Futures muted as Big Tech results, Fed decision inch closer

Send a link to a friend

Send a link to a friend

[July 30, 2024] (Reuters)

- U.S. index futures edged up on Tuesday, as investors hoped for clues

on the timing of interest-rate cuts from this week's Federal Reserve

monetary policy decision, while caution crept in ahead of the day's Big

Tech earnings and jobs data. [July 30, 2024] (Reuters)

- U.S. index futures edged up on Tuesday, as investors hoped for clues

on the timing of interest-rate cuts from this week's Federal Reserve

monetary policy decision, while caution crept in ahead of the day's Big

Tech earnings and jobs data.

Microsoft shares were down 0.2% in premarket trading. The company is set

to report after markets close.

Other megacaps such as Apple, Amazon.com, Meta Platforms, Alphabet and

Tesla were up between 0.4% and 1.6%, while Nvidia was down 0.5%.

At 5:51 a.m. ET, Dow e-minis were up 45 points, or 0.11%, S&P 500

e-minis were up 5.75 points, or 0.10%, and Nasdaq 100 e-minis were up 14

points, or 0.07%.

Alphabet's second-quarter results beat, which failed to impress

investors and knocked down the Google owner's shares last week,

underscored Wall Street's high earnings bar for tech giants. Coupled

with Tesla's disappointing results, Alphabet's earnings induced a

broad-based market slump on Wednesday, largely dragged down by megacap

stocks.

All eyes are on quarterly results from technology behemoths, which have

largely supported the U.S. stock market's record-breaking run since the

start of the year, to see if their over-stretched valuations are

justified and the stocks have the potential for further AI-led equity

rallies.

A key employment report is also due after markets open. Along with

Friday's Non-farm Payrolls reading, this is expected to help investors

size up recent data signaling a loosening U.S. labor market.

The Labor Department's Job Openings and Labor Turnover Survey is

expected to show 8 million job openings in June, down from 8.14 million

in May.

The continued improvement in inflation and an easing jobs market have

bolstered investor expectations of the Federal Reserve signaling an

interest-rate cut in September. The central bank will announce its

policy decision on Wednesday and any hawkish commentary could sharply

weigh on equities.

Investors have fully priced in a rate cut by September, with the odds of

a 25-basis-point cut holding around 90%, according to CME's FedWatch

Tool.

[to top of second column] |

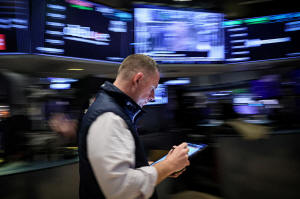

A trader works on the floor at the New York Stock Exchange (NYSE) in

New York City, U.S., March 7, 2024. REUTERS/Brendan McDermid/File

Photo

Hopes of an early start to monetary policy easing have prompted an

investor run to mid- and small-cap stocks lately, away from megacap

tech shares, whose sheer dominance in the U.S. stock market has

drawn scrutiny.

The small-caps index is on track to log its biggest monthly jump

since the start of the year and is poised to sharply outperform the

three major U.S. stock indexes. Futures tracking the Russell 2000

were up 0.1% on the day.

Benefiting from the recent funds rotation into underperforming

sectors, the blue-chip Dow is also set for its best month in 2024,

if gains hold.

Among other single movers, CrowdStrike dropped 5% after a report

that Delta Air Lines sought compensation from the cybersecurity firm

and Microsoft for the global cyber outage earlier this month.

Cybersecurity and cloud services company F5 jumped 14% after

forecasting fourth-quarter results above estimates.

Symbotic slumped 20% after the robotics vendor forecast

current-quarter revenue and adjusted core profit below estimates.

(Reporting by Ankika Biswas in Bengaluru; Editing by Pooja Desai)

[© 2024 Thomson Reuters. All rights

reserved.]

This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content.

|