|

Bribing your way to college? Check your

math, it may not pay

Send a link to a friend

Send a link to a friend

[March 15, 2019]

By Ann Saphir and Howard Schneider [March 15, 2019]

By Ann Saphir and Howard Schneider

SAN FRANCISCO/WASHINGTON (Reuters) -

Experts agree that college pays off. But at any price?

More than two dozen wealthy families charged with allegedly cheating or

bribing their kids’ way into elite schools are learning the hard way

that crime doesn't pay, even when higher education is the prize.

Potential criminal punishments aside, the scheme raises the question:

was the premium parents paid worth the anticipated long-term economic

gain for their children?

Take Bruce Isackson, president of a Woodside, California, real estate

firm, and his wife Davina, who in July 2015 turned over 2,150 shares

worth $251,000 of Facebook Inc stock to help get their daughter into

UCLA as a fake soccer recruit, according to a federal criminal

complaint. If they had just held on to those shares, they would have

been worth around $373,000 today.

They later allegedly spent another $350,000 to get their younger

daughter into the University of Southern California as a bogus rowing

recruit.

Manuel Henriquez, a resident of Atherton, California, who until Tuesday

was chairman of Silicon Valley finance company Hercules Capital Inc, and

his wife Elizabeth were arrested in New York after allegedly shelling

out more than $500,000 to cheat on entrance exams and fake their

daughter's tennis expertise to get her into Georgetown University.

Just imagine the calculus of the unnamed relatives of a teenaged girl

who authorities said paid $1.2 million to get her into Yale University

as a soccer recruit, though she did not play competitively.

And then there are the parents accused by prosecutors of paying $15,000

apiece to cheat on standardized tests to make their kids' applications

look better.

All of these were upfront costs incurred even before the first checks

for tuition, room and board and other fees were written. In each case,

would the crime have even paid off?

GRAPHIC - The college gamble: https://tmsnrt.rs/2O56E6A

DOING THE MATH

Five years ago, San Francisco Federal Reserve Bank President Mary Daly –

then associate director of the bank’s research department – asserted in

a paper that college costs more often than not are worth the expense

over the long term. A student in 2014 paying $21,200 a year for a

four-year degree, she found, would break even with someone with only a

high school diploma by the age of 38 and would have made a cumulative

$831,000 more than that individual by retirement.

But what about the Yale student and her family, who paid $1.2 million up

front and then presumably were on the hook for full tuition and room and

board adding up to more than $70,000 a year? That’s an all-in tab for

that degree of $1.48 million.

Using Daly's approach as a guide and inputting updated government data

on median incomes for individuals with and without college degrees, a

Reuters analysis found a college grad whose $70,000 annual tuition was

paid upfront would outearn a high school grad by $1.3 million over a

lifetime of work, assuming each earned the median national wage for

their demographic inflated over time.

But the unidentified student’s family paid more than five times the Yale

sticker price after the bribe, a cost that would not be fully recovered

until the child reaches age 64, assuming 3 percent annual wage growth

and a one-time, 10 percent increase at age 34 to reflect higher earnings

of older adults.

In many cases involving wealthy parents, future earnings may be less of

a draw than the prestige of saying your offspring were at Yale or

Stanford, or the lure of potential connections with influential

elite-school graduates.

[to top of second column]

|

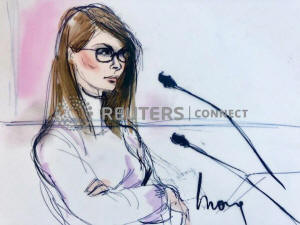

Actor Lori Loughlin appears in this court sketch at a hearing for a

racketeering case involving the allegedly fraudulent admission of

children to elite universities, at the U.S. federal courthouse in

downtown Los Angeles, California, U.S., March 13, 2019. REUTERS/Mona

Shafer Edwards

But had some of these parents not been caught, the payoff alone

might have been worth it.

In the case of a less expensive school like UCLA, the $391,000 cost

to the Isacksons - the $251,000 bribe plus $140,000 for four years

of tuition and fees - would still leave a lifetime earnings surplus

for their daughter of a bit over $1.2 million.

Meanwhile, for those parents like "Desperate Housewives" actress

Felicity Huffman, whose total outlay in the fraudulent enterprise

was just $15,000 to improve their childrens' entrance exam scores by

cheating, the payoff would have been handsome. Assuming the student

graduates, the $22,000 gap in median annual pay between high school

and college graduates would easily offset the extra investment.

Lawyers representing the Henriquez couple and Bruce Isackson did not

respond to a request for comment. Davina Isackson could not be

reached.

GRAPHIC - College pays off, even if you pay your own way: https://tmsnrt.rs/2FbTySj

INTANGIBLES

There are benefits to a degree from a top college beyond excess

earnings over time. Unemployment is lower among college grads and

job satisfaction is higher.

Philip Oreopoulos, an economics professor at the University of

Toronto, has even quantified non-work-related benefits of a college

education, including lower divorce rates, better health, and more

happiness overall, even after accounting for pay differences.

"It goes way beyond financial gain," he says, adding that he in no

way endorses parental cheating, which he called "grossly unfair."

The still-unfolding scandal highlights economic inequalities

exacerbated by college admissions programs that in some cases

legally give preference to children of wealthy parents, even as U.S.

students are saddled with a collective $1.56 trillion in loans,

Federal Reserve data shows.

The financial analysis suggests that, in terms of money alone, at

least some of the bribes and cheating would have led to a net gain -

unless you consider how the money might otherwise have been

invested.

The return on the median fraudulent payment of $250,000, invested at

the standard 6 percent yearly return used by many long-term

financial planners, after high school and through age 65 would have

been $3.9 million, Reuters calculated.

And for $1.2 million - the maximum shelled out? $18.6 million.

Next time, tell your mom to just give you the money.

(Additional reporting by Trevor Hunnicutt in New York; Editing by

Dan Burns and Bill Berkrot)

[© 2019 Thomson Reuters. All rights

reserved.]

Copyright 2019 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |