|

Global stocks rise on trade optimism, set

for best quarter since 2012

Send a link to a friend

Send a link to a friend

[March 29, 2019]

By Ritvik Carvalho [March 29, 2019]

By Ritvik Carvalho

LONDON (Reuters) - Global stocks rose on

Friday on optimism over trade talks between the United States and China

and were set to post their best quarterly performance since 2012, while

global bond yields moved higher after a prolonged slide on growth

worries.

European markets opened higher, with the pan-European STOXX 600 index up

0.4 percent. France's CAC 40 index led gains, up 0.77 percent, while

Britain's FTSE 100 index was up 0.6 percent. Germany's DAX rose 0.4

percent. [.EU]

The rises came on the back of strong gains in Asia, where Chinese shares

climbed more than 3.1 percent after U.S. officials said China has made

proposals in trade talks with the United States on a range of issues

that go further than it has before, including on forced technology

transfer.

U.S. Treasury Secretary Steven Mnuchin said on Friday he had a

"productive working dinner" the previous night in Beijing, kicking off a

day of talks aimed at resolving the bitter trade dispute between the

world's two largest economies.

"Our base case is for the current tariff truce extension to yield only a

partial resolution, including select U.S. tariff rollbacks in exchange

for some Chinese concessions on imports, market access and intellectual

property," strategists at UBS wrote in a note to clients.

S&P 500 E-mini futures were up by 0.16 percent. Gains on Wall Street

overnight also bolstered investor optimism. [.N]

Despite recent turbulence, the S&P 500 has gained 12.3 percent so far

this quarter, which would mark its best quarterly performance since 2009

if sustained.

MSCI's All-Country World Index, which tracks shares in 47 countries, was

up 0.17 percent on the day. It was set to post its best quarterly

performance since March 2012.

German and French government bond yields were poised on for their

biggest monthly falls since June 2016, ending a month where heightened

anxiety about global growth prospects have sparked a flood into fixed

income globally.

Ten-year bond yields across the single currency bloc were marginally

higher in early trade, reflecting the firmer tone in stock markets. [GVD/EUR]

"We have moved a lot in the last two weeks so there is a bit of pause

for now," said Pooja Kumra, European rates strategist, TD Securities.

LIRA IN FOCUS

Analysts at UBS noted that pessimism in the bond market looked overdone,

citing three reasons: economic growth is slowing and not stalling,

central banks remain supportive of growth, and corporate earnings are

stronger than they appear.

The 10-year U.S. bond yield edged up to 2.406 percent from a 15-month

low of 2.352 percent touched on Thursday after an almost relentless fall

since the Federal Reserve's dovish tone last week sparked worries about

the U.S. economic outlook.

[to top of second column]

|

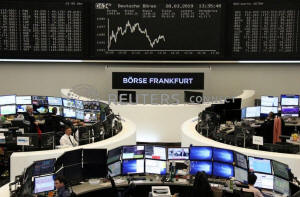

The German share price index DAX graph is pictured at the stock

exchange in Frankfurt, Germany, March 28, 2019. REUTERS/Staff

Investors have been on heightened alert since the yield on the

10-year note fell below that of the three-month U.S. Treasury paper

last Friday, an inversion of the yield curve that is widely seen as

an indicator of a recession.

Data on Thursday showed U.S. economic growth was slower than

initially thought in the fourth quarter, with GDP growth revised

down to an annualised 2.2 percent from an earlier reading of 2.6

percent.

In currencies, the euro was higher by 0.1 percent at $1.1226 though

it was headed for its worst month since October, weighed down by

fears about economic growth and cautious signals from the European

Central Bank. [FRX/]

The single currency has also been weighed down by speculation the

ECB will introduce a tiered deposit rate, providing a sign that

policymakers plant to keep interest rates low for longer.

Against a basket of peers, the dollar was flat.

The Turkish lira dropped 1.7 percent, a day after it had plunged 4

percent. President Tayyip Erdogan blamed the currency's weakness on

attacks by the West ahead of nationwide local elections on Sunday.

The British pound dipped 0.1 percent to $1.3025 after sliding more

than 1 percent the previous day.

Sterling had taken a knock as the prospect of a swift agreement on

Brexit faded with the British parliament yet again failing to agree

on a way forward. [GBP/]

Oil prices rose amid the ongoing OPEC-led supply cuts and U.S.

sanctions against Iran and Venezuela, putting crude markets on track

for their biggest quarterly rise since 2009. [O/R]

U.S. crude futures traded at $59.76 per barrel, up 0.8 percent on

the day and recovering from Thursday's low of $58.20.

Brent rose 0.4 percent to $68.10 per barrel.

(Reporting by Ritvik Carvalho; additional reporting by Dhara

Ranasinghe in London; Editing by Alison Williams)

[© 2019 Thomson Reuters. All rights

reserved.]

Copyright 2019 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |