Social Security expansion to get serious hearing in U.S.

House

Send a link to a friend

Send a link to a friend

[January 31, 2019]

By Mark Miller [January 31, 2019]

By Mark Miller

CHICAGO (Reuters) - The idea that Social Security benefits should be

expanded - not cut - is going mainstream.

Until the last few years, all Washington could talk about was how to cut

Social Security benefits, and by how much. But a grass-roots progressive

coalition began campaigning for expansion in 2013, and the idea has

since moved straight to the heart of the Democratic Party.

That was evident this week when U.S. Representative John Larson

introduced his Social Security 2100 Act in the House of Representatives.

The Connecticut Democrat's proposal calls for a small across-the-board

bump in benefits, a more generous annual cost-of-living adjustment and a

higher minimum benefit for low-income workers. Larson's plan would pay

for the expansion in two ways. First, it would add new payroll taxes to

wages over $400,000 (currently, tax collection stops at $127,200 of

annual income). The bill also would gradually phase in a higher payroll

tax rate, with workers and employers each paying 7.4 percent by 2042,

compared with the current rate of 6.2 percent.

This is not the first time Larson has proposed this legislation, but

this year it stands a very good chance of passage in the House. The

proposal had 54 co-sponsors when Larson first introduced it in 2015;

now, it has more than 200 House co-sponsors - more than 85 percent of

the Democratic majority.

Larson himself is the new chairman of the Social Security subcommittee

of the House Ways and Means Committee. The new chairman of the powerful

Ways and Means Committee, Massachusetts Democrat Richard Neal, is a

co-sponsor of the bill.

Moreover, progressive support for Social Security expansion was an

important campaign plank for many successful Democratic candidates in

November's midterm elections. And nearly every declared and potential

Democratic presidential candidate has endorsed expansion of some type

for Social Security.

The bill is not likely to become law while Republicans control the

Senate and White House. But Larson plans to hold hearings on the bill

this year in Washington and around the country - the first congressional

hearings focused on expansion in 50 years.

That will provide an important forum to help educate the public and

could puncture many of the toxic myths that have taken hold about Social

Security in recent decades. Among the most pernicious of those myths is

that Social Security is headed for bankruptcy, and that benefits will

not be there for young people when their retirement rolls around.

“We need to educate and unmask so many of these myths,” Larson told me

in an interview. “We need to talk about why Social Security is an earned

benefit and not an entitlement. Certainly it is something you are

entitled to, but the word makes Social Security sound like a poverty

program or a handout. Nothing roils people who have been paying into the

program their entire lives more.”

[to top of second column] |

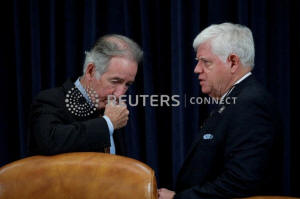

Rep. Richard Neal

(D-MA), (L) and Rep. John Larson (D-CT) speak prior to a House Ways

and Means Committee markup of the Republican Tax Reform legislation

on Capitol Hill in Washington, U.S., November 9, 2017. REUTERS/Aaron

P. Bernstein/File Photo

FIXING THE SHORTFALL

The myths are built on one very important kernel of truth. Social Security does

face a shortfall in revenue needed to pay scheduled benefits. If Congress fails

to act, Social Security benefits will be cut nearly 25 percent in 2034 - just 15

years from now. This would be a financial disaster for current and future

retirees, and it would undermine trust in the program.

Larson’s bill puts Social Security back into balance over the next 75 years -

the period of time the program is required by federal law to project its

finances. On the benefit side, it provides an increase for all enrollees

equivalent to 2 percent of the average benefit, about $30 per month. It would

shift to a more generous annual cost-of-living adjustment formula that is more

sensitive to medical inflation and other costs disproportionately affecting

seniors. The bill would also beef up the special minimum benefit paid to

low-income retirees.

For higher-income seniors, the bill also includes, effectively, a benefit boost

in the form of a tax cut.

Beneficiaries with higher income - usually from work, a pension or drawdowns

from tax-deferred saving - often wind up paying income taxes on their Social

Security benefits.

The proportion of benefit that is taxable is determined using a formula called

“provisional income” - your adjusted gross income (excluding Social Security

benefits), plus non-taxable interest and half of your Social Security benefits.

If your provisional income is $25,000 to $34,000 (single return) or $32,000 to

$44,000 (joint return), up to 50 percent of your Social Security benefit must be

counted as adjusted gross income. If your provisional income is more than

$34,000 on a single return or $44,000 on a joint return, 85 percent must be

added to AGI.

The Larson bill would replace those thresholds with $50,000 (single filer) and

$100,000 (joint filers), and if provisional income is above those levels, up to

85 percent is counted in adjusted gross income.

Despite the bill’s strong odds in the House, the Republican-controlled Senate is

not likely to take it up this year - although Larson says he is reaching out. He

also has put feelers out to the White House, noting that President Donald Trump

opposed cuts to Social Security during the 2016 campaign.

“I think we’re coming to some common-sense solutions,” Larson said. “Especially

when one of the biggest champions of protecting Social Security is the President

of the United States.”

(Reporting and writing by Mark Miller in Chicago; Editing by Matthew Lewis)

[© 2019 Thomson Reuters. All rights

reserved.] Copyright 2019 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |