Colombia policy lurches chill investment, risk economic growth

Send a link to a friend

Send a link to a friend

[March 21, 2024] By

Nelson Bocanegra [March 21, 2024] By

Nelson Bocanegra

BOGOTA (Reuters) - Colombian President Gustavo Petro's track record of

unpredictable policy lurches has contributed to a sharp drop in

investment that is expected to continue this year, as some business

owners complain strategic planning has become almost impossible.

Leftist Petro was elected in 2022 promising to reform healthcare, labor

laws and the pension system, as well as fight poverty and raise taxes on

high earners.

But more than a dozen company executives, bank analysts and industry

associations told Reuters inconsistent polices in sectors ranging from

housing to electricity were undermining investor confidence and hurting

economic growth.

Colombia's economy, the fourth largest in Latin America, grew 0.6% last

year, about half of what had been predicted, and private sector

investment dropped by 24.8%.

Falling investment could keep GDP growth at 0.8% this year, according to

Colombia's central bank, insufficient to meet social and fiscal needs.

Some analysts predicted a 4% drop in private investment in 2024.

"Every day there are announcements, which has an effect," said Mario

Hernandez, who owns businesses in the construction, retail and

agriculture sectors, including an eponymous fashion brand, that employ

about 1,000 people in Colombia and a similar figure abroad.

"We are stopping investments to see what happens, because we don't know

with this government, the insecurity and the confidence in the country,"

Hernandez said, adding his businesses were struggling to keep workers

employed.

Three other executives from different companies, who asked not to be

named, told Reuters they were also holding back investments because of

the uncertainty.

During the last year Petro has changed the structure of subsidies for

public housing, threatened to intervene in electricity prices and

temporarily frozen toll prices for road concessions.

The moves have stoked concerns among business owners that numerous

industries may face more government intervention.

Construction of new houses fell more than 39% year-on-year in the first

two months of 2024 because of the public housing subsidy change,

according to construction guild Camacol.

In February, Petro's government announced it would change financing for

infrastructure, leaving big projects like Bogota's long-awaited metro

short around $200 million in funding.

Vehement criticism from business guilds prompted an about-face by the

government days later. In March Petro again suggested renegotiating

metro contracts, a proposal the capital's mayor Carlos Galan said was

"legally impossible and technically inviable" and could lead to

lawsuits.

Business leaders said legal precedents and already-signed contracts

should be respected.

[to top of second column] |

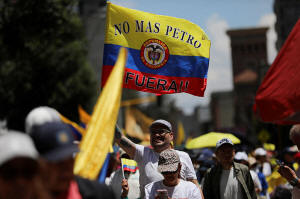

Demonstrators protest against Colombian President Gustavo Petro's

reforms in the health, retirement, employment and prison sectors, in

Bogota, Colombia March 6, 2024. REUTERS/Luisa Gonzalez/File Photo

"If companies don't have the legal, physical or political security

that their business is going to last, then there is effectively a

brake as people wait to see what happens," said Maria Claudia

Lacouture, head of the Colombian-American Chamber of Commerce.

Petro's proposed reforms to healthcare, labor rules and pensions

have also chilled potential investment, said Bruce Mac Master,

president of business association ANDI.

"Not even a really crazy person would invest right now in building

a hospital if they don't know how it's going to exist in the

system," Mac Master said.

IN THE RED

Although investment in Colombia is set to contract by much less

this year than last, it will remain in the red, analysts said.

"The feeling is very negative," said Felipe Klein, economist for

Latin America for BNP Paribas, after meeting in Bogota with

businesses and bankers.

Finance Minister Ricardo Bonilla has attributed a significant part

of the fall in investment to a drop in business inventories that

accumulated during 2021 and 2022, when domestic consumption was

lower because of the coronavirus pandemic. He also blamed high

interest rates and inflation.

However, think tank Fedesarrollo says gross fixed capital

investment, which excludes inventories, was down 8.9% in 2023 to its

lowest level in 18 years. It also blames Petro's policies, with

director Luis Fernando Mejia warning that lower economic growth

would lead to lower tax income and higher public debt.

Colombia will not comply with its fiscal rule, meant to block

deterioration of public finances, this year if planned 2024 spending

is carried out, an independent committee said this week.

Earlier this month commerce minister German Umana dismissed fears

and underlined improved foreign direct investment last year, which

he expects to rise up to 4% this year.

International investors are likely not following the play-by-play

of Petro's comments and social media posts, said Munir Jalil, BTG

Pactual's head economist for the Andean region, and may have

longer-term investment strategies.

"One could almost say that foreigners have more confidence in the

country than locals," Umana told Reuters, as he urged Colombians to

give political change a chance.

"In the medium term we are transforming a development model that

hasn't changed for 30 years."

(Reporting by Nelson Bocanegra; Writing by Julia Symmes Cobb;

Editing by Christian Plumb and Nia Williams)

[© 2024 Thomson Reuters. All rights

reserved.]

This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |