Farmers, livestock operators, and private landowners in the Midwest

can work with NRCS to implement conservation practices on their

working lands, including those that further this new framework. To

learn more, they should contact their local USDA Service Center.

USDA Encourages Producers to Enroll in Grassland

CRP

The U.S. Department of Agriculture (USDA)

encourages producers and landowners to enroll in the Grassland

Conservation Reserve Program (CRP) starting April 4, 2022 through

May 13, 2022. Grassland CRP provides a unique opportunity for

farmers, ranchers, and agricultural landowners to keep land in

agricultural production and supplement their income while improving

their soils and permanent grass cover. The program had its highest

enrollment in history in 2021 and is part of the Biden-Harris

Administration’s broader effort to equip producers with the tools

they need to help address climate change and invest in the long-term

health of our natural resources.

Grassland CRP is a federally funded voluntary working lands program.

Through the program, USDA’s Farm Service Agency (FSA) provides

annual rental payments to landowners to maintain and conserve

grasslands while allowing producers to graze, hay, and produce seed

on that land. Maintaining the existing permanent cover provides

several benefits, including reducing erosion, providing wildlife

habitat and migration corridors, and capturing and maintaining

carbon in the soil and cover.

FSA provides participants with annual rental payments and cost-share

assistance. The annual rental rate varies by county with a national

minimum rental rate of $13 per acre for this signup. Contract

duration is 10 or 15 years.

Grassland CRP National Priority Zones

Because Grassland CRP supports not only grazing operations but also

biodiversity and conserving environmentally sensitive land such as

that prone to wind erosion, FSA created two National Priority Zones

in 2021: the Greater Yellowstone Migration Corridor and Dust Bowl

Zone. As part of the Biden-Harris Administration’s focus on

conservation in important wildlife corridors and key seasonal

ranges, for this year’s signup, FSA is expanding the Greater

Yellowstone Wildlife Migration Corridor Priority Zone to include

seven additional counties across Montana, Wyoming, and Utah, to help

protect the big-game animal migration corridor associated with

Wyoming elk, mule deer, and antelope.

Offers within one of these National Priority Zones will receive an

additional 15 ranking points and $5 per acre if at least 50% of the

offer is located in the zone.

Alongside Grassland CRP, producers and landowners can also enroll

acres in Continuous CRP under the ongoing sign up, which includes

projects available through the Conservation Reserve Enhancement

Program (CREP) and State Acres for Wildlife Enhancement (SAFE).

Broadening Reach of Program

As part of the Agency’s Justice40 efforts, producers and landowners

who are historically underserved, including beginning farmers and

military veterans, will receive 10 additional ranking points to

enhance their offers.

Additionally, USDA is working to broaden the scope and reach of

Grassland CRP by leveraging the Conservation Reserve Enhancement

Program (CREP) to engage historically underserved communities. CREP

is a partnership program that enables states, Tribal governments,

non-profit, and private entities to partner with FSA to implement

CRP practices and address high priority conservation and

environmental objectives. Interested entities are encouraged to

contact FSA.

More Information on CRP

Landowners and producers interested in Grassland CRP should contact

their local USDA Service Center to learn more or to apply for the

program before the May 13, 2022 deadline. Additionally, fact sheets

and other resources are available at fsa.usda.gov/crp.

Signed into law in 1985, CRP is one of the largest voluntary

private-lands conservation programs in the United States. The

working lands signup announced today demonstrates how much it has

evolved from the original program that was primarily intended to

control soil erosion and only had the option to take enrolled land

out of production. The program has expanded over the years and now

supports a greater variety of conservation and wildlife benefits,

along with the associated economic benefits.

Environmental Review Required Before Project

Implementation

The National Environmental Policy Act (NEPA)

requires Federal agencies to consider all potential environmental

impacts for federally-funded projects before the project is

approved.

For all Farm Service Agency (FSA) programs, an environmental review

must be completed before actions are approved, such as site

preparation or ground disturbance. These programs include, but are

not limited to, the Emergency Conservation Program (ECP), Farm

Storage Facility Loan (FSFL) program and farm loans. If project

implementation begins before FSA has completed an environmental

review, the request will be denied. Although there are exceptions

regarding the Stafford Act and emergencies, it’s important to wait

until you receive written approval of your project proposal before

starting any actions.

Applications cannot be approved until FSA has copies of all permits

and plans. Contact your local FSA office early in your planning

process to determine what level of environmental review is required

for your program application so that it can be completed timely.

Transitioning Expiring CRP Land to Beginning,

Veteran or Underserved Farmers and Ranchers

CRP contract holders are encouraged to transition

their Conservation Reserve Program (CRP) acres to beginning, veteran

or socially disadvantaged farmers or ranchers through the Transition

Incentives Program (TIP). TIP provides annual rental payments to the

landowner or operator for up to two additional years after the CRP

contract expires.

CRP contract holders no longer need to be a retired or retiring

owner or operator to transition their land. TIP participants must

agree to sell, have a contract to sell, or agree to lease long term

(at least five years) land enrolled in an expiring CRP contract to a

beginning, veteran, or socially disadvantaged farmer or rancher who

is not a family member.

Beginning, veteran or social disadvantaged farmers and ranchers and

CRP participants may enroll in TIP beginning two years before the

expiration date of the CRP contract. The TIP application must be

submitted prior to completing the lease or sale of the affected

lands. New landowners or renters that return the land to production

must use sustainable grazing or farming methods.

For more information, contact your local County USDA Service Center

or visit fsa.usda.gov.

Update Your Records

FSA is cleaning up our producer record database and

needs your help. Please report any changes of address, zip code,

phone number, email address or an incorrect name or business name on

file to our office. You should also report changes in your farm

operation, like the addition of a farm by lease or purchase. You

should also report any changes to your operation in which you

reorganize to form a Trust, LLC or other legal entity.

FSA and NRCS program participants are required to promptly report

changes in their farming operation to the County Committee in

writing and to update their Farm Operating Plan on form CCC-902.

Maintaining the Quality of Farm-Stored Loan

Grain

Bins are ideally designed to hold a level volume of

grain. When bins are overfilled and grain is heaped up, airflow is

hindered and the chance of spoilage increases.

Producers who take out marketing assistance loans and use the

farm-stored grain as collateral should remember that they are

responsible for maintaining the quality of the grain through the

term of the loan.

Unauthorized Disposition of Grain

If loan grain has been disposed of through feeding,

selling or any other form of disposal without prior written

authorization from the county office staff, it is considered

unauthorized disposition. The financial penalties for unauthorized

dispositions are severe and a producer’s name will be placed on a

loan violation list for a two-year period. Always call before you

haul any grain under loan.

April Interest Rates and Important Dates

CLICK TO ENLARGE

[Illinois/ FPAC]

|