|

Remember, whenever you have questions you can always contact

your local FSA office offices.usda.gov, look online at the FSA

website www.fsa.usda.gov or ask a specific question online at

http://askfsa.custhelp.com/. Remember, whenever you have questions you can always contact

your local FSA office offices.usda.gov, look online at the FSA

website www.fsa.usda.gov or ask a specific question online at

http://askfsa.custhelp.com/.

Administrative Policy

Reminders

Firearms and Dangerous Weapons Forbidden In Federal

Facilities

USDA Service Centers and Farm

Service Agency Offices are Off Limits for Firearms

This is an important reminder to all customers and patrons of

USDA Farm Service Agency (FSA) offices and USDA Service Centers

statewide that firearms are forbidden (even with a

permit/license) in Federal Buildings. A Federal Building by

definition is any building owned, leased or rented by the

Federal Government, where Federal employees are regularly

present for the purpose of performing their official duties.

The items that are prohibited in Federal facilities include any

item prohibited by any applicable Federal, State, local, and

tribal law and/or ordinance, as well as firearms, dangerous

weapons, explosives, or other destructive devices (including

their individual parts or components) designed, redesigned,

used, intended for use, or readily converted to cause injury,

death, or property damage. Possession of firearms and dangerous

weapons in Federal facilities as outlined above is a crime

punishable by fines and imprisonment.

For a complete list of items prohibited in Federal facilities,

please view and/or download the document titled, Items

Prohibited from Federal Facilities: An Interagency Security

Committee Standard: http://www.dhs.gov/sites/default/files/publications/isc-items-prohibited-federal-facilities-feb-2013-508.pdf.

The lists of prohibited items outlined in this document apply to

all facility occupants, contractors, and the visiting public.

If you have questions or concerns regarding this notification,

please contact your local Farm Service Agency office–http://offices.usda.gov.

Changing Bank Accounts

All FSA payments should be electronically transferred into your

bank account. In order to make timely payments, you need to

notify the office if you close your account or if your bank is

purchased by another financial institution. Payments can be

delayed if we are not aware of changes to account and routing

numbers.

Civil Rights/Discrimination Complaint Process

As a participant or applicant for programs or activities

operated or sponsored by USDA you have a right to be treated

fairly. If you believe you have been discriminated against

because of your race, color, national origin, gender, age,

religion, disability, or marital or familial status, you may

file a discrimination complaint. The complaint should be filed

with the USDA Office of Civil Rights within 180 days of the date

you became aware of the alleged discrimination. To file a

complaint of discrimination write USDA, Director, Office of

Civil Rights, Room 326W, Whitten Building, 14th and Independence

Avenue, SW, Washington DC 20250-9410 or call 202-720-5964 (voice

or TDD), USDA is an equal opportunity provider, employer and

lender. A complaint must be filed within 180 calendar days from

the date the complainant knew, or should have known, of the

alleged discrimination.

Nondiscrimination Statement

The U.S. Department of Agriculture (USDA) prohibits

discrimination in all its programs and activities on the basis

of race, color, national origin, age, disability, and where

applicable, sex, marital status, familial status, parental

status, religion, sexual orientation, genetic information,

political beliefs, reprisal, or because all or a part of an

individual’s income is derived from any public assistance

program. (Not all prohibited bases apply to all programs.)

Persons with disabilities who require alternative means for

communication of program information (Braille, large print,

audiotape, etc.) should contact USDA’s TARGET Center at (202)

720-2600 (voice and TDD). To file a complaint of discrimination

write to USDA, Director, Office of Civil Rights, 1400

Independence Avenue, S.W., Washington, D.C. 20250-9410 or call

(800) 795-3272 (voice) or (202) 720-6382 (TDD). USDA is an equal

opportunity provider, employer and lender.

Power of Attorney

For those who find it difficult to visit the county office

personally because of work schedules, distance, health, etc.,

FSA has a power of attorney form available that enables you to

designate another person to conduct your business at the office.

If you are interested, please contact our office or any Farm

Service Agency office near you for more information. Power of

Attorney provisions do not apply to farm loan programs.

Special Accommodations

Special accommodations will be made upon request for individuals

with disabilities, vision impairment or hearing impairment. If

accommodations are required, individuals should contact the

county FSA office directly or by phone.

Farm Program Policy Reminders

Annual Review of Payment Eligibility for New Crop Year

All participants of FSA programs who request program benefits

are required to submit a completed CCC-902 (Farming Operation

Plan) and CCC-941 Average Gross Income (AGI) Certification and

Consent to Disclosure of Tax Information to be considered for

payment eligibility and payment limitation applicable for the

program benefits.

Participants are not required to annually submit new CCC-902s

for payment eligibility and payment limitation purposes unless a

change in the farming operation occurs that may affect the

determination of record. A valid CCC-902 filed by the

participant is considered to be a continuous certification used

for all payment eligibility and payment limitation

determinations applicable for the program benefits requested.

Participants are responsible for ensuring that all CCC-902 and

CCC-941 and related forms on file in the county Office are

correct at all times. Participants are required to timely notify

the county office of any changes in the farming operation that

may affect the determination of record by filing a new or

updated CCC-902 as applicable.

Changes that may require a NEW determination include, but are

not limited to, a change of:

- Shares of a contract, which may reflect:

- A land lease from cash rent to share rent

- A land lease from share rent to cash rent (subject

to the cash rent tenant rule)

- A modification of a variable/fixed bushel-rent

arrangement

- The size of the producer’s farming operation by the

addition or reduction of cropland that may affect the

application of a cropland factor

- The structure of the farming operation, including

any change to a member's share

- The contribution of farm inputs of capital, land,

equipment, active personal labor, and/or active personal

management

- Farming interests not previously disclosed on

CCC-902 including the farming interests of a spouse or

minor child

- Financial status that may affect the 3-year average

for the determination of average AGI or other changes

that affects eligibility under the average adjusted

gross income limitations.

Participants are encouraged to file or review these forms within

the deadlines established for each applicable program for which

program benefits are being requested.

Payment Limitation

Program payments are limited by direct attribution to

individuals or entities. A legal entity is defined as an entity

created under Federal or State law that owns land or an

agricultural commodity, product or livestock. Through direct

attribution, payment limitation is based on the total payments

received by the individual, both directly and indirectly.

Qualifying spouses are eligible to be considered separate

persons for payment limitation purposes, rather than being

automatically combined under one limitation.

Payments and benefits under certain FSA programs are subject to

some or all of the following:

- payment limitation by direct attribution

- payment limitation amounts for the applicable

programs

- actively engaged in farming requirements

- cash-rent tenant rule

- foreign person rule

- average AGI limitations

- programs subject to AGI limitation

- effective date of implementation of AGI

limitation

No program benefits subject to payment eligibility and

limitation will be provided until all required forms for the

specific situation are provided and necessary payment

eligibility and payment limitation determinations are made.

Payment eligibility and payment limitation determinations may be

initiated by the County Committee or requested by the producer.

There are statutory provisions that require entities, earning

program benefits that are subject to limitation, to provide the

names, addresses, and TINs of the entities’ members to the

County Committee.

All applicable payment eligibility and payment limitation forms

submitted by producers are subject to spot check through the

end-of-year review process.

Producers selected for end-of-year review must provide the

County Committee with operating loan documents, income and

expense ledgers, canceled checks for all expenditures, lease and

purchase agreements, sales contracts, property tax statements,

equipment listings, lease agreements, purchase contracts,

documentation of who provided actual labor and management,

employee time sheets or books, crop sales documents, warehouse

ledgers, gin ledgers, corporate or entity papers, etc.

A determination of not actively engaged in farming results in

the producer being ineligible for any payment or benefit

requiring a determination of actively engaged in farming

Noncompliance with AGI provisions, either by exceeding the

applicable limitation or failure to submit a certification and

consent for disclosure statement, will result in the

determination of ineligibility for all program benefits subject

to AGI provisions. Program benefits shall be reduced in an

amount that is commensurate with the direct and indirect

interest held by an ineligible person or legal entity in any

legal entity, general partnership, or joint operation that

receives benefits subject to the average AGI limitations.

If any changes occur that could affect an actively engaged in

farming, cash-rent tenant, foreign person, or average Adjusted

Gross Income (AGI) determination, producers must timely notify

the county Office by filing revised farm operating plans and/or

supporting documentation, as applicable. Failure to timely

notify the County Office may adversely affect payment

eligibility.

Acreage Reporting

Filing an accurate crop and acreage report at your local FSA

office can prevent the loss of benefits for a variety of

programs. Failed acreage is acreage that was timely planted with

the intent to harvest, but because of disaster related

conditions, the crop failed before it could be brought to

harvest.

Prevented planting must be reported no later than 15 days after

the final planting date. Annual acreage reports are required for

most Farm Service Agency programs. Annual crop report deadlines

vary based on region, crop, perennial vs. annual crop type, NAP

or non-NAP crop and fall or winter seeding. Consult your local

FSA office for deadlines in your area.

To be eligible for the Agriculture Risk Coverage (ARC) and Price

Loss Coverage (PLC) program or a Marketing Assistance Loan (MAL)

or Loan Deficiency Payment (LDP), producers must submit an

acreage report to account for all cropland on all farms.

Change in Farming Operation

If you have bought or sold land, or if you have picked up or

dropped rented land from your operation, make sure you report

the changes to the office as soon as possible. You need to

provide a copy of your deed or recorded land contract for

purchased property. Failure to maintain accurate records with

FSA on all land you have an interest in can lead to possible

program ineligibility and penalties. Making the record changes

now will save you time in the spring. Update signature

authorization when changes in the operation occur. Producers are

reminded to contact the office if there is a change in

operations on a farm so that records can be kept current and

accurate.

Controlled Substance

Program participants convicted under federal or state law of any

planting, cultivating, growing, producing, harvesting or storing

a controlled substance are ineligible for program payments and

benefits. If convicted of one of these offensives, the program

participant shall be ineligible during that crop year and the

four succeeding crop years for price support loans, loan

deficiency payments, market loan gains, storage payments, farm

facility loans, Non-insured Crop Disaster Assistance Program

payments or disaster payments.

Program participants convicted of any federal or state offense

consisting of the distribution (trafficking) of a controlled

substance, at the discretion of the court, may be determined

ineligible for any or all program payments and benefits:

- for up to 5 years after the first conviction

- for up to 10 years after the second

conviction

- permanently for a third or subsequent

conviction

Program participants convicted of federal or state offense for

the possession of a controlled substance shall be ineligible, at

the discretion of the court, for any or all program benefits, as

follows:

- up to 1 year upon the first conviction

- up to 5 years after a second or

subsequent conviction

Reconstitutions

To be effective for the current Fiscal Year (FY), farm

combinations and farm divisions must be requested by August 1 of

the FY for farms subject to the Agriculture Risk Coverage (ARC)

and Price Loss Coverage (PLC) program. A reconstitution is

considered to be requested when all:

- of the required signatures are on

form FSA-155

- other applicable documentation, such

as proof of ownership, is submitted

Total Conservation Reserve Program (CRP) and non-ARC/PLC farms

may be reconstituted at any time.

Farm Service Agency (FSA) and Risk Management Agency (RMA) to

Prevent Fraud, Waste, and Abuse

FSA supports the RMA in the prevention of fraud, waste and abuse

of the Federal Crop Insurance Program. FSA has been, and will

continue to, assist RMA and insurance providers by monitoring

crop conditions throughout the growing season. FSA will continue

to refer all suspected cases of fraud, waste and abuse directly

to RMA. Producers can report suspected cases to the county

office staff, the RMA office or the Office of the Inspector

General.

FAV/Wild Rice Exception

Planting fruits, vegetables (FAVs) or wild rice on payment acres

enrolled in the ARC and PLC Program is prohibited unless the

commodity is destroyed without benefit before harvest. Producers

may plant FAV’s and/or wild rice on payment acres if the FAV

and/or wild rice is planted in a double- cropping practice with

covered commodities in any region designated in the 7 Code of

Federal Regulations (7 CFR) as having a history of

double-cropping covered commodities or peanuts with FAVs and/or

wild rice. Failure to comply with FAV and wild rice provisions

will result in an acre-for-acre payment reduction.

Foreign Buyers Notification

The Agricultural Foreign Investment Disclosure Act (AFIDA)

requires all foreign owners of U.S. agricultural land to report

their holdings to the Secretary of Agriculture. Foreign persons

who have purchased or sold agricultural land in the county are

required to report the transaction to FSA within 90 days of the

closing. Failure to submit the AFIDA form could result in civil

penalties of up to 25 percent of the fair market value of the

property. County government offices, realtors, attorneys and

others involved in real estate transactions are reminded to

notify foreign investors of these reporting requirements.

Adjusted Gross Income Requirements

The average adjusted gross income (AGI) limitation for commodity

and disaster programs under the 2014 Farm Bill was changed to a

$900,000 limitation from all income sources. A person or legal

entity, other than a joint venture or general partnership, is

eligible to receive, directly or indirectly, certain program

payments or benefits if the average adjusted gross income of the

person or legal entity falls below the $900,000 threshold for

the three taxable years preceding the most immediately preceding

complete taxable year. However, the AGI limitation for

conservation programs may be waived on a case-by-case basis if

it is determined that environmentally sensitive land of special

significance would be protected.

[to top of second column] |

Signature Policy

Using the correct signature when doing business with FSA can

save time and prevent a delay in program benefits. The following

are FSA signature guidelines:

- A married woman shall sign her given name: Mrs. Mary Doe,

not Mrs. John Doe

- For a minor, FSA requires the minor's signature and one from

an eligible parent

Note, by signing the applicable document, the parent is liable

for actions of the minor and may be liable for refunds,

liquidated damages, etc.

When signing on one’s behalf the signature must agree with the

name typed or printed on the form, or be a variation that does

not cause the name and signature to be in disagreement. Example

- John W. Smith is on the form. The signature may be John W.

Smith or J.W. Smith or J. Smith. Or Mary J. Smith may be signed

as Mrs. Mary Joe Smith, M.J. Smith, Mary Smith, etc.

FAXED signatures will be accepted for certain forms and other

documents provided the acceptable program forms are approved for

FAXED signatures. Producers are responsible for the successful

transmission and receipt of FAXED information.

Examples of documents not approved for FAXED signatures include:

- Promissory note

- Assignment of payment

- Joint payment authorization

- Acknowledgement of commodity certificate purchase

Spouses may sign documents on behalf of each other for FSA and

CCC programs in which either has an interest, unless written

notification denying a spouse this authority has been provided

to the county office.

Spouses shall not sign on behalf of each other as an authorized

signatory for partnerships, joint ventures, corporations or

other similar entities.

Any member of the general partnership can sign on behalf of the

general partnership and bind all members unless the Articles of

Partnership are more restrictive. Spouses may sign on behalf of

each other’s individual interest in a partnership, unless

notification denying a spouse that authority is provided to the

county office. Acceptable signatures for general partnerships,

joint ventures, corporations, estates, and trusts shall consist

of an indicator “by” or “for” the individual’s name,

individual’s name and capacity, or individual’s name, capacity,

and name of entity.

For additional clarification on proper signatures contact your

local FSA office.

ARC/PLC Acreage Maintenance

Producers enrolled in the Agriculture Risk Coverage (ARC) or

Price Loss Coverage (PLC) programs must protect all cropland and

noncropland acres on the farm from wind and water erosion and

noxious weeds. Producers who sign ARC county or individual

contracts and PLC contracts agree to effectively control noxious

weeds on the farm according to sound agricultural practices. If

a producer fails to take necessary actions to correct a

maintenance problem on a farm that is enrolled in ARC or PLC,

the County Committee may elect to terminate the contract for the

program year.

Conservation Reserve Program (CRP) - Annual Certification

Before an annual rental payment can be issued, participants must

certify to contract compliance using either the FSA-578, Report

of Acreage, or CCC-817U, Certification of Compliance for CRP.

Beginning with 2016, once certified, a CRP acreage report is

considered continuous unless there is a CRP revision. Annual

reports on FSA-578 or CCC-817U are not required in this case.

Highly Erodible Land (HEL) and Wetland Conservation

Compliance

Landowners and operators are reminded that in order to receive

payments from USDA, compliance with Highly Erodible Land (HEL)

and Wetland Conservation (WC) provisions are required. Farmers

with HEL determined soils are reminded of tillage, crop residue,

and rotation requirements as specified per their conservation

plan. Producers are to notify the USDA Farm Service Agency prior

to conducting land clearing or drainage projects to insure

compliance. Failure to obtain advance approval for any of these

situations can result in the loss of eligibility and all Federal

payments.

Highly Erodible Land and Wetland Conservation Certification Must

be Filed to Receive FSA Benefits

The 2014 Farm Bill requires farmers to have a Highly Erodible

Land Conservation and Wetland Conservation Certification

(AD-1026) on file with their local Farm Service Agency (FSA)

office in order to maintain eligibility for premium support on

federal crop insurance.

Since enactment of the 1985 Farm Bill, eligibility for most

commodity, disaster and conservation programs has been linked to

compliance with the highly erodible land conservation and

wetland conservation provisions. The 2014 Farm Bill continues

the requirement that producers adhere to conservation compliance

guidelines to be eligible for most programs administered by FSA

and the Natural Resources Conservation Service (NRCS). This

includes financial assistance from the Agriculture Risk Coverage

(ARC) and Price Loss Coverage (PLC) programs, the Conservation

Reserve Program (CRP), livestock disaster assistance programs,

Marketing Assistance Loans (MALs) and most programs implemented

by FSA. It also includes the Environmental Quality Incentives

Program (EQIP), the Conservation Stewardship Program and other

conservation programs implemented by NRCS.

If you have not submitted the AD-1026 form, please do so before

the June 1, 2017 deadline.

When a farmer completes and submits the AD-1026 certification

form, FSA and NRCS staff will review the associated farm records

and outline any additional actions that may be required to meet

the required conservation compliance provisions.

Form AD-1026 is available at USDA Service Centers and online at:

www.fsa.usda.gov. Please contact your local USDA Service Center

for more information.

Nonrecourse Marketing Assistance Loans and Loan Deficiency

Payments

Nonrecourse Marketing Assistance Loans (MALs) and Loan

Deficiency Payments (LDPs) are available to eligible producers

for the 2016 crop year for wheat, corn, grain sorghum, barley,

oats, upland cotton, extra-long staple cotton, long grain rice,

medium grain rice, soybeans, other oilseeds (including sunflower

seed, rapeseed, canola, safflower, flaxseed, mustard seed,

crambe and sesame seed), dry peas, lentils, small chickpeas,

large chickpeas, graded and non-graded wool, mohair, unshorn

pelts, honey and peanuts.

To be eligible for a MAL or LDP, producers must comply with

conservation and wetland protection requirements and submit an

acreage report to account for all cropland on all farms.

Additionally, they must have and retain beneficial interest in

the commodity until the MAL is repaid or the Commodity Credit

Corporation (CCC) takes title to the commodity while also

meeting Adjusted Gross Income (AGI) limitations.

In addition to producer eligibility, the commodity must have

been produced, mechanically harvested, or shorn from live

animals by an eligible producer and be in storable condition. It

also must be merchantable for food, feed or other uses, as

determined by CCC. Nonrecourse MALs must meet specific CCC

minimum grade and quality standards.

If beneficial interest in the commodity is lost, the commodity

loses eligibility for a MAL or LDP and remains ineligible even

if the producer later regains beneficial interest. To retain

beneficial interest, the producer must have control and title to

the commodity. The producer must be able to make all decisions

affecting the commodity including movement, sale and the request

for a MAL or LDP. The producer must not have sold or delivered

the commodity or warehouse receipt to the buyer.

Producers are responsible for any loss in quantity or quality of

commodities pledged as collateral for a farm-stored or warehouse

stored loan. CCC will not assume any loss in quantity or quality

of the loan collateral regardless of storage location.

The 2014 Farm Bill sets national loan rates. County and regional

loan rates are based on each commodity’s national loan rate, and

they vary by county or region and are based on the average

prices and production of the county or region where the

commodity is stored.

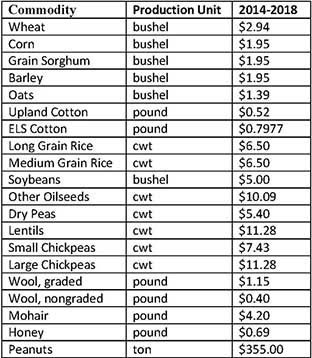

National loan rates for 2014-2018 crops (per production unit)

are as follows:

NOTE: The upland cotton loan rate is subject to change for 2017

and 2018.

For all loan-eligible commodities except extra-long staple (ELS)

cotton, a producer may repay a MAL any time during the loan

period at the lesser of the loan rate plus accrued interest and

other charges or an alternative loan repayment rate as

determined by CCC.

Producers may obtain MALs or receive LDPs on all or part of

their eligible production anytime during the loan availability

period. The loan availability period runs from when the

commodity is normally harvested (or sheared for wool) until

specified dates in the following calendar year.

