|

As Trump targets energy rules, oil

companies downplay their impact

Send a link to a friend

Send a link to a friend

[March 23, 2017]

By Richard Valdmanis [March 23, 2017]

By Richard Valdmanis

BOSTON (Reuters) - President Donald Trumpís

White House has said his plans to slash environmental regulations will

trigger a new energy boom and help the United States drill its way to

independence from foreign oil.

But the top U.S. oil and gas companies have been telling their

shareholders that regulations have little impact on their business,

according to a Reuters review of U.S. securities filings from the top

producers.

In annual reports to the U.S. Securities and Exchange Commission, 13 of

the 15 biggest U.S. oil and gas producers said that compliance with

current regulations is not impacting their operations or their financial

condition.

The other two made no comment about whether their businesses were

materially affected by regulation, but reported spending on compliance

with environmental regulations at less than 3 percent of revenue.

The dissonance raises questions about whether Trumpís war on regulation

can increase domestic oil and gas output, as he has promised, or boost

profits and share prices of oil and gas companies, as some investors

have hoped.

According to the SEC, a publicly traded company must deem a matter

"material" and report it to the agency if there is a substantial

likelihood that a reasonable investor would consider it important.

"Materiality is a fairly low bar," said Cary Coglianese, a law professor

at the University of Pennsylvania who runs the universityís research

program on regulation. "Despite exaggerated claims, regulatory costs are

usually a very small portion of many companiesí cost of doing business."

The oil majorsí annual filings come after the industry and its political

allies have spent years criticizing the Obama administration for

policies aimed at reducing fossil-fuel consumption, curtailing drilling

on federal lands and subsidizing renewable energy.

Trump promised during the campaign that a rollback of the Democratic

administrationís policies would help free the nation from reliance on

imported oil.

"Under my presidency, we will accomplish complete American energy

independence," said Trump, describing regulation as a "self-inflicted

wound."

The Trump administration is now preparing an executive order - dubbed

the "Energy Independence" executive order - to roll back Obama-era

regulations, which could be signed as early as this month, according to

administration officials.

U.S. presidents have aimed to reduce U.S. dependence on foreign oil

since the Arab oil embargo of the 1970s, which triggered soaring prices.

But the United States still imports about 7.9 million barrels of crude

oil a day - almost enough meet total oil demand in Japan and India

combined.

"ENERGY RENAISSANCE"

The Trump administrationís attacks on regulation have been applauded by

the oil industry.

"We havenít seen 3 percent growth in the economy for eight years, and I

think part of the reason is that weíve had a heavy dose of regulation,"

Chevron Corp. <CVX.N> CEO John Watson said at CERAWeek, a global energy

conference in Houston this month.

Continental Resources <CLR.N> CEO, Harold Hamm, who advised Trump on

energy issues during his campaign for the White House, told the

Republican National Convention in Cleveland in July that stripping

regulation could allow the country to double its production of oil and

gas, triggering a new "American energy renaissance."

Yet Continental's annual report, filed last month with the SEC, says

environmental regulation - after eight years under the Obama

administration - does not have a "material adverse effect on our

operations to any greater degree than other similarly situated

competitors."

Continental's competitors who reported actual spending on environmental

compliance told investors that such expenses amount to a small

percentage of operating revenues.

Fourteen of the 15 companies whose filings were reviewed by Reuters

declined to comment on their statements to investors or the impact of

regulation on their profits.

A spokesman for ConocoPhillips acknowledged that regulatory compliance

has not had a material adverse impact on the company's liquidity or

financial position. But red tape can be an unwelcome burden nonetheless.

"Changing, excessive, overlapping, duplicative and potentially

conflicting regulations increase costs, cause potential delays and

negatively impact investment decisions, with great cost to consumers of

energy," the spokesman, Daren Beaudo, said in a written statement.

The American Petroleum Institute - which represents the U.S. oil and gas

industry - also declined to comment.

Last month, before the U.S. Senate Commerce, Science and Transportation

Committee, API President Jack Gerard said that the oil and gas industry

has surged forward despite onerous regulations under the Obama

administration.

"Technological innovations and industry leadership have propelled the

oil and gas industry forward despite the unprecedented onslaught of 145

new and pending federal regulatory actions targeting our industry."

[to top of second column] |

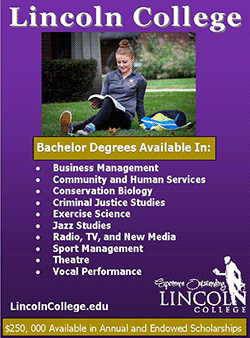

A pump jack operates at a well site leased by Devon Energy

Production Company near Guthrie, Oklahoma September 15, 2015.

REUTERS/Nick Oxford/File Photo

Though the industry saw a staunch opponent in Obama, oil and gas

production soared more than 50 percent during his presidency. That

was mainly because of high oil prices and improved hydraulic

fracturing, a drilling technology that has allowed producers to

access new reserves in previously tough-to -reach shale formations.

The rush of production ultimately contributed to a global glut that

dropped crude oil prices <CLc1> from a high of over $100 a barrel in

early 2014 to a low of nearly $25 by 2016. Current prices hover near

$50 a barrel.

NO "MATERIAL" IMPACT

Four of the 15 companies reviewed by Reuters reported that spending

on environmental matters - including new equipment or facilities, as

well as fines and compliance staffing - amounted to a small fraction

of revenues.

Exxon Mobil <XOM.N> reported spending $4.9 billion worldwide in

2016, or about 2.24 percent of gross revenue. Occidental Petroleum

<OXY.N>, a much smaller company, reported spending $285 million, or

about 2.82 percent of revenue. Neither addressed whether the

spending was "material" in their filings.

Two other companies, ConocoPhillips <COP.N> and Chevron, also broke

out their environmental spending while reporting that regulation had

no material impact on their business. Conoco spent $627 million in

2016, or about 2.57 percent of gross revenue, while Chevron spent

$2.1 billion, or 1.91 percent of gross revenue.

The other 11 companies did not break out spending, but all of them

told the SEC that environmental regulation did not have a material

impact on their business.

In one typical statement, EOG Resources <EOG.N>, one of the biggest

U.S. producers, told investors in a report filed last month:

"Compliance with environmental laws and regulations increases EOG's

overall cost of business, but has not had, to date, a material

adverse effect on EOG's operations, financial condition or results

of operations."

Devon Energy Corp <DVN.N>, Anadarko Petroleum Corp <APC.N>, Pioneer

Natural Resources Co <PXD.N>, Apache Corp <APA.N>, and other large

U.S.-focused oil and gas drillers used similar wording.

"ABSENCE OF A NEGATIVE"

Still, Obama's exit - and Trump's win over Democratic presidential

candidate Hillary Clinton in November - has been enough to brighten

the outlook of some big investors.

"I believe the absence of a negative is a positive," John Dowd, who

manages several energy funds at Fidelity Investments, wrote in his

2017 energy outlook. "The market has been concerned with the

sustainability of fracking, and particularly to what extent it might

have been regulated into obscurity by a different election outcome."

Clinton had said during her campaign that she planned to increase

regulation on fracking.

Other segments of the energy industry, such as coal mining and oil

refining, were harder hit by environmental protection measures

during Obama's presidency. Several coal companies went bankrupt in

recent years and blamed Obamaís climate change initiatives for

raising costs and hurting demand.

Refiners have also long complained that environmental regulations

have stymied attempts to build new refineries and that they have

borne the brunt of costly rules requiring them to blend biofuels

into their gasoline.

Still, some energy analysts and regulation experts point out that

the biggest drivers for these industries, too, tend to be supply and

demand Ė not regulation.

The abundance of cheap natural gas is seen as the biggest obstacle

to reviving coal country, since both fuels compete for space in the

furnaces of U.S. power plants. For refiners, the key driver for

profitability is the differential between the price of their raw

material, crude oil, and the fuels they make with it.

"Supply and demand are the fundamental forces driving markets," said

Coglianese, the University of Pennsylvania law professor.

"Regulation is relatively trivial."

(Editing by Brian Thevenot)

[© 2017 Thomson Reuters. All rights

reserved.]

Copyright 2017 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed. |