China's Aug new bank loans jump more than expected, more policy steps

expected

Send a link to a friend

Send a link to a friend

[September 11, 2023] By

Kevin Yao [September 11, 2023] By

Kevin Yao

BEIJING (Reuters) -New bank lending in China beat expectations by nearly

quadrupling in August from July's level, as the central bank sought to

shore up economic growth amid soft demand at home and abroad.

While recent data showed signs of improvement in an economy that has

been spluttering, analysts said more policy support was needed for the

ailing property sector. The sector accounts for roughly a quarter of the

world's second largest economy.

Chinese banks extended 1.36 trillion yuan ($186.18 billion) in new yuan

loans in August, up from 345.9 billion yuan in July, according to

People's Bank of China data released on Monday.

Analysts polled by Reuters had predicted new yuan loans would rise to

1.20 trillion yuan in August. The new loans were higher than 1.25

trillion yuan in August last year.

"Credit growth improved modestly in August, as the policy measures

helped the economy to stabilise," said Zhiwei Zhang, chief economist at

Pinpoint Asset Management.

"Mortgage loans rebounded which indicates the rate cuts and policy

easing in the property sector helped to boost buyers’ sentiment."

Household loans, including mortgages, rose to 392.2 billion yuan in

August, versus a contraction of 200.7 billion yuan in July. Corporate

loans rose to 948.8 billion yuan from 237.8 billion yuan in July.

The rise in household loans indicated a rebound in the real estate

market, but it was premature to draw conclusions as new home sales in

major cities remain sluggish, said Zhaopeng Xing, senior China

strategist at ANZ.

More Chinese cities have removed restrictions on home buying, as

authorities gradually roll back a measures put in place earlier when the

property sector needed cooling off.

Premier Li Qiang said earlier this month that China is expected to

achieve its 2023 growth target of around 5%, but some analysts believe

the target could be missed due to a worsening property slump, weak

consumer spending and tumbling credit growth.

[to top of second column] |

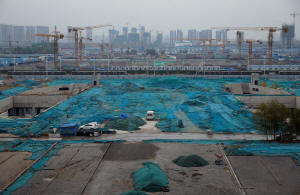

Construction sites are seen next to Zhengzhou East Railway Station

in Zhengzhou, Henan province, China November 29, 2019. REUTERS/Jason

Lee/File Photo

China's consumer prices returned to positive territory in August

while factory-gate price declines slowed, data showed on Saturday,

as deflation pressures ease amid signs of stabilisation in the

economy.

MORE EASING STEPS EXPECTED

To support the economy, the government has rolled out a series of

policy measures in recent months, including steps to spur housing

demand.

Analysts expect the central bank to cut interest rates and banks'

reserve requirement ratio (RRR) as early as this month.

Broad M2 money supply grew 10.6% from a year earlier, central bank

data showed, below estimates of 10.7% forecast in the Reuters poll.

M2 grew 10.7% in July from a year ago.

Outstanding yuan loans grew 11.1% in August from a year earlier,

which was in line with expectations and matched growth in July.

Annual growth of outstanding total social financing (TSF), a broad

measure of credit and liquidity in the economy, quickened to 9.0% in

August from a year earlier and from 8.9% in July.

TSF includes off-balance sheet forms of financing that exist outside

the conventional bank lending system, such as initial public

offerings, loans from trust companies and bond sales.

In August, TSF rose to 3.12 trillion yuan from 528.2 billion yuan in

July. Analysts polled by Reuters had expected August TSF of 2.46

trillion yuan.

(Reporting by Kevin Yao; Editing by Simon Cameron-Moore)

[© 2023 Thomson Reuters. All rights

reserved.]

This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |