Stocks jump on virus hopes, oil hit by OPEC+ delay

Send a link to a friend

Send a link to a friend

[April 06, 2020] By

Marc Jones [April 06, 2020] By

Marc Jones

LONDON (Reuters) - World stock markets jumped on Monday,

encouraged by a slowdown in coronavirus-related deaths and new cases,

though a delay in talks between Saudi Arabia and Russia to cut supply

sent oil tumbling again.

Equity investors were encouraged as the death toll from the virus slowed

across major European nations including France and Italy.

London's FTSE raced up 2%, indexes in Paris and Milan rose 3% and

Germany's DAX gained more than 4% after Japan's Nikkei finished with

similar gains overnight. [.EU][.T]

There was plenty of news to demonstrate just how brutal the virus has

been: eye-popping plunges in car sales and air travel in Europe,

Britain's prime minister being hospitalised, and Japan preparing to

declare a state of emergency. But the markets appeared hopeful.

Wall Street S&P 500 emini futures were up almost 4%, close to their

upper limit too, bouyed by comments from U.S. President Donald Trump

that his country was also seeing a "levelling off" of the crisis.

"What is driving the market is the evidence that the number of new cases

has started to turn the corner," said Rabobank's Head of Macro Strategy

Elwin de Groot.

As well as a slowdown in deaths in Italy, he said, improvements were

starting to become visible in Spain and even in the United States there

had been a little bit of a let-up.

"When you see that happening you can start gauging when lockdowns can

start to be gradually lifted. That gives a little bit more visibility

and that is vital," he added, although he stressed there were still huge

uncertainties and risks.

As has been the pattern for most of the year, commodity markets saw the

day's other big moves.

Brent crude fell as much as $4 after Saudi Arabia and Russia, who have

been at loggerheads this year over production, pushed back the planned

start of a meeting of the Organization of the Petroleum Exporting

Countries and its allies, a group known as OPEC+, until Thursday.[O/R]

OPEC+ is working on a deal to cut oil production by about 10% of world

supply, or 10 million barrels per day (bpd), in what member states

expect to be an unprecedented global effort.

The countries are "very, very close" to a deal on cuts, one of Russia's

top oil negotiators, Kirill Dmitriev, who heads the nation's wealth

fund, told CNBC.

But Rystad Energy's head of oil markets Bjornar Tonhaugen said even if

the group agreed to cut up to 15 million bpd, "it will only be enough to

scratch the surface of the more than 23 million bpd supply overhang

predicted for April 2020."

[to top of second column] |

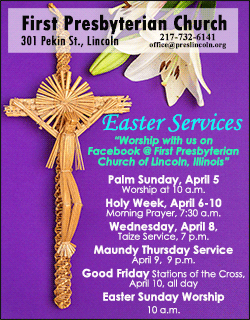

The German share price index DAX graph is pictured at the stock

exchange in Frankfurt, Germany, April 3, 2020. REUTERS/Staff/File

Photo

EMERGENCY CALLS

In currency markets, the yen fell 0.6% to 109.14 against the dollar and weakened

against other major currencies as Japan's Prime Minister Shinzo Abe said the

government would declare a state of emergency as early as Tuesday to curb a

spike in coronavirus infections.

The dollar barely budged against the euro but the pound recovered having dipped

0.4% after British Prime Minister Boris Johnson was admitted to hospital for

tests as he was still suffering symptoms of the coronavirus.

Yields on safe-haven German government bonds crept higher in fixed income

markets too, reflecting the slightly brighter tone in world markets despite some

painful data.

Investor morale in the euro zone fell to an all-time low in April and the

currency bloc's economy is now in deep recession due to the coronavirus, which

is "holding the world economy in a stranglehold", a Sentix survey showed.

Orders for German-made goods had already dropped 1.4% in February, German data

showed. British car sales slumped 40% last month and Norweigen Air's traffic

plummeted 60%.

"Never before has the assessment of the current situation collapsed so sharply

in all regions of the world within one month," Sentix managing director Patrick

Hussy said.

"The situation is ... much worse than in 2009," Hussy said. "Economic forecasts

to date underestimate the shrinking process. The recession will go much deeper

and longer."

CRUCIAL TEST

In Asia, stocks had also proven bullish. Australia's benchmark index rose 4.33%,

Japan's Nikkei added 4.24% after a slow start, while South Korea's KOSPI index

climbed 3.85%. Hong Kong's Hang Seng index was 2.18% higher.

That sent MSCI's broadest index of Asian shares outside of Japan up 2%, on track

for its best performance in more than a week.

Markets in mainland China were closed for a public holiday.

Worryingly, the number of new coronavirus cases jumped in China on Sunday, while

the number of asymptomatic cases surged too as Beijing continued to struggle to

extinguish the outbreak despite drastic containment efforts.

"Focus in markets will now turn to the path out of lockdown and to what extent

containment measures can be lifted without risking a second wave of infections,"

National Australia Bank analyst Tapas Strickland wrote in a note.

"Key to a strong rebound in China will be the ongoing lifting of containment

measures, with Wuhan – the epicentre of the outbreak – set to lift containment

measures on April 8."

(Additional Reporting by Swati Pandey and Paulina Duran in Sydney; Editing by

Gareth Jones)

[© 2020 Thomson Reuters. All rights

reserved.] Copyright 2020 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |