Nvidia sales surge in the fourth quarter on demand for AI chips

[February 27, 2025] By

SARAH PARVINI [February 27, 2025] By

SARAH PARVINI

LOS ANGELES (AP) — Nvidia on Wednesday reported a surge in

fourth-quarter profit and sales as demand for its specialized Blackwell

chips, which power artificial intelligence systems, continued to grow,

sending the company's stock higher after hours.

For the three months that ended Jan. 26, the tech giant based in Santa

Clara, California, posted revenue of $39.3 billion, up 12% from the

previous quarter and 78% from one year ago. Adjusted for one-time items,

it earned 89 cents a share.

“Demand for Blackwell is amazing as reasoning AI adds another scaling

law — increasing compute for training makes models smarter and

increasing compute for long thinking makes the answer smarter,” Nvidia

Founder Jensen Huang said in a statement.

Nvidia has ramped up the massive-scale production of Blackwell AI

supercomputers, Huang said, “achieving billions of dollars in sales in

its first quarter.”

“AI is advancing at light speed as agentic AI and physical AI set the

stage for the next wave of AI to revolutionize the largest industries,”

he said.

Wednesday’s earnings report topped Wall Street expectations. Analysts

had been expecting adjusted earnings of 85 cents a share on revenue of

$38.1 billion, according to FactSet. Nvidia reported net income of

$22.06 billion in the fourth quarter, beating analysts’ predictions of

$19.57 billion. The tech giant expected sales to continue to grow,

forecasting revenue of around $43 billion for the first quarter of

fiscal 2026.

Data center sales, which account for much of Nvidia’s revenues, were a

core part of that uptick — fourth-quarter revenue was $35.6 billion, up

93% from one year ago.

The growth in the data center market comes as President Donald Trump has

talked up a joint venture investing up to $500 billion for

infrastructure tied to AI through a new partnership formed by OpenAI,

Oracle and SoftBank. The Stargate project will start building out data

centers and the energy generation needed for the further development of

AI, according to the White House. Nvidia is a partner in that project.

On an earnings call Wednesday afternoon, Nvidia Chief Financial Officer

Colette Kress said that fourth-quarter Blackwell sales exceeded the

company's expectations.

"We delivered $11 billion of Blackwell architecture revenue in the

fourth quarter of fiscal 2025, the fastest product ramp in our company’s

history," Kress said. “Blackwell sales were led by large cloud service

providers which represented approximately 50% of our data center

revenue.”

[to top of second column] |

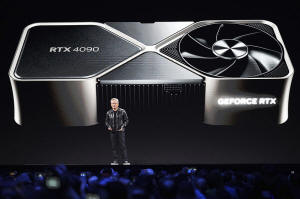

Nvidia founder and CEO Jensen Huang speaks during a Nvidia news

conference ahead of the CES tech show Monday, Jan. 6, 2025, in Las

Vegas. (AP Photo/Abbie Parr, File)

The poster child of the AI boom,

Nvidia has grown into the second-largest company on Wall Street — it

is now worth over $3 trillion — and the stock’s movement carries

more weight on the S&P 500 and other indexes than every company

except Apple. Two years ago, Nvidia’s market value was below $600

billion.

Nvidia and other companies benefiting from the AI boom have been a

major reason the S&P 500 has climbed to record after record

recently, with the latest coming last week. Their explosion of

profits has helped to propel the market despite worries about

stubbornly high inflation and possible pain coming for the U.S.

economy from tariffs and other policies of President Donald Trump.

But those tariffs are still “an unknown,” Kress said, until Nvidia

can better understand what the Trump administration’s plan is.

“We are awaiting,” she said, adding that the company would follow

any export controls or tariff rules.

The fourth-quarter earnings are the company’s first report since

Chinese company DeepSeek boasted it had developed a large language

model that could compete with ChatGPT and other U.S. rivals, but was

more cost-effective in its use of Nvidia chips to train the system

on troves of data.

The frenzy over DeepSeek caused $595 billion in Nvidia’s wealth to

vanish briefly. But the company in a statement commended DeepSeek’s

work as “an excellent AI advancement” that leveraged

“widely-available models and compute that is fully export control

compliant.”

“DeepSeek R1 has ignited global enthusiasm,” Huang said on

Wednesday’s earnings call. “It’s an excellent innovation, but even

more importantly, it has open-sourced a world-class reasoning AI

model. Nearly every AI developer is applying R1, or chain of thought

and reinforcement learning techniques like R1, to scale their

models' performance.”

Speaking to investors, Huang said the “next wave” of AI is coming

with “agentic AI for enterprise, physical AI for robotics and

sovereign AI as the different regions build out their AI for their

own ecosystems.”

"We’re in the center of much of this development," Huang said.

All contents © copyright 2025 Associated Press. All rights reserved |