BOJ chief brushes aside early stimulus exit, calls for

free trade

Send a link to a friend

Send a link to a friend

[March 09, 2018]

By Leika Kihara and Stanley White [March 09, 2018]

By Leika Kihara and Stanley White

TOKYO (Reuters) - Japan's central bank

chief on Friday signaled his readiness to ramp up stimulus if the

economic recovery lost steam, in an emphatic pushback against creeping

speculation it could tighten the money spigot as other economies dial

back crisis-mode policies.

The Bank of Japan kept its monetary policy settings unchanged, as

expected, but Governor Haruhiko Kuroda flagged U.S. President Donald

Trump's move to impose import tariffs on steel and aluminum as risks for

both the domestic and global economies.

With fears of a global trade war and a strong yen clouding the outlook,

Kuroda warned that there was uncertainty over the BOJ's projection

inflation will reach its 2 percent target during the fiscal year ending

in March 2020.

"If the economy loses momentum to achieve our price target, we would of

course consider easing policy further," Kuroda told a briefing.

In a widely expected move, the BOJ maintained its pledge of guiding

short-term interest rates at minus 0.1 percent and the 10-year

government bond yields around zero percent.

It also kept intact its upbeat view that the economy continues to expand

moderately thanks to robust exports and capital expenditure.

But Kuroda's warnings about trade risks and his cautious commentary on

the conditions of an end to accommodative policy marked a stark contrast

to his remarks last week that raised the distant but explicit prospect

of a stimulus exit, which sent the yen and bond yields higher.

There was little financial market reaction to either the central bank

decision or Kuroda's comments on Friday.

The BOJ's monetary policy decision followed data showing workers' wages

fell at the fastest pace in six months, in a sign that consumption may

lose momentum this year and weigh on an economy now enjoying its longest

run of growth in 28 years.

Kuroda said the economy was on course to hit his price target, with the

job market close to full employment and inflation expectations seen

picking up steadily.

But he dismissed the chance of raising the BOJ's yield target any time

soon, even if inflation ticked up.

"Our policy aims to strengthen the degree of monetary easing by

maintaining yields low even as inflation expectations heighten," he

said.

"We have absolutely no plan of doing so now," Kuroda said, when asked

whether the BOJ could raise the yield target before inflation hits its

target.

[to top of second column] |

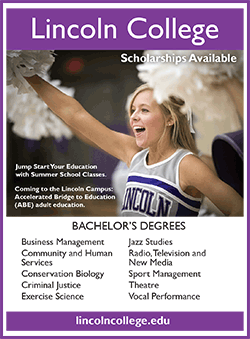

Bank of Japan (BOJ) Governor Haruhiko Kuroda attends a news

conference at the BOJ headquarters in Tokyo, Japan March 9, 2018.

REUTERS/Toru Hanai

NO EXIT IN SIGHT

Kuroda, who is set to serve another term, rattled markets on March 2 by

flagging for the first time the possibility of a stimulus exit if 2

percent inflation were met in fiscal 2019 - a remark he later tempered.

The BOJ is caught in a bind. Inflation remains well below its 2 percent

target even as the economy enjoys solid growth, keeping it from dialing

back stimulus despite the rising costs of prolonged easing.

That leaves Kuroda with a tough task in his second term beginning in

April, which is to navigate the long road toward a stimulus exit with

subtle hints without stoking market fears of an imminent policy shift.

Even if inflation hits 2 percent during fiscal 2019 as it projects, the

BOJ will only begin discussing an exit and won't head for one

immediately, Kuroda said.

"There is still some distance from our price target, so we're not in a

stage now to discuss specifics of an exit strategy," he added.

Kuroda did not see significant prospects of a global trade war, saying

policymakers were united in their resolve to protect free trade.

"G7, G20, WTO, IMF - the international community all share an

understanding of the need for free trade. Protectionism has demerits to

the country that imposes it, so I don't think it will spread globally,"

Kuroda said.

"But each country's trade policy could affect global growth and

financial markets, so we need to carefully watch developments."

With consumption and wage growth subdued, Japan's economy remains

reliant on export growth that could be hurt from a strong yen and fears

of rising protectionism.

"The BOJ is likely to stand pat for the foreseeable future. Given how

currency markets are behaving now, it must be hard to debate an exit

from easy policy any time soon," said Izuru Kato, chief economist at

Totan Research.

A majority of economists polled by Reuters expect the BOJ to keep its

long-term rate target unchanged this year, though 40 percent expect a

hike.

The March rate review was the final one before the BOJ leadership

change, in which two new deputy governors will replace the departing

officeholders on March 20.

(Additional reporting by Tetsushi Kajimoto and Minami Funakoshi; Editing

by Sam Holmes)

[© 2018 Thomson Reuters. All rights

reserved.] Copyright 2018 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |