|

County committee members are an important

component of the operations of FSA and provide a link between

the agricultural community and USDA. Farmers and ranchers

elected to county committees help deliver FSA programs at the

local level, applying their knowledge and judgment to make

decisions on commodity price support programs; conservation

programs; incentive indemnity and disaster programs for some

commodities; emergency programs and eligibility. FSA committees

operate within official regulations designed to carry out

federal laws. County committee members are an important

component of the operations of FSA and provide a link between

the agricultural community and USDA. Farmers and ranchers

elected to county committees help deliver FSA programs at the

local level, applying their knowledge and judgment to make

decisions on commodity price support programs; conservation

programs; incentive indemnity and disaster programs for some

commodities; emergency programs and eligibility. FSA committees

operate within official regulations designed to carry out

federal laws.

To be an eligible voter, farmers and ranchers must participate

or cooperate in an FSA program. A person who is not of legal

voting age but supervises and conducts the farming operations of

an entire farm, may also be eligible to vote. A cooperating

producer is someone who has provided information about their

farming or ranching operation(s) but may not have applied or

received FSA program benefits.

Eligible voters in the local administrative area holding a 2021

election who do not receive a ballot can obtain one from their

local USDA Service Center.

Newly elected committee members will take office January 1,

2022.

More information on county committees, such as the new 2021 fact

sheet, can be found on the FSA website at fsa.usda.gov/elections

or at a local USDA Service Center.

USDA Introduces New Insurance Policy for

Farmers Who Sell Locally

The U.S. Department of Agriculture (USDA) is rolling out a new

insurance option specifically for agricultural producers with

small farms who sell locally. The new Micro Farm policy

simplifies record keeping and covers post-production costs like

washing and value-added products.

USDA’s Risk Management Agency (RMA) created this new policy

based on research directed by the 2018 Farm Bill, and it

includes feedback from producers who grow for their local

communities. The policy will be available beginning with the

2022 crop year.

“We are excited to offer this new coverage for producers who

work to provide their communities with fresh and healthy food,”

said RMA Acting Administrator Richard Flournoy. “USDA is focused

on supporting local and regional food systems, and this new crop

insurance policy is designed with this important sector of

agriculture in mind.”

The new policy is offered through Whole-Farm Revenue Protection

(WFRP) and it has distinct provisions that can provide more

access to the program, including:

No expense or individual commodity reporting needed, simplifying

the recordkeeping requirements for producers

Revenue from post-production costs, such as washing and

packaging commodities and value-added products, are considered

allowable revenue. The Micro Farm policy builds on other RMA

efforts to better serve specialty and organic crop growers. This

includes WFRP, which provides coverage for producers with larger

operations that may not be eligible for Micro Farm. RMA recently

made improvements to WFRP as part of a broader set of new

policies and expanded policies to assist specialty crop and

organic producers.

USDA touches the lives of all Americans each day in so many

positive ways. In the Biden-Harris Administration, USDA is

transforming America’s food system with a greater focus on more

resilient local and regional food production, fairer markets for

all producers, ensuring access to healthy and nutritious food in

all communities, building new markets and streams of income for

farmers and producers using climate smart food and forestry

practices, making historic investments in infrastructure and

clean energy capabilities in rural America, and committing to

equity across the Department by removing systemic barriers and

building a workforce more representative of America. To learn

more, visit www.usda.gov.

The Federal Crop Insurance Corporation approved the Micro Farm

policy in late September, and additional details will be

provided later this fall.

The Micro Farm policy is available to producers who have a farm

operation that earns an average allowable revenue of $100,000 or

less, or for carryover insureds, an average allowable revenue of

$125,000 or less. RMA’s research showed that 85% of producers

who sell locally reported they made less than $75,000 in gross

sales. See the full report.

The Micro Farm policy builds on other RMA

efforts to better serve specialty and organic crop growers. This

includes WFRP, which provides coverage for producers with larger

operations that may not be eligible for Micro Farm. RMA recently

made improvements to WFRP as part of a broader set of new

policies and expanded policies to assist specialty crop and

organic producers.

The Federal Crop Insurance Corporation approved the Micro Farm

policy in late September, and additional details will be

provided later this fall.

More Information

Crop insurance is sold and delivered solely through private crop

insurance agents. A list of crop insurance agents is available

at all USDA Service Centers and online at the RMA Agent Locator.

Learn more about crop insurance and the modern farm safety net

at rma.usda.gov.

USDA touches the lives of all Americans each day in so many

positive ways. In the Biden-Harris Administration, USDA is

transforming America’s food system with a greater focus on more

resilient local and regional food production, fairer markets for

all producers, ensuring access to healthy and nutritious food in

all communities, building new markets and streams of income for

farmers and producers using climate smart food and forestry

practices, making historic investments in infrastructure and

clean energy capabilities in rural America, and committing to

equity across the Department by removing systemic barriers and

building a workforce more representative of America. To learn

more, visit www.usda.gov.

FSA Outlines MAL and LDP Policy

The 2018 Farm Bill extends loan authority

through 2023 for Marketing Assistance Loans (MALs) and Loan

Deficiency Payments (LDPs).

MALs and LDPs provide financing and marketing assistance for

wheat, feed grains, soybeans, and other oilseeds, pulse crops,

rice, peanuts, cotton, wool and honey. MALs provide you with

interim financing after harvest to help you meet cash flow needs

without having to sell your commodities when market prices are

typically at harvest-time lows. A producer who is eligible to

obtain a loan, but agrees to forgo the loan, may obtain an LDP

if such a payment is available. Marketing loan provisions and

LDPs are not available for sugar and extra-long staple cotton.

FSA is now accepting requests for 2021 MALs and LDPs for all

eligible commodities after harvest. Requests for loans and LDPs

shall be made on or before the final availability date for the

respective commodities.

Commodity certificates are available to loan holders who have

outstanding nonrecourse loans for wheat, upland cotton, rice,

feed grains, pulse crops (dry peas, lentils, large and small

chickpeas), peanuts, wool, soybeans and designated minor

oilseeds. These certificates can be purchased at the posted

county price (or adjusted world price or national posted price)

for the quantity of commodity under loan, and must be

immediately exchanged for the collateral, satisfying the loan.

MALs redeemed with commodity certificates are not subject to

Adjusted Gross Income provisions.

To be considered eligible for an LDP, you must have form

CCC-633EZ, Page 1 on file at your local FSA Office before losing

beneficial interest in the crop. Pages 2, 3 or 4 of the form

must be submitted when payment is requested.

Marketing loan gains (MLGs) and loan deficiency payments (LDPs)

are no longer subject to payment limitations, actively engaged

in farming and cash-rent tenant rules.

Adjusted Gross Income (AGI) provisions state that if your total

applicable three-year average AGI exceeds $900,000, then you’re

not eligible to receive an MLG or LDP. You must have a valid

CCC-941 on file to earn a market gain of LDP. The AGI does not

apply to MALs redeemed with commodity certificate exchange.

For more information and additional eligibility requirements,

contact your local County USDA Service Center or visit

fsa.usda.gov.

Farm Storage Facility Loans

FSA’s Farm Storage Facility Loan (FSFL) program

provides low-interest financing to producers to build or upgrade

storage facilities and to purchase portable (new or used)

structures, equipment and storage and handling trucks.

The low-interest funds can be used to build or upgrade permanent

facilities to store commodities. Eligible commodities include

corn, grain sorghum, rice, soybeans, oats, peanuts, wheat,

barley, minor oilseeds harvested as whole grain, pulse crops

(lentils, chickpeas and dry peas), hay, honey, renewable

biomass, fruits, nuts and vegetables for cold storage

facilities, floriculture, hops, maple sap, rye, milk, cheese,

butter, yogurt, meat and poultry (unprocessed), eggs, and

aquaculture (excluding systems that maintain live animals

through uptake and discharge of water). Qualified facilities

include grain bins, hay barns and cold storage facilities for

eligible commodities.

Loans up to $50,000 can be secured by a promissory note/security

agreement and loans between $50,000 and $100,000 may require

additional security. Loans exceeding $100,000 require additional

security.

Producers do not need to demonstrate the lack of commercial

credit availability to apply. The loans are designed to assist a

diverse range of farming operations, including small and

mid-sized businesses, new farmers, operations supplying local

food and farmers markets, non-traditional farm products, and

underserved producers.

To learn more about the FSA Farm Storage Facility Loan, visit

www.fsa.usda.gov/pricesupport or contact your local FSA county

office. To find your local FSA county office, visit

http://offices.usda.gov.

USDA Encourages You to Consider NAP Risk

Protection Coverage Before Crop Sales Deadlines

The Farm Service Agency encourages you to

examine available USDA crop risk protection options, including

federal crop insurance and Noninsured Crop Disaster Assistance

Program (NAP) coverage, before the applicable crop sales

deadline.

Federal crop insurance covers crop losses from natural

adversities such as drought, hail and excessive moisture. NAP

covers losses from natural disasters on crops for which no

permanent federal crop insurance program is available. You can

determine if crops are eligible for federal crop insurance or

NAP by visiting the RMA website.

NAP offers higher levels of coverage, from 50 to 65 percent of

expected production in 5 percent increments, at 100 percent of

the average market price. Producers of organics and crops

marketed directly to consumers also may exercise the “buy-up”

option to obtain NAP coverage of 100 percent of the average

market price at the coverage levels of between 50 and 65 percent

of expected production. Buy-up levels of NAP coverage are

available if the producer can show at least one year of

previously successfully growing the crop for which coverage is

being requested. NAP basic coverage is available at 55 percent

of the average market price for crop losses that exceed 50

percent of expected production.

For all coverage levels, the NAP service fee is the lesser of

$325 per crop or $825 per producer per county, not to exceed a

total of $1,950 for a producer with farming interests in

multiple counties.

Beginning, underserved, veterans and limited resource farmers

are now eligible for free catastrophic level coverage.

Deadlines for coverage vary by state and crop. Contact your

local County USDA Service Center or visit fsa.usda.gov.

Federal crop insurance coverage is sold and delivered solely

through private insurance agents. Agent lists are available at

all USDA Service Centers or at USDA’s online Agent Locator. You

can use the USDA Cost Estimator to predict insurance premium

costs.

Progression Lending from FSA

Farm Service Agency (FSA) farm loans are

considered progression lending. Unlike loans from a commercial

lender, FSA loans are intended to be temporary in nature. Our

goal is to help you graduate to commercial credit, and our farm

loan staff is available to help borrowers through training and

credit counseling.

The FSA team will help borrowers identify their goals to ensure

financial success. FSA staff will advise borrowers on developing

strategies and a plan to meet your goals and graduate to

commercial credit. FSA borrowers are responsible for the success

of their farming operation, but FSA staff will help in an

advisory role, providing the tools necessary to help you achieve

your operational goals and manage your finances.

For more information on FSA farm loan programs, contact your

local County USDA Service Center or visit fsa.usda.gov.

Policy Updating for Acreage Reporting

The USDA Farm Service Agency (FSA) recently

made several policy updates for acreage reporting for cover

crops, revising intended use, late-filed provisions, grazing

allotments as well as updated the definitions of “idle” and

“fallow.”

Reporting Cover Crops:

Cover crop types can be chosen from the following four

categories:

Cereals and other grasses

Legumes

Brassicas and other broadleaves

Mixtures

If the cover crop is harvested for any use other than forage or

grazing and is not terminated according to policy guidelines,

then that crop will no longer be considered a cover crop and the

acreage report must be revised to reflect the actual crop.

Permitted Revision of Intended use After Acreage Reporting

Date:

New operators or owners who pick up a farm after the acreage

reporting deadline has passed and the crop has already been

reported on the farm, have 30 calendar days from the date when

the new operator or owner acquired the lease on land, control of

the land or ownership and new producer crop share interest in

the previously reported crop acreage. Under this policy,

appropriate documentation must be provided to the County

Committee’s satisfaction to determine that a legitimate operator

or ownership and producer crop share interest change occurred to

permit the revision.

Acreage Reports:

In order to maintain program eligibility and benefits, you must

timely file acreage reports. Failure to file an acreage report

by the crop acreage reporting deadline may result in

ineligibility for future program benefits. FSA will not accept

acreage reports provided more than a year after the acreage

reporting deadline.

Reporting Grazing Allotments:

FSA offices can now accept acreage reports for grazing

allotments. You will use form “FSA-578” to report grazing

allotments as animal unit months (AUMs) using the “Reporting

Unit” field. Your local FSA office will need the grazing period

start and end date and the percent of public land.

[to top of second column] |

Definitions of Terms

FSA defines “idle” as cropland or a balance of cropland within a

Common Land Unit (CLU) (field/subfield) which is not planted or

considered not planted and does not meet the definition of fallow or

skip row.

Fallow is considered unplanted cropland acres which are part of a

crop/fallow rotation where cultivated land that is normally planted

is purposely kept out of production during a regular growing season.

For more information, contact your local County USDA Service Center

or visit fsa.usda.gov.

FSA is Accepting CRP Continuous

Enrollment Offers

The Farm Service Agency (FSA) is accepting offers for specific

conservation practices under the Conservation Reserve Program (CRP)

Continuous Signup.

In exchange for a yearly rental payment, farmers enrolled in the

program agree to remove environmentally sensitive land from

agricultural production and to plant species that will improve

environmental health and quality. The program’s long-term goal is to

re-establish valuable land cover to improve water quality, prevent

soil erosion, and reduce loss of wildlife habitat. Contracts for

land enrolled in CRP are 10-15 years in length.

Under continuous CRP signup, environmentally sensitive land devoted

to certain conservation practices can be enrolled in CRP at any

time. Offers for continuous enrollment are not subject to

competitive bidding during specific periods. Instead, they are

automatically accepted provided the land and producer meet certain

eligibility requirements and the enrollment levels do not exceed the

statutory cap.

For more information, including a list of acceptable practices,

contact your local County USDA Service Center or visit fsa.usda.gov/crp.

Communication is the Key to Lending

Farm Service Agency (FSA) is committed to providing

our farm loan borrowers the tools necessary to be successful. FSA

staff will provide guidance and counsel from the loan application

process through the borrower’s graduation to commercial credit.

While it is FSA’s commitment to advise borrowers as they identify

goals and evaluate progress, it is crucial for borrowers to

communicate with their farm loan staff when changes occur. It is the

borrower’s responsibility to alert FSA to any of the following:

Any proposed or significant changes in the farming operation

Any significant changes to family income or expenses

The development of problem situations

Any losses or proposed significant changes in security

If a farm loan borrower can’t make payments to suppliers, other

creditors, or FSA on time, contact your farm loan staff immediately

to discuss loan servicing options.

For more information on FSA farm loan programs, contact your local

County USDA Service Center or visit fsa.usda.gov.

Applying for NAP Payments

The Noninsured Crop Disaster Assistance Program

(NAP) provides financial assistance to you for crops that aren’t

eligible for crop insurance to protect against lower yields or crops

unable to be planted due to natural disasters including freeze,

hail, excessive moisture, excessive wind or hurricanes, flood,

excessive heat and qualifying drought (includes native grass for

grazing), among others.

