U.S. companies list blockchain ETFs as bitcoin proposals

languish

Send a link to a friend

Send a link to a friend

[January 17, 2018]

By Trevor Hunnicutt [January 17, 2018]

By Trevor Hunnicutt

NEW YORK (Reuters) - Investors looking to

profit from excitement surrounding bitcoin technology will get a new

opportunity this week.

Funds coming to market on Wednesday will purchase shares of companies,

such as Hitachi Ltd, Accenture plc and Overstock.com Inc, that may

benefit from the digital asset's underlying technology.

Rather than buying wild-trading "cryptocurrencies" themselves, the

funds' tactic has mollified uneasy regulators who have denied or tabled

more than a dozen proposals for funds that would own bitcoin or futures

based on them.

Amplify Investments LLC and Reality Shares Inc are each launching

exchange-traded funds (ETFs) that invest in companies betting on

blockchain, the decentralized technology bitcoin uses to keep a running

record of transactions.

Companies from JPMorgan Chase & Co to Microsoft Corp and Intel Corp said

blockchain can help them streamline processes, such as settling

financial transactions.

The U.S. Securities and Exchange Commission (SEC) insisted the ETFs not

include the word blockchain in their names if the stocks they hold do

not directly collect a significant portion of their revenue from the

technology, according to people familiar with the matter. Bloomberg News

first reported the SEC's discussions with companies over their funds'

proposed names.

But the funds - Amplify Transformational Data Sharing ETF and Reality

Shares Nasdaq NexGen Economy ETF - will nonetheless trade with the

tickers BLOK and BLCN.

[to top of second column] |

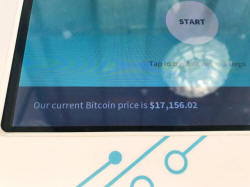

A Bitcoin ATM screen is seen in Santa Monica, California, U.S.,

January 4, 2018. REUTERS/Lucy Nicholson

Bitcoin's 1,500 percent surge last year stoked investor demand for any product

with exposure to the asset.

Bitcoin last fell 15.5 percent to $11,500 on the Bitstamp exchange following

reports suggesting South Korea could ban trading in cryptocurrencies.

The Reality Shares fund's backers have said that buying companies that use

blockchain to cut costs or start new business lines is a more conservative

approach to investing than buying bitcoin directly because those companies are

dependent on more factors than just that technology succeeding.

Eastman Kodak Co shares more than doubled last week after the one-time

photography leader said it would launch a cryptocurrency called KODAKCoin.

Soft drinks maker Long Island Iced Tea's shares have doubled since that company

shifted its focus to blockchain and changed its name to Long Blockchain Corp.

Three other companies have filed proposals for funds that invest primarily in

stocks with blockchain exposure.

(Reporting by Trevor Hunnicutt; Editing by Jennifer Ablan and Andrew Hay)

[© 2018 Thomson Reuters. All rights

reserved.] Copyright 2018 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

|