Oil prices rise on hopes OPEC+ will agree supply cuts

Send a link to a friend

Send a link to a friend

[April 09, 2020] By

Shadia Nasralla [April 09, 2020] By

Shadia Nasralla

LONDON (Reuters) - Oil prices rose on

Thursday on expectations the world's leading crude producers will

overcome obstacles at a meeting later in the day that have so far

prevented a deal to cut output in response to a collapse in global

demand.

Brent crude <LCOc1> futures were up 1.9%, or 62 cents, at $33.46 a

barrel by 1140 GMT after hitting a high of $34.83 early in the session.

U.S. West Texas Intermediate (WTI) crude <CLc1> futures were up 3.2%, or

80 cents, at $25.89 a barrel, after earlier hitting a session high of

$27.46 a barrel.

Both contracts retraced some of their earlier gains after a Kremlin

spokesman said Russian President Putin had no plans as of Thursday to

discuss oil markets with U.S. President Donald Trump and Saudi Arabia's

leadership.

The Organization of the Petroleum Exporting Countries (OPEC) and allies

including Russia - a group known as OPEC+ - are set to hold a video

conference on Thursday at about 1400 GMT.

Hopes of a deal to cut 10 million to 15 million barrels per day (bpd)

rose after reports that Russia was ready to reduce its output by 1.6

million bpd and Algeria's energy minister said he expected a fruitful

meeting.

Such a sizable reduction would be far bigger than any OPEC has agreed

before but Russia has insisted it will only reduce output if the United

States joins the deal.

To boost prices, Thursday's meeting will need to be more successful than

the OPEC+ gathering in March, when it failed to agree to extend much

smaller supply cuts, resulting in Saudi Arabia and Russia pledging to

flood the market with cheap oil.

U.S. President Donald Trump said on Wednesday that U.S. oil producers

were already cutting production and warned that he had many options if

Saudi Arabia and Russia failed to reach a deal.

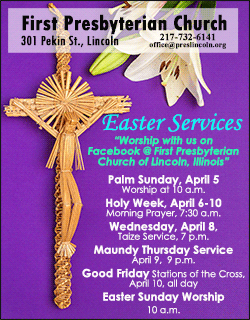

[to top of second column] |

Oil pump

jacks work at sunset near Midland, Texas, U.S., August 21, 2019.

Picture taken August 21, 2019. REUTERS/Jessica Lutz/File Photo

The reference baseline for any cuts was also still unclear.

Following the OPEC+ meeting, energy ministers from the Group of 20 major

economies are set to meet.

However, with oil prices having halved since the start of the year and global

oil demand forecast to slide as much as 30%, some analysts remain sceptical

about how effective an OPEC+ cut would be in shoring up prices.

"Ultimately, the size of the demand shock is simply too large for a coordinated

supply cut," Goldman Sachs said in a note.

UBS expects oil demand this quarter to fall by about 20 million bpd, down 20%

from a year earlier.

"Even if a production-cut agreement is reached, which will surely give prices a

short-term boost, we believe the enthusiasm will subside at some point and the

reality of the size of the demand imbalance will eventually hit the market,"

said Rystad Energy's head of oil markets Bjornar Tonhaugen.

U.S. Energy Information Administration data on Wednesday showed crude stocks

rose by 15.2 million barrels last week as fuel demand slumped, their biggest

weekly rise ever.

(Additional reporting by Sonali Paul and Seng Li Peng; editing by David Clarke

and Jason Neely, Kirsten Donovan)

[© 2020 Thomson Reuters. All rights

reserved.] Copyright 2020 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |