|

The 2014 Farm Bill established additional payment eligibility

provisions relating to the farm management component of meeting

“actively engaged in farming”. These new provisions apply to

joint operations comprised of non-family members or partners,

stockholders or persons with an ownership in the farming

operation. Effective for 2016 and subsequent crop years,

non-family joint operations are afforded to one member that may

use a significant contribution of active personal management

exclusively to meet the requirements to be determined “actively

engaged in farming”. The person or member will be defined as the

Farm Manager for the purposes of administering these new

management provisions. The 2014 Farm Bill established additional payment eligibility

provisions relating to the farm management component of meeting

“actively engaged in farming”. These new provisions apply to

joint operations comprised of non-family members or partners,

stockholders or persons with an ownership in the farming

operation. Effective for 2016 and subsequent crop years,

non-family joint operations are afforded to one member that may

use a significant contribution of active personal management

exclusively to meet the requirements to be determined “actively

engaged in farming”. The person or member will be defined as the

Farm Manager for the purposes of administering these new

management provisions.

In some instances, additional persons or members of a non-family

member joint operation who meet the definition of Farm Manager

may also be allowed to use such a contribution of active

personal management to meet the eligibility requirements.

However, under no circumstances may the number of Farm Managers

in a non-family joint operation exceed a total of three in any

given crop and program year.

Filing CCC-941 Adjusted Gross Income (AGI) Certifications

Many producers have experienced delays in receiving Agriculture

Risk Coverage (ARC) and Price Loss Coverage (PLC) payments, Loan

Deficiency Payments (LDPs) and Market Gains on Marketing

Assistance Loans (MALs) because they have not filed form

CCC-941, Adjusted Gross Income Certification.

Producers without a valid CCC-941 certifying their compliance

with the average adjusted gross income provisions will not

receive payments that have been processed. All farm

operator/tenants/owners who have not filed a CCC-941 and have

pending payments should IMMEDIATELY file the form with their

recording county FSA office.

FSA can accept the CCC-941 for 2015, 2016 and 2017. Unlike the

past, producers must have the CCC-941 certifying their AGI

compliance before any payments can be issued.

USDA Announces New Conservation Opportunities to Improve

Water Quality and Restore Wildlife Habitat

USDA will offer farmers and ranchers more opportunities to

participate in the Conservation Reserve Program (CRP). The

announcement includes new CRP practices to protect water quality

and adds an additional 1.1 million acres targeted to benefit

wildlife, pollinators and wetlands.

The new conservation initiative known as Clean Lakes, Estuaries

and Rivers (CLEAR) will add new tools to CRP that can help to

improve water quality. CLEAR will assist landowners with the

cost of building bioreactors and saturated buffers that filter

nitrates and other nutrients from tile-drained cropland. Early

estimates indicate that CLEAR could help to reduce nitrate

runoff by as much as 40 percent over traditional conservation

methods. CLEAR may cover up to 90 percent of the cost to install

these new practices through incentives and cost-share. These new

methods are especially important in areas where traditional

buffers have not been enough to prevent nutrients from reaching

bodies of water.

USDA will also add an additional 1.1 million acres to a number

of key CRP practices that are critically important to wildlife

and conservation. These include 700,000 acres for State Acres

for Wildlife Enhancement (SAFE) efforts, which restore

high-priority wildlife habitat tailored to a specific state’s

needs. In addition to SAFE, 300,000 acres will be added to

target wetlands restoration that are nature’s water filters and

100,000 acres for pollinator habitat that support 30 percent of

agricultural production.

The continued strong demand for CRP combined with the limited

acreage available for enrollment and lower land rental rates,

allows USDA to modify certain program components without

affecting the integrity of the program. Signing incentives are

being reduced by $25 per acre on certain practices for fiscal

year 2018 enrollments (incentives are currently between $100 and

$150 per acre) and a cap on the maximum soil rental rate is

being instituted for Continuous CRP at $300 per acre. The

savings from these changes are being reinvested back in CRP,

including the additional acres for SAFE, pollinator habitat and

wetlands restoration.

To learn more about FSA’s conservation programs, visit

www.fsa.usda.gov/conservation or contact your local FSA office.

A Simple Start to Retirement Savings

Don’t have access to a retirement savings plan? Haven’t found an

easy way to start saving? The U.S. Department of the Treasury’s

myRA can help you get on the path to retirement saving. It costs

nothing to open an account and there are no fees. Visit myRA.gov

today to get started.

Loan Servicing

There are options for Farm Service Agency loan customers during

financial stress. If you are a borrower who is unable to make

payments on a loan, contact your local FSA Farm Loan Manager to

learn about the options available to you.

USDA Microloans Help Farmers Purchase Farmland and Improve

Property

The U.S. Department of Agriculture (USDA) is offering farm

ownership microloans, creating a new financing avenue for

farmers to buy and improve property. These microloans are

especially helpful to beginning or underserved farmers, U.S.

veterans looking for a career in farming, and those who have

small and mid-sized farming operations.

The microloan program has been hugely successful, providing more

than 16,800 low-interest loans, totaling over $373 million to

producers across the country. Microloans have helped farmers and

ranchers with operating costs, such as feed, fertilizer, tools,

fencing, equipment, and living expenses since 2013. Seventy

percent of loans have gone to new farmers.

Now, microloans will be available to also help with farm land

and building purchases, and soil and water conservation

improvements. FSA designed the expanded program to simplify the

application process, expand eligibility requirements and

expedite smaller real estate loans to help farmers strengthen

their operations. Microloans provide up to $50,000 to qualified

producers, and can be issued to the applicant directly from the

USDA Farm Service Agency (FSA).

To learn more about the FSA microloan program visit

www.fsa.usda.gov/microloans, or contact your local FSA office.

USDA Offers New Loans for Portable Farm Storage and Handling

Equipment

USDA’s Farm Service Agency (FSA) will provide a new financing

option to help farmers purchase portable storage and handling

equipment through the Farm Storage Facility Loan (FSFL) program.

The loans, which now include a smaller microloan option with

lower down payments, are designed to help producers, including

new, small and mid-sized producers, grow their businesses and

markets. The FSFL program allows producers of eligible

commodities to obtain low-interest financing to build or upgrade

farm storage and handling facilities.

The program also offers a new “microloan” option, which allows

applicants seeking less than $50,000 to qualify for a reduced

down payment of five percent and no requirement to provide three

years of production history, with CCC providing a loan for the

remaining 95 percent of the net cost of the eligible FSFL

equipment. Farms and ranches of all sizes are eligible. The

microloan option is expected to be of particular benefit to

smaller farms and ranches, and specialty crop producers who may

not have access to commercial storage or on-farm storage after

harvest. These producers can invest in equipment like conveyers,

scales or refrigeration units and trucks that can store

commodities before delivering them to markets. FSFL microloans

can also be used to finance wash and pack equipment used

post-harvest, before a commodity is placed in cold storage.

Producers do not need to demonstrate the lack of commercial

credit availability to apply for FSFL’s.

Larger farming and ranching operations, that may not be able to

participate in the new “microloan” option, may apply for the

traditional, larger FSFL’s with the maximum principal amount for

each loan through FSFL of $500,000.00. Participants are required

to provide a down payment of 15 percent, with CCC providing a

loan for the remaining 85 percent of the net cost of the

eligible storage facility and permanent drying and handling

equipment. Additional security is required for poured-cement

open-bunker silos, renewable biomass facilities, cold storage

facilities, hay barns and for all loans exceeding $100,000.00.

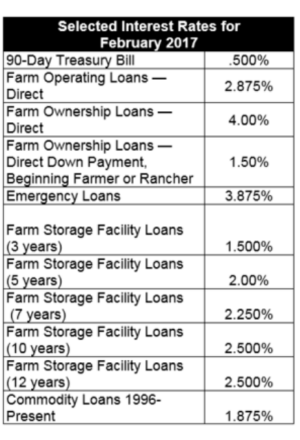

FSFL loan terms of 3, 5, 7, 10 or 12 years are available

depending on the amount of the loan. Interest rates for each

term rate may be different and are based on the rate which CCC

borrows from the Treasury Department.

Earlier this year, FSA significantly expanded the list of

commodities eligible for FSFL. Eligible commodities now include

aquaculture; floriculture; fruits (including nuts) and

vegetables; corn, grain sorghum, rice, oilseeds, oats, wheat,

triticale, spelt, buckwheat, lentils, chickpeas, dry peas sugar,

barley, rye, hay, honey, hops, maple sap, unprocessed meat and

poultry, eggs, milk, cheese, butter, yogurt and renewable

biomass.

