As one of China's 'Detroits' reopens, world's automakers worry about

disruptions

Send a link to a friend

Send a link to a friend

[March 09, 2020]

By Norihiko Shirouzu and Yilei Sun [March 09, 2020]

By Norihiko Shirouzu and Yilei Sun

BEIJING (Reuters) - Automakers across the

world face the possibility of extended supply chain disruptions as

factories in China stutter back to life after closures due to the

coronavirus outbreak.

The car industry is especially exposed as Wuhan - the epicenter of the

outbreak - is known as one of China's 'Detroits', accounting for nearly

10% of vehicles made in the country and home to hundreds of parts

suppliers.

Non-essential factories in Wuhan and other cities in Hubei province

remain on lockdown at least until Wednesday. When they reopen on March

11, or whenever authorities give the go-ahead, it is not clear if

companies will have the raw materials or workers to get back to normal

operations.

Automakers are concerned about their employees' health and the uneven

and unpredictable application of rules in different cities and regions

that is making it hard for an industry that is used to uniformity to

plan ahead.

"In some cities, one worker gets infected, the whole factory where he

works needs to be shut down," said one official at Honda Motor Co, which

has a manufacturing hub and more than 100 suppliers in Wuhan and the

surrounding area.

"In Wuhan, that has not been clarified," he said. "You donít know whatís

going to happen to your factory until you report an infection case to

authorities. Itís hard to live with that kind of uncertainty when youíre

running a massive factory."

Employees reported back to work at Honda's other Chinese manufacturing

hub, in the southern China city of Guangzhou, on Feb. 10 and partial

production restarted on Feb. 17. Production there is still running well

below capacity due to parts shortages and logistical delays, the company

official said.

Honda is expecting to reopen its Wuhan hub this week, after the lockdown

is lifted or whenever authorities allow it. Together, Honda's two China

hubs have the capacity to produce 1.2 million vehicles a year, or more

than 20% of the company's total global production.

Like other manufacturers in Wuhan, automakers and parts suppliers are

still dealing with partially blocked roads and health inspections on

major transportation arteries, which are creating problems moving around

raw materials and finished parts, according to Yohei Shinoda, personnel

manager for Kasai Kogyo Co, a Japanese company with four plants in China

producing interior door and roof trims for Honda and other automakers.

"Even if we wanted to resume production, we can't access the materials

we need due to supply chain disruptions," said Shinoda, whose firm has

plants in Wuhan, Guangzhou, Kaifeng and Dalian. "On top of that, weíre

facing staffing shortages at our plants."

A joint venture between U.S. company Cummins Inc and truck maker

Dongfeng Motor Group which makes diesel engines for big buses and

commercial vehicles in the city of Xiangyang in Hubei province may face

problems.

"The logistics between cities remains an issue, we expect it will take

longer for us to get parts from upstream suppliers and send engines to

Dongfeng plants in other cities," an official of the joint venture told

Reuters.

[to top of second column]

|

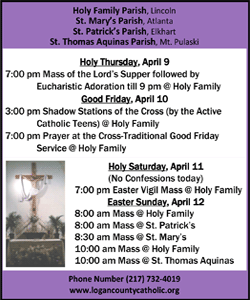

An employee wearing a face mask works on a car seat assembly line at

Yanfeng Adient factory in Shanghai, China, as the country is hit by

an outbreak of a novel coronavirus, February 24, 2020. REUTERS/Aly

Song/File Photo

LASTING DAMAGE

The corporate damage in Hubei could be significant and long-lasting.

A joint survey of 573 Hubei companies - including 12 involved in

auto manufacturing - by Wuhan University and the Wuhan Federation of

Industry and Commerce late last month showed more than 97% of them

halted or partially halted production due to the coronavirus

outbreak. Nearly 60% said they would be bankrupt in three months or

fewer if operations are not restored.

The picture in the rest of China is slightly better. More than 90%

of some 300-plus automotive parts suppliers outside Hubei say they

have resumed production, with 80% of workers present, according to

the China Association of Automobile Manufacturers.

However, the association said production rates were still not high,

given the dearth of orders from manufacturers and logistics problems

at smaller second- and third-tier suppliers.

Chinese automakers and parts producers exported $53 billion worth of

automotive components to the United States, Europe, Japan, South

Korea and elsewhere last year. If plants do not get back up to speed

quickly, vehicle assembly lines across the world are at risk of

slowing or shutting down.

General Motors Co Chief Executive Mary Barra said on Wednesday that

the company's North American car and truck plants have secured

components to last "quite far into this month." Normally, automakers

have parts shipments lined up and assured for many months in

advance.

Companies are doing what they can to get back on track, but there is

no guarantee against disruptions.

U.S. drivetrain supplier Dana Inc's global purchasing team scrambled

to get more than 200,000 facial masks for its plants in China to

keep workers safe on the job. So far, Dana has avoided any

significant disruptions, CEO James Kamsickas said.

U.S. auto supplier Cooper Standard has 13 factories across China

which have resumed production with 65% of the normal workforce, said

Larry Ott, Cooper Standardís head of global human resources at the

companyís headquarters outside Detroit.

"That's basically what we need right now to satisfy the customer

demand," he said.

(This story corrects company name to Dana Inc from Dana Corp in

paragraph 19)

(Reporting By Norihiko Shirouzu and Yilei Sun in Beijing; Additional

reporting by Naomi Tajitsu in Tokyo, Ben Klayman in Detroit and

Yawen Chen in Beijing; Editing by Joseph White and Bill Rigby)

[© 2020 Thomson Reuters. All rights

reserved.] Copyright 2020 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |