U.S. mortgage firms push for support as borrowers halt

payments

Send a link to a friend

Send a link to a friend

[May 05, 2020] By

Matt Scuffham [May 05, 2020] By

Matt Scuffham

NEW YORK (Reuters) - U.S. mortgage firms

facing billions of dollars of missed home loan repayments are continuing

to push for emergency government support as data published Monday showed

a further rise in borrowers asking to halt payments.

The number of people seeking to have mortgage payments paused or reduced

rose to 7.5% as of April 26 from 7.0% a week earlier as the economic

effects of the novel coronavirus outbreak stretched household finances,

figures from the Mortgage Bankers Association (MBA) showed. The MBA

estimates that 3.8 million homeowners are now in forbearance.

The surge in delayed payments could leave mortgage service companies,

which pool home loans and sell them to investors, with a liquidity

shortfall of as much as $100 billion over the next nine months,

according to the MBA. That is because mortgage servicers still have to

advance scheduled payments to investors even if borrowers fail to make

their payments.

Mortgage servicers want the Federal Reserve and Treasury to introduce an

emergency liquidity facility to cover those payments but Treasury

Secretary Steven Mnuchin said last week there were no current plans to

offer such a lifeline.

In an interview, the MBA's Chief Executive Officer Bob Broeksmit said it

was still discussing the issues with the Fed, Treasury and Federal

Housing Finance Agency.

"We don't see it as the end of the matter," he said. "We understand that

the Fed and Treasury will continue to monitor the situation. We continue

to advocate for the facility so we can prepare for the worst and hope

for the best."

The Fed and Treasury declined to comment. The FHFA did not respond to a

request for comment.

As part of last month's $2.3 trillion congressional rescue package,

lenders must allow struggling borrowers to postpone mortgage payments.

The law allows borrowers of mortgages backed by government entities

Fannie Mae and Freddie Mac to delay up to a year's worth of repayments.

[to top of second column] |

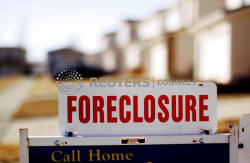

The sign for a foreclosed house for sale sits at the property in

Denver, Colorado March 4, 2009. REUTERS/Rick Wilking/File Photo

The FHFA said last month it would cap the number of payments mortgage companies

must advance to investors in some government-backed mortgage bonds.

However, David Merkur, a partner at law firm Greenspoon Marder, which represents

mortgage servicers, said there was still a serious danger of some firms going

bust if a facility was not introduced.

"I don't think, without federal government assistance, the picture is very

positive for them," he said. "If big servicers go out of business, it could lead

to another housing crisis".

Servicers play a critical role in the mortgage finance ecosystem, receiving

payments from borrowers and passing them on to investors, tax authorities and

insurers.

Industry and regulatory sources say that forbearance data for May and June could

be key to determining whether the Fed and Treasury intervene. Borrowers that

used savings to make repayments in April may struggle in May and June, they say.

"The level of job market distress continues to worsen. That is why we expect

that the share of loans in forbearance will continue to grow, particularly as

new mortgage payments come due in May," said the MBA's Chief Economist Mike

Fratantoni.

(Reporting by Matt Scuffham)

[© 2020 Thomson Reuters. All rights

reserved.] Copyright 2020 Reuters. All rights reserved. This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content.

|