|

Oil edges up to $42 after

slide, but glut still weighs

Send a link to a friend

Send a link to a friend

[August 03, 2016]

By Alex Lawler [August 03, 2016]

By Alex Lawler

LONDON (Reuters) - Oil edged higher

towards $42 a barrel on Wednesday after hitting its lowest since

April the previous day, supported by an industry report showing a

fall in U.S. inventories and a weaker dollar.

But prices could struggle to make much headway, analysts said, as

sentiment remains bearish. A supply glut that has weighed on prices

could increase if oil exports restart from ports in Libya that have

been closed since 2014.

Brent crude was up 11 cents a barrel at $41.91 at 1121 GMT (0721

ET). It reached $41.51 on Tuesday, the lowest since April 18. U.S.

crude added 13 cents to $39.64.

"The sentiment is still quite negative and depressed on oil prices,"

said Eugen Weinberg, analyst at Commerzbank.

"There are factors which should be supportive, but at the moment I

think there is no single (piece of) news which would convince the

bears that the decline is over."

The U.S. dollar stayed close to a six-week low against a basket of

currencies, lending oil some support. Weakness in the dollar makes

dollar-denominated commodities cheaper for other currency holders.

Also supportive was Tuesday's American Petroleum Institute report on

U.S. inventories, which showed a 1.34 million-barrel drop in crude

stocks, although the decline was about in line with analyst

expectations. [API/S]

Oil rallied from a 12-year low near $27 in January to a 2016 high of

almost $53 in June, supported by an initiative from OPEC and outside

producers including Russia to freeze output and by hopes that the

supply glut would ease.

But the output deal fell apart and since June, signs that the glut

is proving more resilient as well as concern about slowing economies

in Asia - the driver of oil demand growth - and Europe have weighed.

"Risks for oil remain skewed to the downside in the second half of

2016," analysts at Morgan Stanley said in a report. "Supply

disruptions and risk appetite were supportive April-June, but

fundamental headwinds are growing, which outnumber any recent

positives."

[to top of second column] |

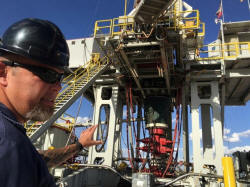

Rig supervisor David Crow shows off the oil rig he manages

foreElevation Resources at the Permian Basin drilling site in

Andrews County, Texas, U.S. in this photo taken May 16, 2016.

REUTERS/Ann Saphir

Not all share that view. Standard Chartered bank said there was "no fundamental

justification for recent oil-price falls" and "the global oil market has

rebalanced, and U.S. crude supply and inventories are expected to fall."

The U.S. government's report on oil inventories is due for release at 1430 GMT.

Analysts in a Reuters poll expected declines in both crude and refined product

stocks. [EIA/S]

(Additional reporting by Henning Gloystein; Editing by David Evans and Alexandra

Hudson)

[© 2016 Thomson Reuters. All rights

reserved.] Copyright 2016 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

|