U.S. retail sales, labor market data paint upbeat

economic picture

Send a link to a friend

Send a link to a friend

[April 19, 2019]

By Lucia Mutikani [April 19, 2019]

By Lucia Mutikani

WASHINGTON (Reuters) - U.S. retail sales increased by the

most in 1-1/2 years in March as households boosted purchases of motor

vehicles and a range of other goods, the latest indication that economic

growth picked up in the first quarter after a false start.

The economy's enduring strength was reinforced by other data on Thursday

showing the number of Americans filing applications for unemployment

benefits dropped to the lowest in nearly 50 years last week. Fears of an

abrupt slowdown in growth escalated at the turn of the year after a

batch of weak economic reports.

They were also exacerbated by a brief inversion of the U.S. Treasury

yield curve in late March. But those concerns have dissipated in recent

weeks amid fairly upbeat data on trade, inventories and construction

spending that have suggested growth last quarter could be better than

the moderate pace logged in the final three months of 2018.

A report from the Federal Reserve on Wednesday described economic

activity as expanding at a "slight-to-moderate" pace in March and early

April. The Fed's "Beige Book" report of anecdotal information on

business activity collected from contacts nationwide showed a "few" of

the U.S. central bank's districts reported "some strengthening."

"The rebound in retail sales underscores that the domestic outlook

remains favorable and well-supported by the labor market, and it dispels

the misguided concerns that the U.S. economy is slipping into

recession," said Kathy Bostjancic, head of U.S. macro investor services

at Oxford Economics in New York.

The Commerce Department said retail sales surged 1.6 percent in March,

the biggest increase since September 2017, after dropping 0.2 percent in

February. Economists polled by Reuters had forecast retail sales

accelerating 0.9 percent last month.

With March's rebound, retail sales have now erased the plunge in

December that put consumer spending and the overall economy on a sharply

lower growth trajectory. Retail sales last month were probably lifted by

tax refunds, even though they have been smaller than in previous years,

following the revamping of the U.S. tax code in January 2018.

Excluding automobiles, gasoline, building materials and food services,

retail sales rebounded 1.0 percent in March after declining 0.3 percent

in February. These so-called core retail sales correspond most closely

with the consumer spending component of gross domestic product.

Consumer spending accounts for more than two-thirds of economic activity

and is being buoyed by a tightening labor market that is driving up wage

growth.

STRONG LABOR MARKET

A separate report from the Labor Department on Thursday showed initial

claims for state unemployment benefits dropped 5,000 to a seasonally

adjusted 192,000 for the week ended April 13, the lowest level since

September 1969. Claims have now declined for five straight weeks.

Economists had forecast claims rising to 205,000 in the latest week.

[to top of second column] |

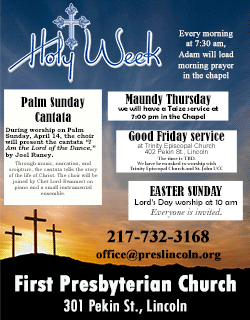

People walk with shopping bags at Roosevelt Field mall in Garden

City, New York, U.S., December 7, 2018. REUTERS/Shannon Stapleton

Though the trend in hiring has slowed, job gains remain above the roughly

100,000 needed per month to keep up with growth in the working-age population.

The reports boosted the dollar against a basket of currencies. Stocks on Wall

Street were mixed, while U.S. Treasury prices rose.

As a result of March's strong core retail sales, the Atlanta Fed raised its

first-quarter GDP estimate by four-tenths of a percentage point to a 2.8 percent

annualized rate.

Growth forecasts for the January-March quarter have been upgraded from as low as

a 0.5 percent rate following the recent trade, inventories and construction

spending data. The economy grew at a 2.2 percent pace in the fourth quarter.

Stronger growth in the first quarter will probably not change the view that the

economy will slow this year as the stimulus from a $1.5 trillion tax cut package

diminishes and the impact of interest rate hikes over the last few years

lingers.

It also is unlikely to have any impact on monetary policy after the Fed recently

suspended its three-year campaign to tighten monetary policy. The central bank

dropped projections for any rate hikes this year after increasing borrowing

costs four times in 2018.

"Key downside risks to U.S. growth are fading from view," said Allison Nathan,

an economist at Goldman Sachs in New York. "While we still think the next Fed

move is much more likely to be a hike than a cut, we've pushed back our forecast

for the next hike from the first quarter to the fourth of next year."

Goldman Sachs has lifted its growth estimate for the second half of 2019 by 25

basis points to 2.5 percent. Despite the recent wave of relatively strong data,

business surveys suggest pockets of weakness persist, especially in

manufacturing.

A third report on Thursday from the Philadelphia Fed showed factory activity in

the mid-Atlantic region slowed in April and manufacturers were less optimistic

about business and labor market conditions over the next six months.

That was corroborated by a fourth report from data firm IHS Markit showing its

measure of national factory activity was unchanged near a two-year low in early

April, with the survey's gauge of factory employment dropping to its lowest

level since June 2017.

"Many of the 'hard' readings on activity suggest that the economy started

picking up momentum late in the first quarter, but this is not evident in much

of the recent survey data," said Daniel Silver, an economist at JPMorgan in New

York.

(Reporting by Lucia Mutikani; Editing by Paul Simao)

[© 2019 Thomson Reuters. All rights

reserved.] Copyright 2019 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |