|

Pandemic assistance programs continue to roll out and we

implement them as quickly as possible to the best of our

ability. Despite the current grain markets, significant risk

remains with the record input costs and questionable

availability of crop inputs. Our traditional programs such as

marketing assistance and farm storage facility loans remain

available. We also look forward to increasing our role in urban

food systems. Pandemic assistance programs continue to roll out and we

implement them as quickly as possible to the best of our

ability. Despite the current grain markets, significant risk

remains with the record input costs and questionable

availability of crop inputs. Our traditional programs such as

marketing assistance and farm storage facility loans remain

available. We also look forward to increasing our role in urban

food systems.

Many beginning farmers are highly leveraged and may need

assistance with their first farm or major equipment purchase.

FSA direct and guaranteed loans assist by supplementing

traditional financing options. We work in partnership with

agriculture lenders throughout the State. Discuss these options

with your farm lender and please contact your local FSA office

if you have any questions. Our County Offices are ready to

assist Illinois farmers whenever possible.

Our thoughts and prayers are with those that suffered loss

during the recent storms; a stark reminder that “the most

important things in life are not things”.

I join all Illinois FSA employees in wishing you a joyous,

peaceful holiday season spent with your family and friends..

John Gehrke

Acting State Executive Director

USDA Expands Farmers.gov to Include Farm Records

Producers with farmers.gov accounts can now access farm records

and maps online, the latest self-service feature added to the

U.S. Department of Agriculture (USDA) website.

You can quickly and easily access your land information in real

time by desktop computer, tablet or phone. Capabilities include:

--View, print and export detailed farm records such as cropland,

base acres, yields, CRP acres, land ownership details, and much

more;

--View, print and export farm/tract maps that can be provided to

lenders, chemical or fertilizer providers, and FSA for reporting

acreage and crop insurance agents; and

--Export common land unit (field) boundaries as ESRI shapefiles.

The ability to access these records on demand without a visit to

the service center saves you time and money.

Farmers.gov now includes the most popular functionalities from

FSAFarm+, the FSA portal for producers, while providing enhanced

functionality and an improved user experience. A new enhancement

expands the scope of accessibility to include farmers and

ranchers who are members of an entity, as well as people with a

power of attorney form (FSA-211) on file with FSA.

Managing USDA Business Online

Using farmers.gov, producers, entities and those acting on their

behalf can also:

--View, upload, download, and e-sign conservation documents.

--Request financial assistance, including submitting a program

application.

--View and submit conservation requests.

--View technical references and submit questions.

--Access information on current and past conservation practices,

plans and contracts.

--Report practice completion and request practice certification.

--View farm loan and interest information (producers only).

Future plans include adding the ability to import and view other

shapefiles, such as precision agriculture planting boundaries.

To access your information, you’ll will need a USDA eAuth

account to login to farmers.gov. After obtaining an eAuth

account, producers should visit farmers.gov and sign into the

site’s authenticated portal via the Sign In/Sign Up link at the

top right of the website. Google Chrome, Mozilla Firefox or

Microsoft Edge are the recommended browsers to access the

feature.

In addition to the self-service features available by logging

into farmers.gov, the website also has ample information on USDA

programs, including pandemic assistance, farm loans, disaster

assistance, conservation programs and crop insurance. Recently,

USDA updated the navigation and organization of the site as well

as added some new webpages, including “Get Involved,” “Common

Forms,” and “Translations.” Learn more about these changes.

Applying for FSA Direct Loans

FSA offers direct farm ownership and direct farm operating loans

to producers who want to establish, maintain, or strengthen

their farm or ranch. Direct loans are processed, approved and

serviced by FSA loan officers.

Direct farm operating loans can be used to purchase livestock

and feed, farm equipment, fuel, farm chemicals, insurance, and

other costs including family living expenses. Operating loans

can also be used to finance minor improvements or repairs to

buildings and to refinance some farm-related debts, excluding

real estate.

Direct farm ownership loans can be used to purchase farmland,

enlarge an existing farm, construct and repair buildings, and to

make farm improvements.

The maximum loan amount for direct farm ownership loans is

$600,000 and the maximum loan amount for direct operating loans

is $400,000 and a down payment is not required. Repayment terms

vary depending on the type of loan, collateral and the

producer's ability to repay the loan. Operating loans are

normally repaid within seven years and farm ownership loans are

not to exceed 40 years.

Please contact your local FSA office for more information or to

apply for a direct farm ownership or operating loan.

Small-Scale, Local Producers Get Improved

Insurance Coverage through New Micro Farm Policy

Agricultural producers with small-scale farms

who sell locally can now get simplified insurance coverage

through a new policy designed for their needs. The U.S.

Department of Agriculture (USDA) developed the new Micro Farm

policy, which simplifies recordkeeping and covers

post-production costs like washing and value-added products.

USDA is focused on supporting local and regional food systems,

and Micro Farm is one more example of how we’re helping

agricultural producers with farms of all shapes and sizes to

manage their unique operations and risk. The Risk Management

Agency values collaboration and feedback from our customers, and

Micro Farm is one way we're responding to producers’ needs.

Micro Farm is offered through Whole-Farm Revenue Protection (WFRP)

and is geared to local producers. Details include:

Eligibility: Micro Farm is available to producers who

have a farm operation that earns an average allowable revenue of

$100,000 or less, or for carryover insureds, an average

allowable revenue of $125,000 or less. The increase in allowable

revenue for a carry-over insured will allow for some farm growth

in subsequent years before they become ineligible for the

program. RMA’s research showed that 85% of producers who sell

locally reported they made less than $75,000 in gross sales.

Coverage Levels: All coverage levels

will be available to producers using Micro Farm. This will

enable producers to purchase the 80% and 85% coverage levels

without providing additional paperwork.

Underwriting and Recordkeeping Requirements:

Micro Farm minimizes underwriting and recordkeeping

requirements, and producers will not have to report expenses and

individual commodities.

Post-production Revenue: Producers can

include post-production activities as revenue, such as washing

and packaging commodities or value-added products like jam.

Micro Farm is available for the 2022 crop year.

Sales closing dates are January 31, 2022, February 28, 2022, or

March 15, 2022, depending on the producer’s county.

Producers with crops insured under another crop insurance policy

or a vertically integrated operation will not be eligible.

This new policy derived from research directed by the 2018 Farm

Bill, and it includes feedback from producers who grow for their

local communities. See the full report.

Specialty and Organic Crops

The Micro Farm policy builds on other RMA efforts to better

serve specialty and organic crop growers. This includes WFRP,

which provides coverage for producers with larger operations

that may not be eligible for Micro Farm. RMA recently made. RMA

recently made improvements to WFRP as part of a broader set of

new policies and expanded policies to assist specialty crop and

organic producers.

More Information

Crop insurance is sold and delivered solely through private crop

insurance agents. A list of crop insurance agents is available

at all USDA Service Centers and online at the RMA Agent Locator.

If you have difficulty finding an agent, contact your RMA

Regional Office. Learn more about crop insurance and the modern

farm safety net at rma.usda.gov.

USDA touches the lives of all Americans each day in so many

positive ways. In the Biden-Harris Administration, USDA is

transforming America’s food system with a greater focus on more

resilient local and regional food production, fairer markets for

all producers, ensuring access to safe, healthy, and nutritious

food in all communities, building new markets and streams of

income for farmers and producers using climate smart food and

forestry practices, making historic investments in

infrastructure and clean energy capabilities in rural America,

and committing to equity across the Department by removing

systemic barriers and building a workforce more representative

of America. To learn more, visit

www.usda.gov.

Applying for FSA Guaranteed Loans

FSA guaranteed loans allow lenders to provide agricultural

credit to farmers who do not meet the lender's normal

underwriting criteria. Farmers and ranchers apply for a

guaranteed loan through a lender, and the lender arranges for

the guarantee. FSA can guarantee up to 95 percent of the loss of

principal and interest on a loan. Guaranteed loans can be used

for both farm ownership and operating purposes.

Guaranteed farm ownership loans can be used to purchase

farmland, construct or repair buildings, develop farmland to

promote soil and water conservation or to refinance debt.

Guaranteed operating loans can be used to purchase livestock,

farm equipment, feed, seed, fuel, farm chemicals, insurance and

other operating expenses.

FSA can guarantee farm ownership and operating loans up to

$1,825,000. Repayment terms vary depending on the type of loan,

collateral and the producer's ability to repay the loan.

Operating loans are normally repaid within seven years and farm

ownership loans are not to exceed 40 years.

For more information on guaranteed loans, contact your local

County USDA Service Center or visit fsa.usda.gov.

USDA Reminds Illinois Producers to File Crop

Acreage Reports

Agricultural producers in Illinois who have not

yet completed their crop acreage reports after planting should

make an appointment with their Farm Service Agency (FSA) office

before the applicable deadline.

An acreage report documents a crop grown on a farm or ranch and

its intended uses. Filing an accurate and timely acreage report

for all crops and land uses, including failed acreage and

prevented planted acreage, can prevent the loss of benefits.

How to File a Report

The following acreage reporting dates are applicable in

Illinois:

December 15, 2021

Fall-Seeded Small Grains, Canola

January 15, 2021

Apples, Asparagus, Blueberries, Caneberries, Cherries, Grapes,

Nectarines, Peaches, Pears, Plums, Strawberries

Service Center staff continue to work with agricultural

producers via phone, email, and other digital tools. Because of

the pandemic, some USDA Service Centers are open to limited

visitors. Contact your Service Center to set up an in-person or

phone appointment.

To file a crop acreage report, you will need to provide:

-

Crop and crop type or variety.

-

Intended use of the crop.

-

Number of acres of the crop.

-

Map with approximate boundaries for the crop.

-

Planting date(s).

-

Planting pattern, when applicable.

-

Producer shares.

-

Irrigation practice(s).

-

Acreage prevented from planting, when applicable.

-

Other information as required.

Acreage Reporting Details

The following exceptions apply to acreage

reporting dates:

If the crop has not been planted by the acreage reporting date,

then the acreage must be reported no later than 15 calendar days

after planting is completed.

If a producer acquires additional acreage after the acreage

reporting date, then the acreage must be reported no later than

30 calendar days after purchase or acquiring the lease.

Appropriate documentation must be provided to the county office.

Producers should also report crop acreage they intended to

plant, but due to natural disaster, were unable to plant.

Prevented planting acreage must be reported on form CCC-576,

Notice of Loss, no later than 15 calendar days after the final

planting date as established by FSA and USDA’s Risk Management

Agency.

Noninsured Crop Disaster Assistance Program (NAP) policy holders

should note that the acreage reporting date for NAP-covered

crops is the earlier of the dates listed above or 15 calendar

days before grazing or harvesting of the crop begins.

More Information

For questions, please contact your local FSA office. To locate

your local FSA office visit farmers.gov/service-center-locator.

Sign up for Wetland Reserve Easements for

2022

USDA's Natural Resources Conservation Service (NRCS) announced

the application period for the Fiscal Year (FY) 2022

Agricultural Conservation Easement Program - Wetland Reserve

Easements. (ACEP-WRE). The purpose of the Wetland Reserve

Easements (WRE) program is to help landowners enhance and

protect habitat for wetland wildlife on their lands, reduce

impacts from flooding, recharge groundwater, provide outdoor

recreation, and increase habitat for migratory waterfowl.

NRCS wants landowners and farmers to know that the first

application cut-off date for fiscal year 2022 has been

established. NRCS accepts applications for Wetland Reserve

Easements (WRE) year round. Applications NRCS receives that meet

program eligibility by December 10, 2021 will be considered for

funding in our 2022 program.

Land eligible for WRE includes farmed or converted wetlands that

have been previously altered for agricultural production that

can be successfully and cost-effectively restored. NRCS

prioritizes applications based on the easement’s potential for

improving water quality and protecting and enhancing habitat for

migratory birds and other wildlife. To enroll land through this

program, NRCS enters into purchase agreements with eligible

private landowners and then they work together to develop and

implement a wetland reserve plan to guide the restoration

easement process. This plan restores, enhances, and protects the

wetland’s functions and values.

Applications for ACEP-WRE are continuous and can be submitted at

any time. For FY 2022, Illinois NRCS has received $3.8 million

in funding and will make funding decisions for eligible

applicant interested in ACEP-WRE.

NRCS provides technical and financial assistance directly to

private landowners to restore, protect and enhance wetlands

through the purchase of these easements, and eligible landowners

can choose to enroll in either a permanent easement or a 30-year

easement. To apply for a wetland easement through ACEP - WRE,

visit NRCS at your local USDA Service Center. Due to COVID-19

restrictions, producers should call to set up appointments with

their local NRCS office staff. Visit www.nrcs.usda.gov to learn

more.

Find more information about ACEP and other NRCS conservation

programs in Illinois online at

https://www.nrcs.usda.

gov/wps/portal/nrcs/il/programs/.

Double Cropping

Each year, state committees review and approve or disapprove

county committee recommended changes or additions to specific

combinations of crops.

Double-cropping is approved when two specific crops have the

capability to be planted and carried to maturity for the

intended use, as reported by the producer, on the same acreage

within a crop year under normal growing conditions. The specific

combination of crops recommended by the county committee must be

approved by the state committee.

Double-cropping is approved in Illinois on a county-by-county

basis. Contact your local FSA Office for a list of approved

double-cropping combinations for your county.

A crop following a cover crop terminated according to

termination guidelines is approved double cropping and these

combinations do not have to be approved by the state committee.

Disaster Assistance for 2021 Livestock

Forage Losses

Producers in Boone, Cook, DeKalb, Kane, Lake, McHenry and

Winnebago Counties in Illinois are eligible to apply for 2021

Livestock Forage Disaster Program (LFP) benefits.

Producers in Boone, Lake and McHenry Counties are eligible to

apply for LFP benefits for native pasture, improved pasture, and

forage sorghum.

Producers in Cook, DeKalb, Kane and Winnebago Counties are

eligible to apply for LFP benefits for native pasture and

improved pasture.

LFP provides compensation if you suffer grazing losses for

covered livestock due to drought on privately owned or cash

leased land or fire on federally managed land.

County committees can only accept LFP applications after

notification is received by the National Office of qualifying

drought or if a federal agency prohibits producers from grazing

normal permitted livestock on federally managed lands due to

qualifying fire.

You must complete a CCC-853 and the required supporting

documentation no later than February 1, 2022, for 2021 losses.

For additional information about LFP, including eligible

livestock and fire criteria, contact your local County USDA

Service Center or visit fsa.usda.gov.

Farm Storage Facility Loans

FSA’s Farm Storage Facility Loan

(FSFL) program provides low-interest financing to producers to

build or upgrade storage facilities and to purchase portable

(new or used) structures, equipment and storage and handling

trucks.

The low-interest funds can be used to build or upgrade permanent

facilities to store commodities. Eligible commodities include

corn, grain sorghum, rice, soybeans, oats, peanuts, wheat,

barley, minor oilseeds harvested as whole grain, pulse crops

(lentils, chickpeas and dry peas), hay, honey, renewable

biomass, fruits, nuts and vegetables for cold storage

facilities, floriculture, hops, maple sap, rye, milk, cheese,

butter, yogurt, meat and poultry (unprocessed), eggs, and

aquaculture (excluding systems that maintain live animals

through uptake and discharge of water). Qualified facilities

include grain bins, hay barns and cold storage facilities for

eligible commodities.

[to top of second column] |

Loans up to $50,000 can be secured by a promissory note/security

agreement and loans between $50,000 and $100,000 may require

additional security. Loans exceeding $100,000 require additional

security.

Producers do not need to demonstrate the lack of commercial credit

availability to apply. The loans are designed to assist a diverse

range of farming operations, including small and mid-sized

businesses, new farmers, operations supplying local food and farmers

markets, non-traditional farm products, and underserved producers.

To learn more about the FSA Farm Storage Facility Loan, visit

www.fsa.usda.gov/pricesupport or contact your local FSA county

office. To find your local FSA county office, visit

http://offices.usda.gov.

Transitioning Expiring CRP Land to Beginning,

Veteran or Underserved Farmers and Ranchers

CRP contract holders are encouraged to transition

their Conservation Reserve Program (CRP) acres to beginning, veteran

or socially disadvantaged farmers or ranchers through the Transition

Incentives Program (TIP). TIP provides annual rental payments to the

landowner or operator for up to two additional years after the CRP

contract expires.

CRP contract holders no longer need to be a retired or retiring

owner or operator to transition their land. TIP participants must

agree to sell, have a contract to sell, or agree to lease long term

(at least five years) land enrolled in an expiring CRP contract to a

beginning, veteran, or socially disadvantaged farmer or rancher who

is not a family member.

Beginning, veteran or social disadvantaged farmers and ranchers and

CRP participants may enroll in TIP beginning two years before the

expiration date of the CRP contract. The TIP application must be

submitted prior to completing the lease or sale of the affected

lands. New landowners or renters that return the land to production

must use sustainable grazing or farming methods.

For more information, contact your local County USDA Service Center

or visit fsa.usda.gov.

USDA Builds Pandemic Support for Certified

Organic and Transitioning Operations

The U.S. Department of Agriculture (USDA) will

provide pandemic assistance to cover certification and education

expenses to agricultural producers who are certified organic or

transitioning to organic. USDA will make $20 million available

through the new Organic and Transitional Education and Certification

Program (OTECP) as part of USDA’s broader Pandemic Assistance for

Producers initiative, which provides new, broader and more equitable

opportunities for farmers, ranchers and producers.

During the COVID-19 pandemic, certified organic and transitional

operations faced challenges due to loss of markets, and increased

costs and labor shortages, in addition to costs related to obtaining

or renewing their organic certification, which producers and

handlers of conventionally grown commodities do not incur.

Transitional operations also faced the financial challenge of

implementing practices required to obtain organic certification

without being able to obtain the premium prices normally received

for certified organic commodities.

Eligible Expenses

OTECP funding is provided through the Coronavirus Aid, Relief, and

Economic Security Act (CARES Act). Certified operations and

transitional operations may apply for OTECP for eligible expenses

paid during the 2020, 2021 and 2022 fiscal years. For each year,

OTECP covers 25% of a certified operation’s eligible certification

expenses, up to $250 per certification category (crop, livestock,

wild crop, handling and State Organic Program fee). This includes

application fees, inspection fees, USDA organic certification costs,

state organic program fees and more.

Crop and livestock operations transitioning to organic production

may be eligible for 75% of a transitional operation’s eligible

expenses, up to $750, for each year. This includes fees charged by a

certifying agent or consultant for pre-certification inspections and

development of an organic system plan.

For both certified operations and transitional operations, OTECP

covers 75% of the registration fees, up to $200, per year, for

educational events that include content related to organic

production and handling in order to assist operations in increasing

their knowledge of production and marketing practices that can

improve their operations, increase resilience and expand available

marketing opportunities. Additionally, both certified and

transitional operations may be eligible for 75% of the expense of

soil testing required under the National Organic Program (NOP) to

document micronutrient deficiency, not to exceed $100 per year.

Applying for Assistance

Signup for 2020 and 2021 OTECP will be November 8, 2021, through

January 7, 2022. Producers apply through their local Farm Service

Agency (FSA) office and can also obtain one-on-one support with

applications by calling 877-508-8364. Visit farmers.gov/otecp to

learn more.

Additional Organic Support

OTECP builds upon USDA’s Organic Certification Cost Share Program (OCCSP)

which provides cost share assistance of 50%, up to a maximum of $500

per scope, to producers and handlers of agricultural products who

are obtaining or renewing their certification under the NOP. This

year’s application period for OCCSP ended November 1, 2021.

Additionally, USDA’s Risk Management Agency announced improvements

to the Whole-Farm Revenue Program including increasing expansion

limits for organic producers to the higher of $500,000 or 35%.

Previously, small and medium size organic operations were held to

the same 35% limit to expansion as conventional practice producers.

Also, producers can now report acreage as certified organic, or as

acreage in transition to organic, when the producer has requested an

organic certification by the acreage reporting date.

To learn more about USDA’s assistance for organic producers, visit

usda.gov/organic.

As USDA looks for long-term solutions to build back a better food

system, the Department is committed to delivery of financial

assistance to farmers, ranchers and agricultural producers and

businesses who have been impacted by COVID-19 market disruptions.

Since USDA rolled out the Pandemic Assistance for Producers

initiative in March, the Department has provided support to

America’s farmers and ranchers including:

--$18 billion in Coronavirus Food Assistance Program 2 payments,

including a fourfold increase in participation by historically

underserved producers since the program reopened in April 2021.

--Over $35 million in assistance for those who had to depopulate

livestock and poultry due to insufficient processing access

(Pandemic Livestock Indemnity Program).

--Over $7 million to date for the logging and log

hauling industry (Pandemic Assistance for Timber Harvesters and

Haulers). Final payments are being calculated to be disbursed soon.

--$1 billion to purchase healthy food for food

insecure Americans and build food bank capacity.

--$350 million in additional dairy assistance

related to market volatility.

--$500 million deployed through existing USDA

programs.

--For more details, please visit

www.farmers.gov/pandemic-assistance.

FSA is Accepting CRP Continuous Enrollment

Offers

The Farm Service Agency (FSA) is accepting offers

for specific conservation practices under the Conservation Reserve

Program (CRP) Continuous Signup.

In exchange for a yearly rental payment, farmers enrolled in the

program agree to remove environmentally sensitive land from

agricultural production and to plant species that will improve

environmental health and quality. The program’s long-term goal is to

re-establish valuable land cover to improve water quality, prevent

soil erosion, and reduce loss of wildlife habitat. Contracts for

land enrolled in CRP are 10-15 years in length.

Under continuous CRP signup, environmentally sensitive land devoted

to certain conservation practices can be enrolled in CRP at any

time. Offers for continuous enrollment are not subject to

competitive bidding during specific periods. Instead, they are

automatically accepted provided the land and producer meet certain

eligibility requirements and the enrollment levels do not exceed the

statutory cap.

For more information, including a list of acceptable practices,

contact your local County USDA Service Center or visit fsa.usda.gov/crp.

This October, USDA’s National Agricultural

Statistics Service will mail its first Hemp Acreage and Production

Survey. The survey will collect information on the total planted and

harvested area, yield, production, and value of hemp in the United

States.

The Domestic Hemp Production Program established in the Agriculture

Improvement Act of 2018 (2018 Farm Bill) allows for the cultivation

of hemp under certain conditions. The Hemp Acreage and Production

survey will provide needed data about the hemp industry to assist

producers, regulatory agencies, state governments, processors, and

other key industry entities.

Producers may complete the survey online at agcounts.usda.gov or

they may complete and return the survey by mail using the return

envelope provided.

Learn more about the survey at nass.usda.gov/go/hemp

USDA Expands Assistance to Cover Feed

Transportation Costs for Drought-Impacted Ranchers

In response to the severe drought conditions in the

West and Great Plains, the U.S. Department of Agriculture (USDA)

announced today its plans to help cover the cost of transporting

feed for livestock that rely on grazing. USDA is updating the

Emergency Assistance for Livestock, Honeybees and Farm-Raised Fish

Program (ELAP) to immediately cover feed transportation costs for

drought impacted ranchers. USDA’s Farm Service Agency (FSA) will

provide more details and tools to help ranchers get ready to apply

at their local USDA Service Center later this month at fsa.usda.gov/elap.

ELAP provides financial assistance to eligible producers of

livestock, honeybees, and farm-raised fish for losses due to

disease, certain adverse weather events or loss conditions as

determined by the Secretary of Agriculture.

ELAP already covers the cost of hauling water during drought, and

this change will expand the program beginning in 2021 to cover feed

transportation costs where grazing and hay resources have been

depleted. This includes places where:

--Drought intensity is D2 for eight consecutive weeks as indicated

by the U.S. Drought Monitor;

--Drought intensity is D3 or greater; or

--USDA has determined a shortage of local or

regional feed availability.

Cost share assistance will also be made available

to cover eligible cost of treating hay or feed to prevent the spread

of invasive pests like fire ants.

Under the revised policy for feed transportation cost assistance,

eligible ranchers will be reimbursed 60% of feed transportation

costs above what would have been incurred in a normal year.

Producers qualifying as underserved (socially disadvantaged, limited

resource, beginning or military veteran) will be reimbursed for 90%

of the feed transportation cost. above what would have been incurred

in a normal year.

A national cost formula, as established by USDA, will be used to

determine reimbursement costs which will not include the first 25

miles and distances exceeding 1,000 transportation miles. The

calculation will also exclude the normal cost to transport hay or

feed if the producer normally purchases some feed. For 2021, the

initial cost formula of $6.60 per mile will be used (before the

percentage is applied), but may be adjusted on a state or regional

basis.

To be eligible for ELAP assistance, livestock must be intended for

grazing and producers must have incurred feed transportation costs

on or after January 1, 2021. Although producers will self-certify

losses and expenses to FSA, producers are encouraged to maintain

good records and retain receipts and related documentation in the

event these documents are requested for review by the local FSA

County Committee. The deadline to file an application for payment

for the 2021 program year is January 31, 2022.

USDA offers a comprehensive portfolio of disaster assistance

programs. On farmers.gov, the Disaster Assistance Discovery Tool,

Disaster Assistance-at-a-Glance fact sheet, and Farm Loan Discovery

Tool can help producers and landowners determine all program or loan

options available for disaster recovery assistance.

More information on this expansion to ELAP is forthcoming. In the

meantime, more information is available at fsa.usda.gov/elap or by

contacting a local USDA Service Center.

FSA Outlines MAL and LDP Policy

The 2018 Farm Bill extends loan authority through

2023 for Marketing Assistance Loans (MALs) and Loan Deficiency

Payments (LDPs).

MALs and LDPs provide financing and marketing assistance for wheat,

feed grains, soybeans, and other oilseeds, pulse crops, rice,

peanuts, cotton, wool and honey. MALs provide you with interim

financing after harvest to help you meet cash flow needs without

having to sell your commodities when market prices are typically at

harvest-time lows. A producer who is eligible to obtain a loan, but

agrees to forgo the loan, may obtain an LDP if such a payment is

available. Marketing loan provisions and LDPs are not available for

sugar and extra-long staple cotton.

FSA is now accepting requests for 2021 MALs and LDPs for all

eligible commodities after harvest. Requests for loans and LDPs

shall be made on or before the final availability date for the

respective commodities.

Commodity certificates are available to loan holders who have

outstanding nonrecourse loans for wheat, upland cotton, rice, feed

grains, pulse crops (dry peas, lentils, large and small chickpeas),

peanuts, wool, soybeans and designated minor oilseeds. These

certificates can be purchased at the posted county price (or

adjusted world price or national posted price) for the quantity of

commodity under loan, and must be immediately exchanged for the

collateral, satisfying the loan. MALs redeemed with commodity

certificates are not subject to Adjusted Gross Income provisions.

To be considered eligible for an LDP, you must have form CCC-633EZ,

Page 1 on file at your local FSA Office before losing beneficial

interest in the crop. Pages 2, 3 or 4 of the form must be submitted

when payment is requested.

Marketing loan gains (MLGs) and loan deficiency payments (LDPs) are

no longer subject to payment limitations, actively engaged in

farming and cash-rent tenant rules.

Adjusted Gross Income (AGI) provisions state that if your total

applicable three-year average AGI exceeds $900,000, then you’re not

eligible to receive an MLG or LDP. You must have a valid CCC-941 on

file to earn a market gain of LDP. The AGI does not apply to MALs

redeemed with commodity certificate exchange.

For more information and additional eligibility requirements,

contact your local County USDA Service Center or visit fsa.usda.gov.

Unauthorized Disposition of Grain

If loan grain has been disposed of through feeding, selling or any

other form of disposal without prior written authorization from the

county office staff, it is considered unauthorized disposition. The

financial penalties for unauthorized dispositions are severe and a

producer’s name will be placed on a loan violation list for a

two-year period. Always call before you haul any grain under loan.

Maintaining the Quality of Farm-Stored Loan

Grain

Bins are ideally designed to hold a level volume of grain. When bins

are overfilled and grain is heaped up, airflow is hindered and the

chance of spoilage increases.

Producers who take out marketing assistance loans and use the

farm-stored grain as collateral should remember that they are

responsible for maintaining the quality of the grain through the

term of the loan.

Transitioning Expiring CRP Land to Beginning,

Veteran or Underserved Farmers and Ranchers

CRP contract holders are encouraged to transition their Conservation

Reserve Program (CRP) acres to beginning, veteran or socially

disadvantaged farmers or ranchers through the Transition Incentives

Program (TIP). TIP provides annual rental payments to the landowner

or operator for up to two additional years after the CRP contract

expires.

CRP contract holders no longer need to be a retired or retiring

owner or operator to transition their land. TIP participants must

agree to sell, have a contract to sell, or agree to lease long term

(at least five years) land enrolled in an expiring CRP contract to a

beginning, veteran, or socially disadvantaged farmer or rancher who

is not a family member.

Beginning, veteran or social disadvantaged farmers and ranchers and

CRP participants may enroll in TIP beginning two years before the

expiration date of the CRP contract. The TIP application must be

submitted prior to completing the lease or sale of the affected

lands. New landowners or renters that return the land to production

must use sustainable grazing or farming methods.

For more information, contact your local County USDA Service Center

or visit fsa.usda.gov.

NASS to Send 2021 Hemp Acreage and Production

Survey This Fall

This October, USDA’s National Agricultural Statistics Service will

mail its first Hemp Acreage and Production Survey. The survey will

collect information on the total planted and harvested area, yield,

production, and value of hemp in the United States.

The Domestic Hemp Production Program established in the Agriculture

Improvement Act of 2018 (2018 Farm Bill) allows for the cultivation

of hemp under certain conditions. The Hemp Acreage and Production

survey will provide needed data about the hemp industry to assist

producers, regulatory agencies, state governments, processors, and

other key industry entities.

Producers may complete the survey online at agcounts.usda.gov or

they may complete and return the survey by mail using the return

envelope provided.

Learn more about the survey at nass.usda.gov/go/hemp

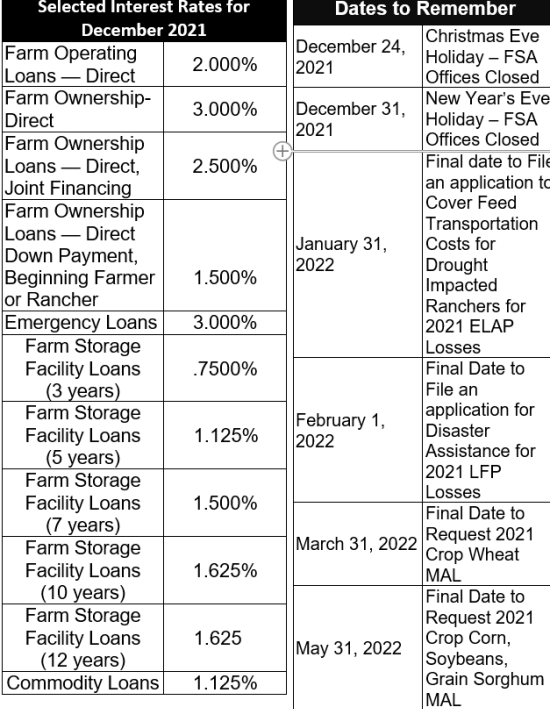

December Interest Rates and Important Dates

["Farmers.gov] |