In order to participate, you must obtain NAP coverage for the crop

year by the applicable deadline using form CCC-471 “Application for

Coverage” and pay the service fee. Application closing dates vary by

crop. Producers are also required to submit an acceptable crop

acreage report. Additionally, NAP participants must provide:

The quantity of all harvested production of the crop in which the

producer held an interest during the crop year

The disposition of the harvested crop, such as whether it is

marketable, unmarketable, salvaged or used differently than intended

Acceptable crop production records (when requested by FSA)

Producers who fail to report acreage and production information for

NAP-covered crops could see reduced or zero NAP assistance. These

reports are used to calculate the approved yield.

If your NAP-covered crops are affected by a natural disaster, notify

your FSA office by completing Part B of form CCC-576 “Notice of Loss

and Application for Payment.” This must be completed within 15

calendar days of the occurrence of the disaster or when losses

become apparent or 15 days of the final harvest date. For

hand-harvested crops and certain perishable crops, you must notify

FSA within 72 hours of when a loss becomes apparent.

To receive benefits, you must also complete Parts D, E, F and G of

the CCC-576 “Notice of Loss and Application for Payment” within 60

days of the last day of coverage for the crop year for any NAP

covered crops. The CCC-576 requires acceptable appraisal

information. Producers must provide evidence of production and note

whether the crop was marketable, unmarketable, salvaged or used

differently than intended.

Eligible crops must be commercially produced agricultural

commodities for which crop insurance is not available, including

perennial grass forage and grazing crops, fruits, vegetables,

mushrooms, floriculture, ornamental nursery, aquaculture, turf

grass, ginseng, honey, syrup, bioenergy, and industrial crops.

For more information on NAP, contact your local County USDA Service

Center or visit fsa.usda.gov/nap.

Unauthorized Disposition of Grain

If loan grain has been disposed of through feeding, selling or any

other form of disposal without prior written authorization from the

county office staff, it is considered unauthorized disposition. The

financial penalties for unauthorized dispositions are severe and a

producer’s name will be placed on a loan violation list for a

two-year period. Always call before you haul any grain under loan.

Double-Cropping

Each year, state committees review and approve or

disapprove county committee recommended changes or additions to

specific combinations of crops.

Double-cropping is approved when two specific crops have the

capability to be planted and carried to maturity for the intended

use, as reported by the producer, on the same acreage within a crop

year under normal growing conditions. The specific combination of

crops recommended by the county committee must be approved by the

state committee.

Double-cropping is approved in Illinois on a county-by-county basis.

Contact your local FSA Office for a list of approved double-cropping

combinations for your county.

A crop following a cover crop terminated according to termination

guidelines is approved double cropping and these combinations do not

have to be approved by the state committee.

USDA Encourages You to Consider NAP Risk

Protection Coverage Before Crop Sales Deadlines

The Farm Service Agency encourages you to examine

available USDA crop risk protection options, including federal crop

insurance and Noninsured Crop Disaster Assistance Program (NAP)

coverage, before the applicable crop sales deadline.

Federal crop insurance covers crop losses from natural adversities

such as drought, hail and excessive moisture. NAP covers losses from

natural disasters on crops for which no permanent federal crop

insurance program is available. You can determine if crops are

eligible for federal crop insurance or NAP by visiting the RMA

website.

NAP offers higher levels of coverage, from 50 to 65 percent of

expected production in 5 percent increments, at 100 percent of the

average market price. Producers of organics and crops marketed

directly to consumers also may exercise the “buy-up” option to

obtain NAP coverage of 100 percent of the average market price at

the coverage levels of between 50 and 65 percent of expected

production. Buy-up levels of NAP coverage are available if the

producer can show at least one year of previously successfully

growing the crop for which coverage is being requested. NAP basic

coverage is available at 55 percent of the average market price for

crop losses that exceed 50 percent of expected production.

For all coverage levels, the NAP service fee is the lesser of $325

per crop or $825 per producer per county, not to exceed a total of

$1,950 for a producer with farming interests in multiple counties.

Beginning, underserved, veterans and limited resource farmers are

now eligible for free catastrophic level coverage.

Deadlines for coverage vary by state and crop. Contact your local

County USDA Service Center or visit fsa.usda.gov.

