|

Post-Fed boost for

small-cap stocks may be limited

Send a link to a friend

Send a link to a friend

[ March 18, 2017]

By Caroline Valetkevitch March 18, 2017]

By Caroline Valetkevitch

NEW YORK (Reuters) - Small-cap stocks

benefited from a dovish lining to the U.S. Federal Reserve's decision to

raise interest rates this past week, but strategists warn it will take

more to make these pricey stocks outperform their larger brethren in the

long haul.

The Fed on Wednesday raised rates by a quarter of a percentage point, as

expected, but did not flag any plan to accelerate the pace of monetary

tightening. A less aggressive monetary policy may benefit small-caps,

which tend to get hit harder as borrowing costs increase when rates

rise.

Stocks in the small-cap space rallied after the Nov. 8 election that put

Donald Trump in the White House as investors bet Trump's plans to cut

back on regulations and taxes would especially help small companies.

That hasn't panned out in the new year, as they have underperformed the

S&P 500 year-to-date. Their near-term performance hinges on how much the

profit picture improves, but so far small-cap earnings have yet to

rebound in the same way that large caps have.

Investors consider small-cap stocks comparatively expensive.

"We're in a show-me state for small caps," said Steve DeSanctis, equity

strategist at Jefferies. "We've gotten (price-to-earnings) multiple

expansion, so you need earnings growth."

Fourth-quarter earnings for companies in the small-cap S&P 600 <.SPCY>

were down 1.0 percent from a year ago, while the benchmark S&P 500's

earnings <.SPX> rose 7.8 percent, Thomson Reuters data show.

Analysts expect profit growth for the S&P 600 in the first quarter of

2017, but at a rate still well below that of the S&P 500.

The S&P 600 is up just 1.4 percent since Dec. 31, after rising 24.7

percent in 2016. The S&P 500 by comparison has gained 6.2 percent since

the start of the year.

[to top of second column] |

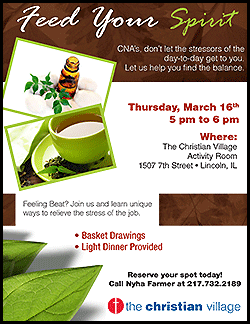

A street sign for Wall Street is seen outside the New York Stock

Exchange (NYSE) in Manhattan, New York City, U.S. December 28, 2016.

REUTERS/Andrew Kelly/File Photo

At 20.4 times forward earnings estimates, the S&P 600 looks expensive compared

with its long-term average of 17, Thomson Reuters data showed. The S&P 500

trades at about 17.8 times forward earnings, also above its long-term average.

The Russell 2000 <.RUT>, a widely used gauge for small-caps, has a forward

price-to-earnings ratio of 25.4, brushing against its highest level since 2009.

Its 10-year average sits at 20.7.

"Growth and the interest rate trajectory are going to be two key factors," said

Dan Suzuki, senior U.S. equity strategist at Bank of America Merrill Lynch in

New York. He thinks small caps may have more room to gain in the short run,

especially if earnings surprise to the upside, but that valuations remains a

negative.

On the flip side, rising rates also tend to boost the U.S. dollar, which would

have a bigger negative impact on large-cap multinationals as a stronger dollar

weighs on offshore revenues when they are translated into the U.S. currency.

Investors also worry that any tax reductions under the Trump administration may

not come for many months, or even until 2018.

"Small-caps generally pay more in terms of U.S. corporate taxes," said Nicholas

Colas, chief market strategist at Convergex, a global brokerage company based in

New York.

"You can somewhat view small-caps as a bit of a proxy for confidence in the tax

reduction piece of the Trump economic plan."

(Reporting by Caroline Valetkevitch; Editing by Daniel Bases and Leslie Adler)

[© 2017 Thomson Reuters. All rights

reserved.] Copyright 2017 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed. |