Your Money: Furloughed college students struggle

financially

Send a link to a friend

Send a link to a friend

[March 14, 2020] By

Beth Pinsker [March 14, 2020] By

Beth Pinsker

NEW YORK (Reuters) - George Curtis is

facing a severe financial crisis.

He has to be out of his Swarthmore College dorm room by Sunday. He lost

his campus job and cannot travel home to Montana from the

Philadelphia-area liberal arts college because he is not feeling well.

Nor does he want to endanger the health of his 71-year-old father.

There were about 20 million students attending U.S. colleges and

universities as of last fall, according to the National Center for

Education Statistics. Now, like Curtis, a 20-year-old Classics junior,

many of them are in limbo because of coronavirus closures on campuses.

Swarthmore, like most every major institution of higher education, is

moving to remote learning in the coming days and sending students

packing, except a few who receive exemptions to stay on campus.

The competition for those spots is tough, and Curtis was denied.

College communities are responding in a variety of ways, some offering

pro-rated refunds for room and board, covering travel for those on

financial aid and offering stipends for moving and packing expenses.

U-Haul is also offering free storage for students across the country.

(https://bit.ly/2QcqKhK)

Harvard's Primus organization, for first-generation low-income students,

reached out immediately to the school's vast alumni network with a set

of Google spreadsheets to find out who could take in students, store

boxes and offer jobs.

At Berea College in Kentucky, a free-tuition institution that serves a

low-income population, President Lyle Roelofs said he expects to house

more than 200 students out of 1,660 because they have nowhere else to

go. Remote instruction is being tailored to a population that does not

have reliable internet at home, and deadlines to drop classes have been

extended.

There are also crowd-sourcing appeals coming from all over to help

American students. As these are not vetted or registered charities,

potential donors should do their own research before sending funds.

To help students beyond just one's own school affiliation, there are

national efforts that are official charities, like the Student Relief

Fund (studentrelieffund.org).

For Sara Goldrick-Rab, the founding director of the Hope Center for

College, Community and Justice and a professor at Temple University in

Philadelphia, the current situation highlights an ongoing crisis of

income instability for many college students. She has a running hashtag

on social media (#RealCollege) to help raise awareness.

One plea Goldrick-Rab received was from a young woman who is being

raised by her sister, who is also in college. With her school closing,

she needed to get from Florida to Ohio, but she had no funds, so she was

going to try to hitchhike.

[to top of second column] |

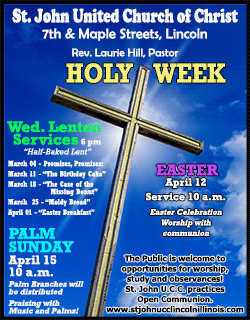

Students carry boxes to their dorms at Harvard University, after the

school asked its students not to return to campus after Spring Break

and said it would move to virtual instruction for graduate and

undergraduate classes, in Cambridge, Massachusetts, U.S., March 10,

2020. REUTERS/Brian Snyder

"People think that these students will go home and party and chill and mom and

dad will take care of them. Some of them will. Good for them. But a lot of them

aren't in that situation," Goldrick-Rab said.

CONTINUING ED

Sustained online learning presents a few particular financial issues for

students:

* Students using military stipends via the GI Bill may face a lower housing

payout "for any subsequent terms pursued solely online," according to Christina

Mandreucci, press secretary for the Department of Veterans Affairs. If the

program is not approved by the relevant authority, all funding could stop, she

noted.

* Students who chose to discontinue or pause their studies rather than continue

with online learning may go into repayment status on their student loans, or use

up their six-month grace period.

"The best advice is to make a phone call to the loan servicer and see what

applies to your situation," said Sabrina Manville, co-founder of Edmit.me, a

college financial information site.

* Students already in repayment status who are facing income disruptions should

also heed the advice to call their loan servicer and check into their options,

Manville said. Those who think this might be a long-term issue can look into

income-driven repayment plans, and for just short-term issues there are

forbearance options that can pause your payment. Deferment is a middle option,

Manville said, because interest still accrues on the loan balance.

President Donald Trump announced on Friday that student loan interest would be

waived until further notice.

* Students who are no longer on campus also no longer have income from their

student jobs. This is still a developing situation, so most schools have not

announced how they will help. At Berea College, though, Roelofs said students

would continue to be paid.

For now, Curtis is planning to couch-surf somewhere in the Northeast and get by

as best he can. He and his friends still on campus are using up as many of their

meal credits as possible.

"It’s like Belshazzar’s Feast,” Curtis said, referring to the biblical story and

the Rembrandt painting depicting it.

(Follow us @ReutersMoney or at http://www.reuters.com/finance/personal-finance.

Editing by Lauren Young, Dan Grebler and Matthew Lewis)

[© 2020 Thomson Reuters. All rights

reserved.] Copyright 2020 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |