Japan manufacturers want BOJ to keep yen stable, survey shows

Send a link to a friend

Send a link to a friend

[May 20, 2024] By

Leika Kihara [May 20, 2024] By

Leika Kihara

TOKYO (Reuters) -Japan's large manufacturers saw exchange rate stability

as the biggest factor they wanted out of the central bank's monetary

policy, a Bank of Japan survey showed on Monday.

Roughly 70% of firms polled said they experienced drawbacks from the

BOJ's 25-year-long monetary easing measures including a weak yen that

pushed up import costs, the survey showed.

About 90% of the total also saw benefits from the BOJ's prolonged easing

such as low borrowing costs, the poll showed.

The survey, conducted on roughly 2,500 firms nationwide, highlights the

importance Japanese firms place on yen moves in assessing the impact of

monetary policy.

Many firms surveyed also said they were no longer able to hire enough

workers if they kept wage growth low, and saw an economy where wages and

inflation rose in tandem as more favorable than one where wages and

prices barely moved.

"Japan is on the cusp of seeing big changes in corporate behavior," the

BOJ said in the survey conducted as part of a long-term review of the

pros and cons of its past monetary easing steps.

About 90% of firms said they were more willing to hike wages largely to

address labor shortages, while over 80% said they found it easier than

before to hike prices, the survey showed.

The findings underscore the BOJ's view that rising wages and prices will

keep inflation sustainably around its 2% target, and allow it to raise

interest rates from current near-zero levels.

[to top of second column] |

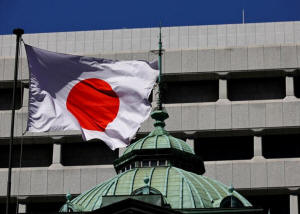

The Japanese national flag waves at the Bank of Japan building in

Tokyo, Japan March 18, 2024. REUTERS/Kim Kyung-Hoon/Files

The BOJ ended eight years of negative interest rates and other

remnants of its radical monetary stimulus in March, making a

historical shift away from decades of ultra-loose policy.

But the decision failed to reverse the yen's declines that have hurt

consumption by pushing up imported goods prices, as markets focused

on the still-large interest rate divergence between Japan and the

United States.

The long-term review was launched by BOJ Governor Kazuo Ueda in

April last year, and looks into the benefits and drawbacks of the

unconventional easing tools the central bank used during its 25-year

battle with deflation.

While the BOJ has said the review won't have a direct impact on

future monetary policy, analysts say the discussions could offer

clues on how soon the central bank would raise rates again and

reduce its huge bond purchases.

Monday's survey, which was part of the review, polled companies on

how they saw their business activities affected by the central

bank's monetary easing measures since the mid-1990s.

The BOJ will also hold on Tuesday a second workshop where its

officials and academics discuss the impact of past monetary easing

steps on the economy and prices.

(Reporting by Leika Kihara; Editing by Jamie Freed, Sam Holmes and

Shri Navaratnam)

[© 2024 Thomson Reuters. All rights

reserved.]

This material may not be published,

broadcast, rewritten or redistributed.

Thompson Reuters is solely responsible for this content. |