The final loan/LDP availability dates for the respective

commodities are:

- Jan. 31 - Peanuts, Wool, Mohair and LDP only for

Unshorn Pelts

- March 31 - Barley, Canola, Crambe, Flaxseed, Honey,

Oats, Rapeseed, Sesame seed and Wheat

- May 31 - Corn, Dry peas, Grain sorghum, Lentils,

Mustard seed, Long grain rice, Medium grain rice,

Safflower, Small chickpeas, Large chickpeas, Cotton,

Soybeans and Sunflower seed

Measurement Service

Farmers who would like a guarantee on their crop plantings and

land use acreages can make it official by using the FSA

measurement service. Producers must file a request with the

county office staff and pay the cost of a field visit to have

stake and referencing done on the farm. Measurement service is

available using digital imagery. If an on-site visit is not

required producers are charged a reduced rate.

Incorrect acreage self-certification can result in reduced

program payments, penalty or loss of eligibility.

Farm Loan Policy Reminders

Loans for Targeted Underserved Producers

FSA has a number of loan programs available to assist applicants

to begin or continue in agriculture production. Loans are

available for operating purposes and/or to purchase or improve

farms or ranches. While all qualified producers are eligible to

apply for these loan programs, the FSA has provided priority

funding for underserved applicants. An underserved applicant is

one of a group whose members have been subjected to racial,

ethnic or gender prejudice because of his or her identity as

members of the group without regard to his or her individual

qualities. For purposes of this program, underserved groups are

women, African Americans, American Indians, Alaskan Natives,

Hispanics, Asian Americans, and Pacific Islanders. If producers

or their spouses believe they would qualify as underserved, they

should contact their local FSA office for details. FSA loans are

only available to applicants who meet all eligibility

requirements and are unable to obtain the needed credit

elsewhere.

Disaster Set-Aside (DSA) Program

FSA borrowers with farms located in designated primary or

contiguous disaster areas who are unable to make their scheduled

FSA loan payments should consider the Disaster Set-Aside (DSA)

program.

DSA is available to producers who suffered losses as a result of

a natural disaster and is intended to relieve immediate and

temporary financial stress. FSA is authorized to consider

setting aside the portion of a payment/s needed for the

operation to continue on a viable scale. Borrowers must have at

least two years left on the term of their loan in order to

qualify.

Borrowers have eight months from the date of the disaster

designation to submit a complete application. The application

must include a written request for DSA signed by all parties

liable for the debt along with production records and financial

history for the operating year in which the disaster occurred.

FSA may request additional information from the borrower in

order to determine eligibility.

All farm loans must be current or less than 90 days past due at

the time the DSA application is complete. Borrowers may not set

aside more than one installment on each loan.

The amount set-aside, including interest accrued on the

principal portion of the set-aside, is due on or before the

final due date of the loan.

For more information, contact your local FSA farm loan office.

Farm Loan Graduation Reminder

FSA Direct Loans are considered a temporary source of credit

that is available to producers who do not meet normal

underwriting criteria for commercial banks.

FSA periodically conducts Direct Loan graduation reviews to

determine a borrower’s ability to graduate to commercial credit.

If the borrower’s financial condition has improved to a point

where they can refinance their debt with commercial credit, they

will be asked to obtain other financing and partially or fully

pay off their FSA debt.

By the end of a producer’s operating cycle, the Agency will send

a letter requesting a current balance sheet, actual financial

performance and a projected farm budget. The borrower has 30

days to return the required financial documents. This

information will be used to evaluate the borrower’s potential

for refinancing to commercial credit.

If a borrower meets local underwriting criteria, FSA will send

the borrower’s name, loan type, balance sheet and projected cash

flow to commercial lenders. The borrower will be notified when

loan information is sent to local lenders.

If any lenders are interested in refinancing the borrower’s

loan, FSA will send the borrower a letter with a list of lenders

that are interested in refinancing the loan. The borrower must

contact the lenders and complete an application for commercial

credit within 30 calendar days.

If a commercial lender rejects the borrower, the borrower must

obtain written evidence that specifies the reasons for rejection

and submit to their local FSA farm loan office.

If a borrower fails to provide the requested financial

information or to graduate, FSA will notify the borrower of

noncompliance, FSA’s intent to accelerate the loan, and appeal

rights.

Questions?

Please contact your local FSA Office.

[USDA Farm Service Agency] |