Federal crop insurance coverage is sold and delivered solely through

private insurance agents. Agent lists are available at all USDA

Service Centers or at USDA’s online Agent Locator. You can use the

USDA Cost Estimator to predict insurance premium costs.

Obtaining Payments Due to Deceased Producers

In order to claim a Farm Service Agency (FSA)

payment on behalf of a deceased producer, all program conditions for

the payment must have been met before the applicable producer’s date

of death.

If a producer earned a FSA payment prior to his or her death, the

following is the order of precedence for the representatives of the

producer:

administrator or executor of the estate

the surviving spouse

surviving sons and daughters, including adopted children

surviving father and mother

surviving brothers and sisters

heirs of the deceased person who would be entitled to payment

according to the State law

For FSA to release the payment, the legal representative of the

deceased producer must file a form FSA-325 to claim the payment for

themselves or an estate. The county office will verify that the

application, contract, loan agreement, or other similar form

requesting payment issuance, was signed by the applicable deadline

by the deceased or a person legally authorized to act on their

behalf at that time of application.

If the application, contract or loan agreement form was signed by

someone other than the deceased participant, FSA will determine

whether the person submitting the form has the legal authority to

submit the form.

Payments will be issued to the respective representative’s name

using the deceased program participant’s tax identification number.

Payments made to representatives are subject to offset regulations

for debts owed by the deceased.

FSA is not responsible for advising persons in obtaining legal

advice on how to obtain program benefits that may be due to a

participant who has died, disappeared or who has been declared

incompetent.

Environmental Review Required Before Project

Implementation

The National Environmental Policy Act (NEPA)

requires Federal agencies to consider all potential environmental

impacts for federally-funded projects before the project is

approved.

For all Farm Service Agency (FSA) programs, an environmental review

must be completed before actions are approved, such as site

preparation or ground disturbance. These programs include, but are

not limited to, the Emergency Conservation Program (ECP), Farm

Storage Facility Loan (FSFL) program and farm loans. If project

implementation begins before FSA has completed an environmental

review, the request will be denied. Although there are exceptions

regarding the Stafford Act and emergencies, it’s important to wait

until you receive written approval of your project proposal before

starting any actions.

Applications cannot be approved until FSA has copies of all permits

and plans. Contact your local FSA office early in your planning

process to determine what level of environmental review is required

for your program application so that it can be completed timely.

Filing CCC-941 Adjust Gross Income AGI

Certificates

If you have experienced delays in receiving

Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC)

payments, Loan Deficiency Payments (LDPs) and Market Gains on

Marketing Assistance Loans (MALs), it may be because you have not

filed form CCC-941, Adjusted Gross Income Certification.

If you don’t have a valid CCC-941 on file for the applicable crop

year you will not receive payments. All farm operator/tenants/owners

who have not filed a CCC-941 and have pending payments should

IMMEDIATELY file the form with their recording county FSA office.

Farm operators and tenants are encouraged to ensure that their

landowners have filed the form.

FSA can accept the CCC-941 for 2018, 2019, 2020, 2021, and 2022.

Unlike the past, you must have the CCC-941 certifying your AGI

compliance before any payments can be issued.

Maintaining the Quality of Farm-Stored Loan

Grain

Bins are ideally designed to hold a level volume of

grain. When bins are overfilled and grain is heaped up, airflow is

hindered and the chance of spoilage increases.

Producers who take out marketing assistance loans and use the

farm-stored grain as collateral should remember that they are

responsible for maintaining the quality of the grain through the

term of the loan.

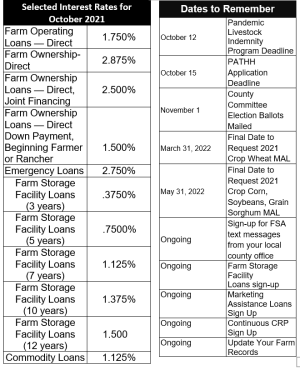

October Interest Rates and Important Dates

["Farmers.gov] |