Applications for FSFL must be submitted to the FSA county office

that maintains the farm's records. The FSFL application must be

approved before: purchasing the FSFL equipment, beginning any

excavation or site preparation, accepting delivery of FSFL

equipment, beginning installation or construction.

To learn more about Farm Storage Facility Loans, visit

www.fsa.usda.gov/pricesupport or contact a local FSA county

office. To find your local FSA county office, visit

http://offices.usda.gov.

Marketing Assistance Loans Available for 2016 Crops

The 2014 Farm Bill authorized 2014-2018 crop year Marketing

Assistance Loans (MALs) and Loan Deficiency Payments (LDPs).

MALs provide financing and marketing assistance for 2016 crop

wheat, feed grains, soybeans and other oilseeds, pulse crops,

wool and honey. MALs provide producers interim financing after

harvest to help them meet cash flow needs without having to sell

their commodities when market prices are typically at

harvest-time lows.

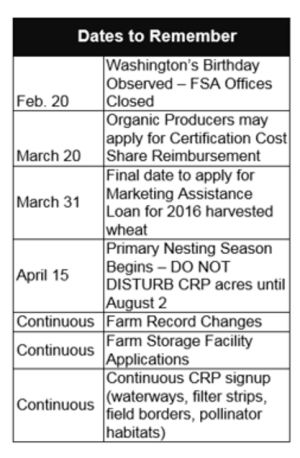

Illinois FSA county offices are now accepting requests for 2016

crop commodity and honey MALs and LDPs for eligible commodities

after harvest. As 2016 crop harvest wraps up, Illinois FSA

county offices are accepting requests for 2016 fall harvested

crops; corn, grain sorghum and soybeans.

A producer who is eligible to obtain an MAL, but agrees to forgo

the loan, may obtain an LDP if such a payment is available.

To be eligible for an MAL or an LDP, producers must have a

beneficial interest in the commodity, in addition to other

requirements. A producer retains beneficial interest when

control of and title to the commodity is maintained. For an LDP,

the producer must retain beneficial interest in the commodity

from the time of planting through the date the producer filed

Form CCC-633EZ (page 1) in the FSA County Office. For more

information, producers should contact their local FSA county

office or view the LDP Fact Sheet.

Maintaining the Quality of Loaned Grain

Bins are ideally designed to hold a level volume of grain. When

bins are overfilled and grain is heaped up, airflow is hindered

and the chance of spoilage increases.

Producers who take out marketing assistance loans and use the

farm-stored grain as collateral should remember that they are

responsible for maintaining the quality of the grain through the

term of the loan.

[to top of second column] |

Unauthorized

Disposition of Grain

If loan grain has been disposed of through feeding, selling or any

other form of disposal without prior written authorization from the

county office staff, it is considered unauthorized disposition and a

violation of the terms and conditions of the Note and Security

Agreement. The financial penalties for unauthorized dispositions are

severe and a producer’s name will be placed on a loan violation list

for a two-year period. Always call before you haul any grain under

loan. If you have questions concerning the movement of grain under

loan, please contact your local county FSA office.

Recently the Farm Service

Agency (FSA), Natural Resources Conservation Service (NRCS) and Risk

Management Agency (RMA) worked together to develop consistent,

simple and a flexible policy for cover crop practices. The

termination and reporting guidelines were updated for cover crops.

Termination:

The cover crop termination guidelines provide the timeline for

terminating cover crops, are based on zones and apply to

non-irrigated cropland. To view the zones and additional guidelines

visit https://www.nrcs.

usda.gov/wps/portal/nrcs/main/national/ landuse/crops/ and

click “Cover Crop Termination Guidelines.”

Reporting: The

intended use of cover only will be used to report cover crops. This

includes cropsthat were terminated by tillage and reported with an

intended use code of green manure. An FSA policy change will allow

cover crops to be hayed and grazed. Program eligibility for the

cover crop that is being hayed or grazed will be determined by each

specific program.

If the crop reported as

cover only is harvested for any use other than forage or grazing and

is not terminated properly, then that crop will no longer be

considered a cover crop.

Crops reported with an

intended use of cover only will not count toward the total cropland

on the farm. In these situations a subsequent crop will be reported

to account for all cropland on the farm.

Cover crops include

grasses, legumes, and forbs, for seasonal cover and other

conservation purposes. Cover crops are primarily used for erosion

control, soil health Improvement, and water quality improvement.

The cover crop may be terminated by natural causes, such as frost,

or intentionally terminated through chemical application, crimping,

rolling, tillage or cutting. A cover crop managed and terminated

according to NRCS Cover Crop Termination Guidelines is notconsidered

a crop for crop insurance purposes.

Cover crops can be

planted: with no subsequent crop planted, before a subsequent crop,

after prevented planting acreage, after a planted crop, or into a

standing crop.

Upcoming Noninsured Crop Disaster Assistance Program (NAP)

Application Closing Date

The Noninsured Crop Disaster Assistance Program (NAP) closing

deadline for spring and summer planted crops, including fruits

and vegetables is March 15. Eligible producers must apply for

coverage and pay the applicable service fees annually by the

application closing date. Acreage reports are also due annually.

Coverage for specific crops may be checked online at

www.fsa.usda.gov/nap.

Organic Producers and Handlers May Apply for Certification

Cost Share Reimbursements; Expanded Eligibility for Transition

and State Certification Cost

Starting March 20, 2017, organic producers and handlers will be

able to visit over 2,100 USDA Farm Service Agency (FSA) offices

to apply for federal reimbursement to assist with the cost of

receiving and maintaining organic or transitional certification.

USDA reimburses organic producers up to 75 percent of the cost

of organic certification, but only about half of the nation’s

organic operations currently participate in the program.

Starting March 20, USDA will provide a uniform, streamlined

process for organic producers and handlers to apply for organic

cost share assistance either by mail or in person.

USDA is making changes to increase participation in the National

Organic Certification Cost Share Program (NOCCSP) and the

Agricultural Management Assistance Organic Certification Cost

Share Program, and at the same time provide more opportunities

for organic producers to access other USDA programs, such as

disaster protection and loans for farms, facilities and

marketing. Producers can also access information on nonfederal

agricultural resources, and get referrals to local experts,

including organic agriculture, through USDA’s Bridges to

Opportunity service at the local FSA office.

Historically, many state departments of agriculture have

obtained grants to disburse reimbursements to those producers

and handlers qualifying for cost share assistance. FSA will

continue to partner with states to administer the programs. For

states that want to continue to directly administer the

programs, applications will be due Feb. 17, 2017.

Eligible producers include any certified producers or handlers

who have paid organic or transitional certification fees to a

USDA-accredited certifying agent. Application fees, inspection

costs, fees related to equivalency agreement/ arrangement

requirements, travel/per diem for inspectors, user fees, sales

assessments and postage are all eligible for a cost share

reimbursement from USDA.

Once certified, producers and handlers are eligible to receive

reimbursement for up to 75 percent of certification costs each

year up to a maximum of $750 per certification scope—crops,

livestock, wild crops

Reporting Organic Crops

Producers who want to use the Noninsured Crop Disaster

Assistance Program (NAP) organic price and selected the

"organic" option on their NAP application must report their

crops as organic.

When certifying organic acres, the buffer zone acreage must be

included in the organic acreage.

Producers must also provide a current organic plan, organic

certificate or documentation from a certifying agent indicating

an organic plan is in effect. Documentation must include:

- name of certified individuals

- address

- telephone number

- effective date of certification

- certificate number

- list of commodities certified

- name and address of certifying agent

- a map showing the specific location of each field of

certified organic, including the buffer zone acreage

Certification exemptions are available for producers whose

annual gross agricultural income from organic sales totals

$5,000 or less.

Although exempt growers are not required to provide a written

certificate, they are still required to provide a map showing

the specific location of each field of certified organic,

transitional and buffer zone acreage.

For questions about reporting organic crops, contact your local

FSA office. To find your local office, visit

http://offices.usda.gov.

Illinois Farm Service Agency

3500 Wabash Ave.

Springfield, IL 62711

Phone: 217-241-6600

Fax: 855-800-1760

www.fsa.usda.gov/il

Acting State Executive Director:

Richard L. Graden

Acting State Committee:

Jill Appell-Chairperson

Brenda Hill-Member

Jerry Jimenez-Member

Joyce Matthews-Member

Gordon Stine-Member

Administrative Officer:

Dan Puccetti

Division Chiefs:

Doug Bailey

Jeff Koch

Randy Tillman

To find contact information for your local office go to

www.fsa.usda.gov/il

|