OPEC's pact with Russia falls apart, sending oil into

tailspin

Send a link to a friend

Send a link to a friend

[March 07, 2020] By

Rania El Gamal, Alex Lawler and Olesya Astakhova [March 07, 2020] By

Rania El Gamal, Alex Lawler and Olesya Astakhova

VIENNA (Reuters) - A three-year pact

between OPEC and Russia ended in acrimony on Friday after Moscow refused

to support deeper oil cuts to cope with the outbreak of coronavirus and

OPEC responded by removing all limits on its own production.

Oil prices plunged 10% as the development revived fears of a 2014 price

crash, when Saudi Arabia and Russia fought for market share with U.S.

shale oil producers, which have never participated in output limiting

pacts.

Brent has lost about a third of its value this year, tumbling towards

$45 a barrel, its lowest since 2017, putting oil-dependent nations and

many oil firms under heavy strain as the global economy reels due to the

virus outbreak, which has dampened business activity and stopped people

traveling.

"From April 1 neither OPEC nor non-OPEC have restrictions," Russian

Energy Minister Alexander Novak told reporters after marathon talks at

the OPEC headquarters in Vienna on Friday.

Saudi Energy Minister Prince Abdulaziz bin Salman told reporters when

asked whether the kingdom had plans to increase production: "I will keep

you wondering".

The failure of talks may have more far reaching implications as OPEC's

de facto leader Saudi Arabia and Russia have used oil talks to build a

broader political partnership in the last few years after effectively

supporting opposite sides in the Syrian war.

"Russia's refusal to support emergency supply cuts would effectively and

fatally undermine OPEC+'s ability to play the role of oil price

stabilizing swing producer," said Bob McNally, founder of Rapidan Energy

Group.

"It will gravely rupture the budding Russian-Saudi financial and

political rapprochement. The result will be higher oil price volatility

and geopolitical volatility," he said.

SHALE SLOWDOWN

Beyond Moscow and Riyadh's ties, plunging oil prices will put pressure

on U.S. shale producers, whose output costs are much higher than those

of Russian and Saudi production, even though many shale producers are

well hedged against price falls.

[to top of second column] |

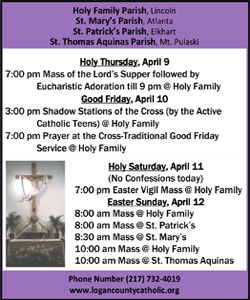

The logo of the Organisation of the Petroleum Exporting Countries

(OPEC) sits outside its headquarters ahead of the OPEC and NON-OPEC

meeting, Austria December 6, 2019. REUTERS/Leonhard Foeger/File

Photo

"This crisis has revealed that Saudi is not willing to keep a floor under shale

and other producers. They are expediting the slowdown on shale," said Christyan

Malek, head of JP Morgan oil and gas research for Europe, Middle East and

Africa.

The OPEC+ talks collapsed after OPEC effectively presented Russia with an

ultimatum on Thursday, offering it a choice of accepting a deal with much bigger

than expected cuts or no deal at all.

Forecasts for 2020 demand growth have been slashed but Moscow has long argued it

was too early to assess the impact. Sources said Novak delivered the same

message on Friday.

OPEC ministers said on Thursday they backed an additional 1.5 million barrels

per day (bpd) of oil cuts until the end of 2020, in addition to rolling over

existing cuts of 2.1 million bpd. That would have meant removing a total of

about 3.6 million bpd from the market, or 3.6% of global supply.

Moscow rejected the proposal on Friday, saying it was only willing to extend

existing OPEC+ cuts of 2.1 million bpd, which were due to expire at the end of

March. But in response, OPEC even refused to extend the existing cuts.

The Kremlin said on Friday President Vladimir Putin had no immediate plans to

talk to the Saudi leadership, an announcement that dashed hopes that a deal

could be salvaged at the very top.

The collapse of the deal means OPEC members and non-OPEC producers can in theory

pump at will in an oversupplied market.

"This is an unexpected development that falls far below our worst case scenario

and will create one of the most severe oil price crises in history," said

Bjoernar Tonhaugen of Rystad Energy.

(Additional reporting by Shadia Nasralla and Ahmad Ghaddar; Editing by Edmund

Blair and Dmitry Zhdannikov)

[© 2020 Thomson Reuters. All rights

reserved.] Copyright 2020 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |