LDN - Business

|

|

|

Sponsored by:

Investment Center Sponsored by:

Investment Center

Something new in your

business?

Click here to

submit your business press release

Chamber Corner

|

Main Street News

|

Job Hunt |

Classifieds

| Calendar |

Illinois Lottery |

|

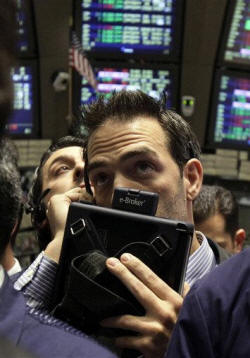

Stock futures little changed before jobs data

Send a link to a friend

Send a link to a friend

[October 14, 2010]

NEW YORK (AP)

--

Stock futures traded in a tight range Thursday as investors put the market's latest rally on hold before key reports on unemployment and inflation.

There was more movement in the currency and gold markets than in stocks futures early in the day. Traders are sending the dollar lower because of expectations the Federal Reserve will start buying government bonds to try to stimulate the sluggish economy. Buying bonds would drive down interest rates from already low levels. That makes gold and other currencies where interest rates are higher more attractive than the dollar.

|

|

|

Gold hit another record high, while the dollar fell to a 15-year low against the yen and touched its lowest level against the euro since January. Gold hit another record high, while the dollar fell to a 15-year low against the yen and touched its lowest level against the euro since January.

Stock futures movement is likely to pick up after the government releases its weekly report on first-time unemployment claims and data on inflation at the wholesale level.

Traders will want to see if first-time claims for unemployment benefits continued to fall. Last week's report showed claims were at their lowest level since mid-July, but still not low enough to signal broad hiring. High unemployment remains a key obstacle to a stronger economy and any Fed action would be partially aimed at reviving job growth.

Low inflation is also a concern for the Fed. At its meeting last month, the Fed hinted that future bond purchases would help get inflation back to more historically normal levels. The lower interest rates are also aimed at sparking new borrowing and spending by companies and consumers. More spending would drive prices for goods higher.

Economists polled by Thomson Reuters forecast the Producer Price Index, a measure of the cost of goods before they reach consumers, rose 0.2 percent last month. Excluding volatile food and energy spending, costs likely rose 0.1 percent.

| | | |

[to top of second column]

Ahead of the opening bell, Dow Jones industrial average futures rose 11, or 0.1 percent, to 11,055. Standard & Poor's 500 index futures rose 1.20, or 0.1 percent, to 1,175.50, while Nasdaq 100 index futures rose 0.50, or less than 0.1 percent, to 2,056.50.

Bond prices were mixed Thursday. The yield on the benchmark 10-year Treasury note, which moves opposite its price, rose to 2.44 percent from 2.42 percent late Wednesday.

Gold touched a record of $1,388.10 an ounce before pulling back to $1,379.90 an ounce.

[Associated

Press; By STEPHEN BERNARD]

Copyright 2010 The Associated Press. All rights reserved. This

material may not be published, broadcast, rewritten or

redistributed.

|

|

|

|

<

Recent articles |

Back to top |

News |

Sports | Business |

Rural Review |

Teaching & Learning

|

Home and Family |

Tourism

| Obituaries

Community |

Perspectives

|

Law & Courts |

Leisure Time

|

Spiritual Life |

Health & Fitness |

Teen Scene

Calendar

|

Letters to the Editor

|